420 Wyecliff Ct Unit 5 Duluth, GA 30097

Estimated Value: $580,000 - $695,000

4

Beds

3

Baths

2,828

Sq Ft

$228/Sq Ft

Est. Value

About This Home

This home is located at 420 Wyecliff Ct Unit 5, Duluth, GA 30097 and is currently estimated at $645,303, approximately $228 per square foot. 420 Wyecliff Ct Unit 5 is a home located in Fulton County with nearby schools including Shakerag Elementary School, River Trail Middle School, and Northview High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 5, 2005

Sold by

Khanna Rajesh

Bought by

Khanna Rajesh and Khanna Komal

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$230,400

Interest Rate

6.21%

Mortgage Type

New Conventional

Purchase Details

Closed on

Nov 24, 2003

Sold by

Porterfield Clark F and Porterfield Elizabeth

Bought by

Fuller Michael C and Fuller Kelly

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$246,000

Interest Rate

5.97%

Mortgage Type

New Conventional

Purchase Details

Closed on

Feb 28, 1995

Sold by

Peachtree Residential Prop Inc

Bought by

Porterfield Clark F Elizabeth

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Khanna Rajesh | -- | -- | |

| Khanna Rajesh | $288,000 | -- | |

| Fuller Michael C | $259,900 | -- | |

| Porterfield Clark F Elizabeth | $181,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Khanna Rajesh | $230,400 | |

| Previous Owner | Fuller Michael C | $246,000 | |

| Closed | Porterfield Clark F Elizabeth | $0 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,883 | $232,280 | $71,160 | $161,120 |

| 2023 | $6,517 | $230,880 | $55,440 | $175,440 |

| 2022 | $3,723 | $182,280 | $40,760 | $141,520 |

| 2021 | $3,673 | $142,320 | $45,400 | $96,920 |

| 2020 | $3,704 | $152,920 | $54,600 | $98,320 |

| 2019 | $450 | $135,400 | $26,880 | $108,520 |

| 2018 | $3,743 | $132,240 | $26,240 | $106,000 |

| 2017 | $3,646 | $121,720 | $25,440 | $96,280 |

| 2016 | $3,568 | $121,720 | $25,440 | $96,280 |

| 2015 | $3,607 | $121,720 | $25,440 | $96,280 |

| 2014 | $2,939 | $96,360 | $20,160 | $76,200 |

Source: Public Records

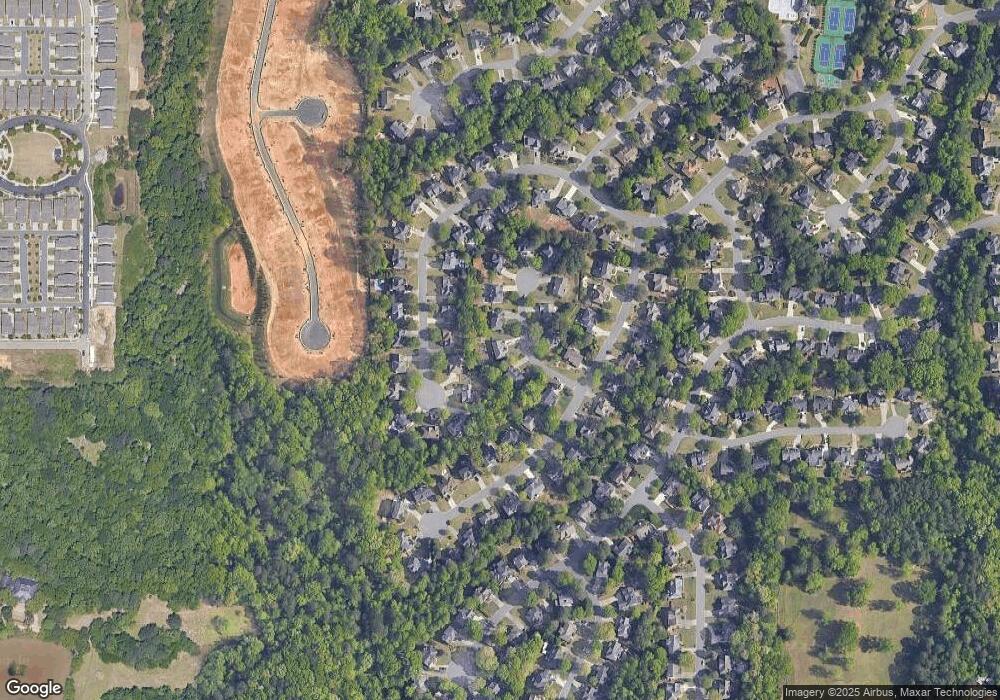

Map

Nearby Homes

- 260 Ketton Downs

- 951 Olmsted Ln

- 120 Croftwood Ct

- 828 Olmsted Ln

- 345 Wiman Park Ln

- 10635 N Edgewater Place

- 11100 Crofton Overlook Ct Unit 2

- 6879 Downs Ave

- 10792 Glenleigh Dr Unit 5B2

- 7067 Walham Grove

- 10723 Glenleigh Dr

- 11100 Brookhavenclub Dr

- 320 Brookhaven Walk

- 7315 Craigleith Dr

- 7405 Ledgewood Way

- 211 Hamlet Dr

- 7520 Ledgewood Way

- 1001 Shurcliff Ln

- 430 Wyecliff Ct

- 0 Wyecliff Ct

- 7025 Devonhall Way

- 7015 Devonhall Way

- 7005 Devonhall Way

- 415 Wyecliff Ct Unit 5

- 7035 Devonhall Way

- 440 Wyecliff Ct Unit 5

- 425 Wyecliff Ct Unit 5

- 11040 Chandon Way

- 11030 Chandon Way

- 7045 Devonhall Way Unit 4

- 11060 Chandon Way Unit 5

- 6995 Devonhall Way Unit 4

- 450 Wyecliff Ct Unit 5

- 11020 Chandon Way Unit 5

- 435 Wyecliff Ct

- 11070 Chandon Way Unit 118

- 11070 Chandon Way

- 7055 Devonhall Way