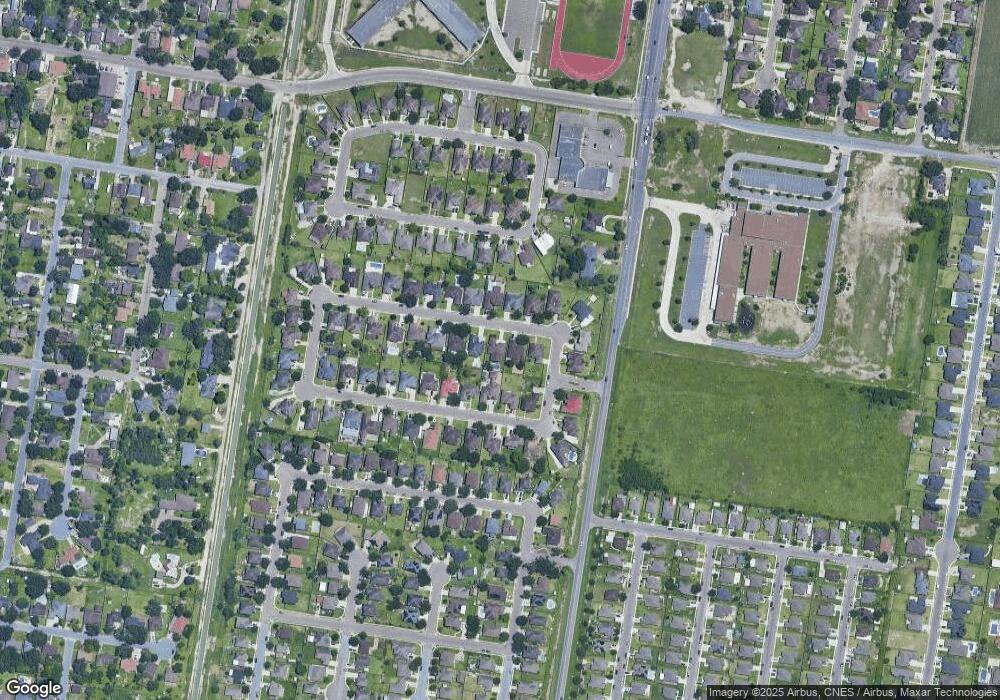

420 James St San Juan, TX 78589

Estimated Value: $260,000 - $272,000

3

Beds

2

Baths

1,926

Sq Ft

$139/Sq Ft

Est. Value

About This Home

This home is located at 420 James St, San Juan, TX 78589 and is currently estimated at $267,359, approximately $138 per square foot. 420 James St is a home located in Hidalgo County with nearby schools including Alfred Sorensen Elementary, Stephen F. Austin Middle School, and PSJA Early College High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 9, 2015

Sold by

Deleon Romeo and De Leon Mayra

Bought by

Cantu Raul C and Cantu Gabriela

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$90,000

Interest Rate

4.03%

Mortgage Type

Seller Take Back

Purchase Details

Closed on

Mar 20, 2009

Sold by

Lasalle Bank National Association

Bought by

Cantu Raul C

Purchase Details

Closed on

Jan 6, 2009

Sold by

Cabrera Kerissa and Coca Napoleon

Bought by

Lasalle Bank National Association

Purchase Details

Closed on

Jul 20, 2007

Sold by

Coca Napoleon

Bought by

Coca Kerissa

Purchase Details

Closed on

Jan 26, 2007

Sold by

Ozimar Construction Llc

Bought by

Coca Napoleon and Cabrera Kerissa

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$120,000

Interest Rate

8.2%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 7, 2006

Sold by

Esponjas Development Ltd

Bought by

Ozimar Cons Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Cantu Raul C | -- | Attorney | |

| Cantu Raul C | -- | None Available | |

| Lasalle Bank National Association | $136,249 | None Available | |

| Coca Kerissa | -- | None Available | |

| Coca Napoleon | -- | Southern Star Title Co | |

| Ozimar Cons Llc | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Cantu Raul C | $90,000 | |

| Previous Owner | Coca Napoleon | $120,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $5,420 | $273,333 | -- | -- |

| 2024 | $5,420 | $248,485 | $62,496 | $185,989 |

| 2023 | $6,488 | $250,604 | $62,496 | $188,108 |

| 2022 | $5,892 | $213,167 | $0 | $0 |

| 2021 | $5,477 | $193,788 | $45,360 | $149,625 |

| 2020 | $5,064 | $176,171 | $45,360 | $137,539 |

| 2019 | $4,774 | $160,155 | $45,360 | $133,005 |

| 2018 | $4,365 | $145,595 | $40,320 | $134,516 |

| 2017 | $3,994 | $132,359 | $40,320 | $136,028 |

| 2016 | $3,631 | $120,326 | $30,240 | $137,539 |

| 2015 | $2,758 | $109,387 | $30,240 | $139,049 |

Source: Public Records

Map

Nearby Homes

- 503 Rio Colorado St

- 1320 Rio Comal Cir

- 1212 Garden Ridge Ave

- 1304 Garden Ridge Ave

- 1213 Garden Ridge Ave

- 901 S Stewart Rd Unit 5

- 901 S Stewart Rd

- 312 E 10th St

- 1223 Ohio Ave

- 603 E Ridge Rd

- 1105 Houston Way

- 712 Sundance Ln

- 1214 S Ohio Ave

- 1511 Garden Ridge Ave

- 209 E 11th St

- 1000 Via Cantera Dr

- 301 E 8th St

- 1009 S Nebraska Ave

- 1017 S Nebraska Ave

- 1218 S Ohio