4206 Cascada Cr Unit 4206 Cooper City, FL 33024

Monterra NeighborhoodEstimated Value: $472,000 - $560,000

3

Beds

3

Baths

1,458

Sq Ft

$366/Sq Ft

Est. Value

About This Home

This home is located at 4206 Cascada Cr Unit 4206, Cooper City, FL 33024 and is currently estimated at $533,085, approximately $365 per square foot. 4206 Cascada Cr Unit 4206 is a home located in Broward County with nearby schools including Cooper City Elementary School, Pioneer Middle School, and Cooper City High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 29, 2022

Sold by

Turner Kimber C

Bought by

Thomas Emmanuel and Thomas Natasha J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$441,000

Outstanding Balance

$427,311

Interest Rate

6.58%

Mortgage Type

New Conventional

Estimated Equity

$105,774

Purchase Details

Closed on

Dec 30, 2019

Sold by

Aetros Llc

Bought by

Turner Kimber C

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$339,963

Interest Rate

3.7%

Mortgage Type

VA

Purchase Details

Closed on

Feb 14, 2014

Sold by

Perez Erick Montero and Montero Maria

Bought by

Aetos Llc

Purchase Details

Closed on

Dec 16, 2011

Sold by

Minto Monterra Llc

Bought by

Perez Erick Montero

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$233,321

Interest Rate

4.4%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Thomas Emmanuel | $490,000 | South Florida Title | |

| Turner Kimber C | $330,000 | Butler Title | |

| Aetos Llc | $300,000 | Trans State Title Insurance | |

| Perez Erick Montero | $239,400 | Founders Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Thomas Emmanuel | $441,000 | |

| Previous Owner | Turner Kimber C | $339,963 | |

| Previous Owner | Perez Erick Montero | $233,321 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,940 | $456,480 | -- | -- |

| 2024 | $9,447 | $443,620 | $54,760 | $375,940 |

| 2023 | $9,447 | $430,700 | $54,760 | $375,940 |

| 2022 | $8,399 | $326,850 | $0 | $0 |

| 2021 | $7,583 | $297,140 | $39,730 | $257,410 |

| 2020 | $7,276 | $277,460 | $39,730 | $237,730 |

| 2019 | $7,423 | $276,580 | $39,730 | $236,850 |

| 2018 | $7,374 | $275,270 | $39,730 | $235,540 |

| 2017 | $7,139 | $260,830 | $0 | $0 |

| 2016 | $7,050 | $260,830 | $0 | $0 |

| 2015 | $7,052 | $260,830 | $0 | $0 |

| 2014 | $5,409 | $219,460 | $0 | $0 |

| 2013 | -- | $216,220 | $39,730 | $176,490 |

Source: Public Records

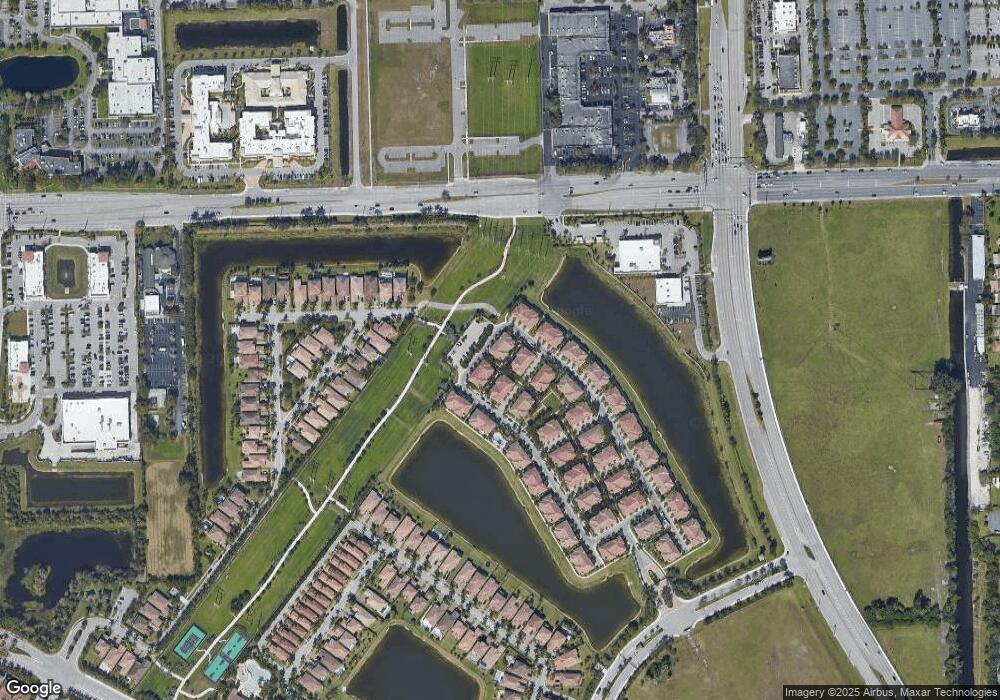

Map

Nearby Homes

- 4186 Cascada Cir

- 4164 Cascada Cir

- 4126 Cascada Cir

- 4284 Cascada Cir

- 4064 Cascada Cir

- 8513 NW 41st St

- 4038 NW 85th Ave

- 3990 NW 85th Ave

- 8020 Stirling Rd

- 8541 NW 38th St

- 3679 NW 82nd Terrace

- 3730 NW 84th Way

- 8727 NW 39th St

- 3292 NW 82nd Way

- 3777 NW 78th Ave Unit 15G

- 3777 NW 78th Ave Unit 1G

- 3777 NW 78th Ave Unit 1B

- 3777 NW 78th Ave Unit 8E

- 3777 NW 78th Ave Unit 3H

- 3325 NW 79th Way

- 4206 Cascada Cr Unit 4206

- 4206 Cascada Cir

- 4208 Cascada Cir Unit 1101

- 4204 Cascada Cir

- 4202 Cascada Cir Unit 1104

- 4202 Cascada Cir Unit 4202

- 4202 Cascada Cir

- 4184 Cascada Cir

- 4184 Cascada Cir

- 4186 Cascada Cir Unit 4186

- 4186 Cascada Cir Unit 4186

- 4222 Cascada Cir Unit 4222

- 4188 Cascada Cir

- 4224 Cascada Cir Unit 4224

- 4188 Cascada Cir Unit 1201

- 4182 Cascada Cir Unit 4182

- 4248 Cascada Cir

- 4226 Cascada Cir

- 4197 Cascada Cir Unit 104