4200 S Valley View Blvd Unit 3023 Las Vegas, NV 89103

West of the Strip NeighborhoodEstimated Value: $355,706

3

Beds

2

Baths

1,257

Sq Ft

$283/Sq Ft

Est. Value

About This Home

This home is located at 4200 S Valley View Blvd Unit 3023, Las Vegas, NV 89103 and is currently priced at $355,706, approximately $282 per square foot. 4200 S Valley View Blvd Unit 3023 is a home located in Clark County with nearby schools including Joseph E Thiriot Elementary School, Grant Sawyer Middle School, and Ed W Clark High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 23, 2009

Sold by

Zarabi Romina

Bought by

Shavalian Masoud

Current Estimated Value

Purchase Details

Closed on

Feb 17, 2009

Sold by

Us Bank National Association

Bought by

Shavalian Masoud

Purchase Details

Closed on

Sep 19, 2007

Sold by

Brinson John Kenneth

Bought by

Dlj Mortgage Capital Inc

Purchase Details

Closed on

Sep 13, 2006

Sold by

Flamingo Palms Villas Llc

Bought by

Brinson John Kenneth

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$414,400

Interest Rate

8%

Mortgage Type

Unknown

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shavalian Masoud | -- | Fidelity National Title Agen | |

| Shavalian Masoud | $61,200 | Lsi Title Agency Inc | |

| Us Bank National Association | $61,200 | Fidelity National Title Agen | |

| Dlj Mortgage Capital Inc | $419,272 | Fidelity National Title | |

| Brinson John Kenneth | $592,000 | Commonwealth Title | |

| Brinson John Kenneth | $592,000 | Commonwealth Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Brinson John Kenneth | $414,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $969 | $51,175 | $23,450 | $27,725 |

| 2024 | $898 | $51,175 | $23,450 | $27,725 |

| 2023 | $898 | $51,100 | $25,200 | $25,900 |

| 2022 | $832 | $45,691 | $22,050 | $23,641 |

| 2021 | $770 | $45,142 | $22,050 | $23,092 |

| 2020 | $712 | $40,591 | $17,500 | $23,091 |

| 2019 | $668 | $42,282 | $19,250 | $23,032 |

| 2018 | $637 | $30,452 | $7,875 | $22,577 |

| 2017 | $900 | $30,694 | $7,438 | $23,256 |

| 2016 | $598 | $29,721 | $6,125 | $23,596 |

| 2015 | $595 | $27,720 | $4,375 | $23,345 |

| 2014 | $577 | $19,073 | $4,550 | $14,523 |

Source: Public Records

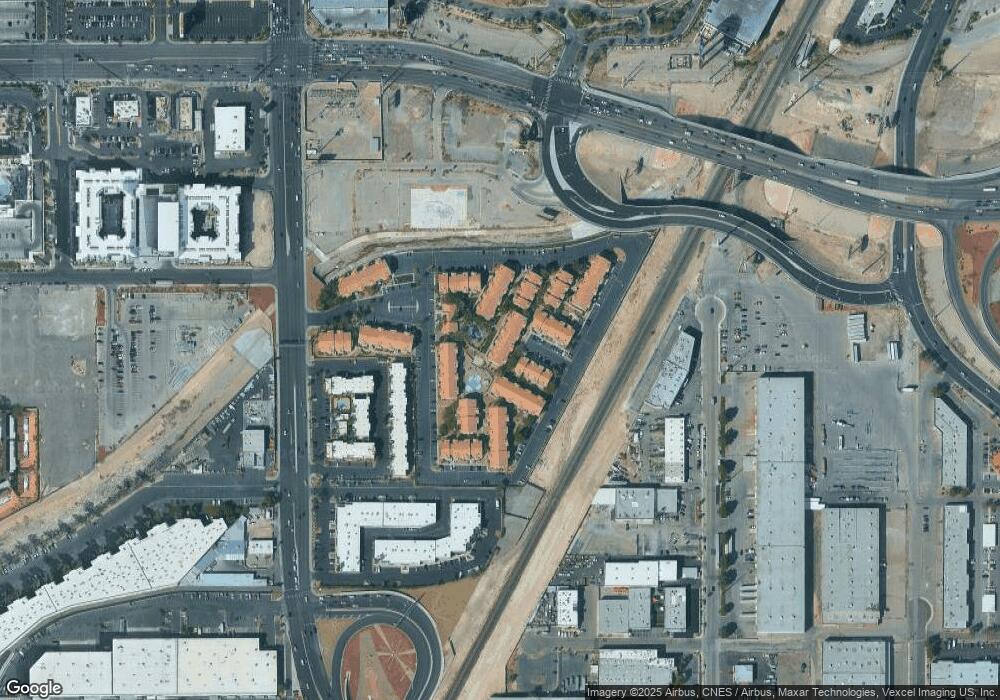

Map

Nearby Homes

- 4200 S Valley View Blvd Unit 1035

- 4200 S Valley View Blvd Unit 3030

- 4200 S Valley View Blvd Unit 1074

- 4200 S Valley View Blvd Unit 1007

- 4200 S Valley View Blvd Unit 3049

- 4200 S Valley View Blvd Unit 3078

- 4200 S Valley View Blvd Unit 2097

- 4200 S Valley View Blvd Unit 3065

- 4200 S Valley View Blvd Unit 2009

- 4200 S Valley View Blvd Unit 2057

- 4200 S Valley View Blvd Unit 1069

- 4471 Dean Martin Dr Unit 2907

- 4471 Dean Martin Dr Unit 1907

- 4471 Dean Martin Dr Unit 3805

- 4471 Dean Martin Dr Unit 3301

- 4471 Dean Martin Dr Unit 810

- 4471 Dean Martin Dr Unit 2005

- 4471 Dean Martin Dr Unit 1104

- 4471 Dean Martin Dr Unit 3810

- 4471 Dean Martin Dr Unit 1109

- 4200 S Valley View Blvd Unit 1046

- 4200 S Valley View Blvd Unit 3027

- 4200 S Valley View Blvd Unit 1028

- 4200 S Valley View Blvd Unit 1008

- 4200 S Valley View Blvd Unit 2071

- 4200 S Valley View Blvd Unit 3018

- 4200 S Valley View Blvd Unit 3077

- 4200 S Valley View Blvd Unit 2103

- 4200 S Valley View Blvd Unit 3029

- 4200 S Valley View Blvd Unit 1119

- 4200 S Valley View Blvd Unit 3021

- 4200 S Valley View Blvd Unit 2061

- 4200 S Valley View Blvd Unit 3039

- 4200 S Valley View Blvd Unit 2002

- 4200 S Valley View Blvd Unit 1112

- 4200 S Valley View Blvd Unit 2053

- 4200 S Valley View Blvd Unit 3008

- 4200 S Valley View Blvd Unit 2105

- 4200 S Valley View Blvd Unit 2043

- 4200 S Valley View Blvd Unit 2106