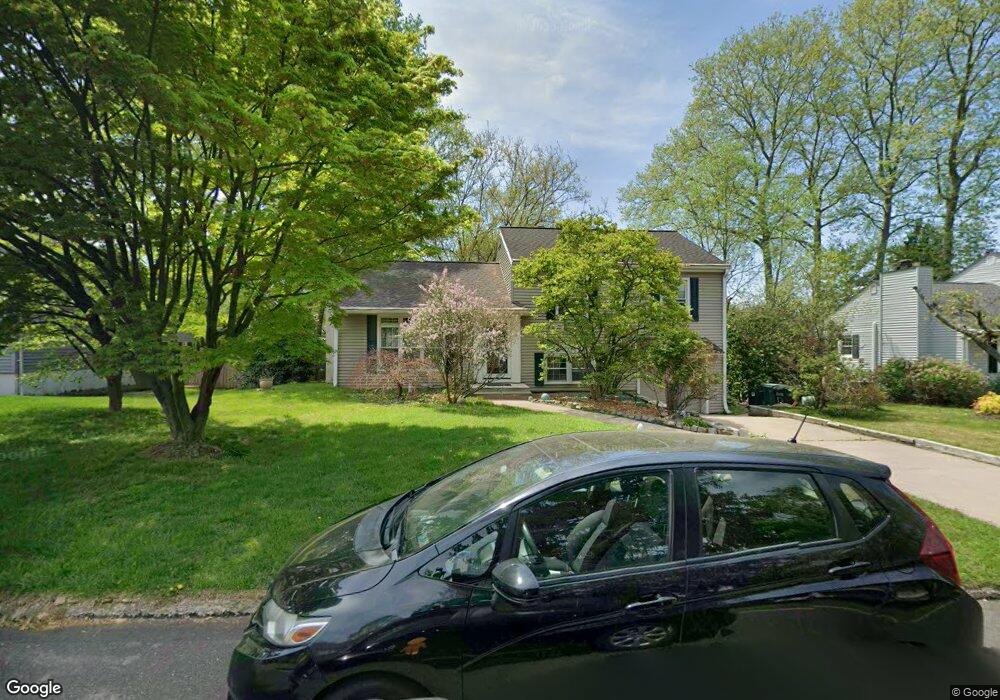

42 Laubert Rd Conshohocken, PA 19428

Estimated Value: $482,928 - $530,000

3

Beds

2

Baths

1,482

Sq Ft

$341/Sq Ft

Est. Value

About This Home

This home is located at 42 Laubert Rd, Conshohocken, PA 19428 and is currently estimated at $505,232, approximately $340 per square foot. 42 Laubert Rd is a home located in Montgomery County with nearby schools including Ridge Park Elementary School, Colonial Elementary School, and Colonial Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 5, 2016

Sold by

Lavalley Brett and Lavalley Kiely Hall

Bought by

Lavalley Brett and Lavalley Kiely Hall

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$239,000

Outstanding Balance

$189,871

Interest Rate

3.68%

Mortgage Type

New Conventional

Estimated Equity

$315,361

Purchase Details

Closed on

Feb 9, 2007

Sold by

Fancher Roderick M

Bought by

Lavalley Brett and Hall Kiely

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$262,400

Interest Rate

6.27%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Lavalley Brett | -- | Quality Abstract Services | |

| Lavalley Brett | $328,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Lavalley Brett | $239,000 | |

| Previous Owner | Lavalley Brett | $262,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,184 | $128,500 | $48,160 | $80,340 |

| 2024 | $4,184 | $128,500 | $48,160 | $80,340 |

| 2023 | $4,033 | $128,500 | $48,160 | $80,340 |

| 2022 | $3,941 | $128,500 | $48,160 | $80,340 |

| 2021 | $3,823 | $128,500 | $48,160 | $80,340 |

| 2020 | $3,683 | $128,500 | $48,160 | $80,340 |

| 2019 | $3,573 | $128,500 | $48,160 | $80,340 |

| 2018 | $996 | $128,500 | $48,160 | $80,340 |

| 2017 | $3,450 | $128,500 | $48,160 | $80,340 |

| 2016 | $3,400 | $128,500 | $48,160 | $80,340 |

| 2015 | $3,342 | $128,500 | $48,160 | $80,340 |

| 2014 | $3,251 | $128,500 | $48,160 | $80,340 |

Source: Public Records

Map

Nearby Homes

- 2017 Spring Mill Rd

- 117 Karrs Ln

- 10 Maple Dr

- 1705 Harmon Rd

- 2150 Julia Dr

- 264 Roberts Ave Unit 10

- 1975 West Ave

- 35 White Pine Ct

- 2134 Birch Dr

- 7 Plum Ct

- 1410 Butler Pike

- 1408 Butler Pike

- 411 Roberts Ave

- 10 Gum Tree Rd

- 25 E Germantown Pike

- 4004 School House Ln

- 1004 Aspen Ct

- 121 Scarlet Dr

- 140 W 11th Ave

- 253 E 10th Ave