4210 Cimmaron Trail Granbury, TX 76049

Estimated Value: $396,000 - $503,000

3

Beds

3

Baths

2,349

Sq Ft

$187/Sq Ft

Est. Value

About This Home

This home is located at 4210 Cimmaron Trail, Granbury, TX 76049 and is currently estimated at $438,098, approximately $186 per square foot. 4210 Cimmaron Trail is a home located in Hood County with nearby schools including Acton Elementary School, Acton Middle School, and Granbury High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 17, 2017

Sold by

Andersen Joseph and Andersen Shirley

Bought by

Ireland Bruce and Ireland Brenda

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$208,000

Outstanding Balance

$170,602

Interest Rate

3.87%

Mortgage Type

New Conventional

Estimated Equity

$267,496

Purchase Details

Closed on

Dec 11, 2006

Sold by

Winquist James Lee and Winquist Anne Greer

Bought by

Andersen Joseph and Andersen Shirley

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$96,550

Interest Rate

6.3%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Nov 10, 1998

Sold by

Cocanour Paul N

Bought by

Ireland Bruce Et Ux Brenda

Purchase Details

Closed on

Jun 15, 1992

Sold by

Cocanour Paul N

Bought by

Ireland Bruce Et Ux Brenda

Purchase Details

Closed on

Feb 11, 1991

Sold by

Dufraine Nancy P

Bought by

Ireland Bruce Et Ux Brenda

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ireland Bruce | -- | Central Texas Title | |

| Andersen Joseph | -- | Central Texas Title | |

| Ireland Bruce Et Ux Brenda | -- | -- | |

| Ireland Bruce Et Ux Brenda | -- | -- | |

| Ireland Bruce Et Ux Brenda | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ireland Bruce | $208,000 | |

| Previous Owner | Andersen Joseph | $96,550 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,205 | $403,340 | $40,000 | $363,340 |

| 2024 | $3,349 | $399,916 | $40,000 | $373,670 |

| 2023 | $4,424 | $415,880 | $40,000 | $375,880 |

| 2022 | $3,997 | $388,400 | $40,000 | $348,400 |

| 2021 | $4,613 | $305,850 | $20,000 | $285,850 |

| 2020 | $4,242 | $275,430 | $20,000 | $255,430 |

| 2019 | $4,037 | $248,320 | $20,000 | $228,320 |

| 2018 | $3,834 | $235,820 | $20,000 | $215,820 |

| 2017 | $3,726 | $222,790 | $20,000 | $202,790 |

| 2016 | $3,491 | $208,750 | $20,000 | $188,750 |

| 2015 | $2,565 | $192,530 | $20,000 | $172,530 |

| 2014 | $2,565 | $201,610 | $20,000 | $181,610 |

Source: Public Records

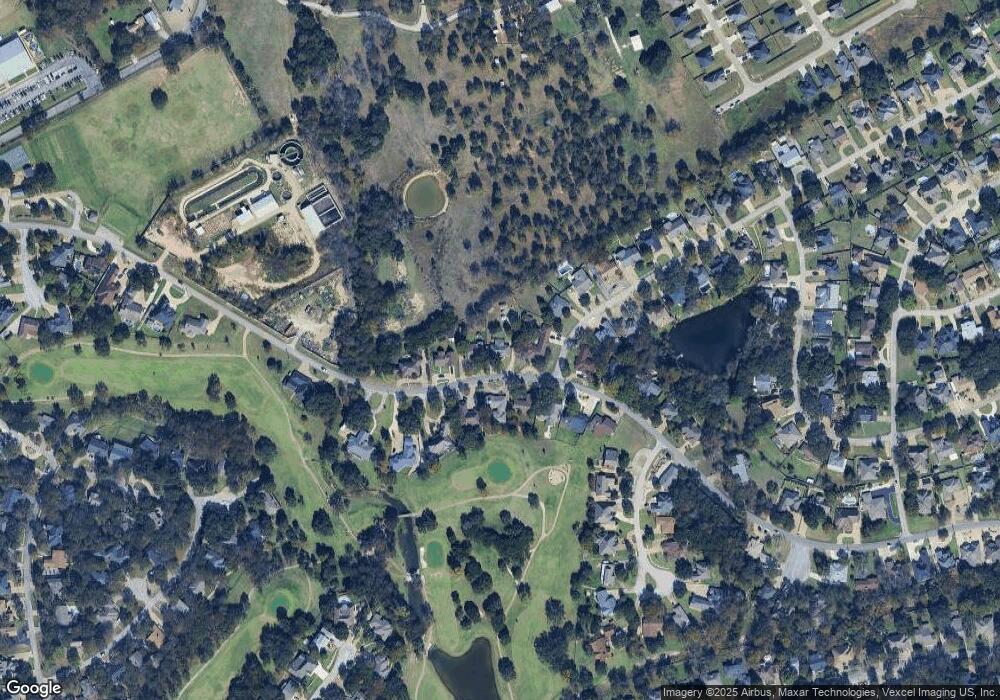

Map

Nearby Homes

- 4112 Cimmaron Trail

- 4904 Fairway Place Ct

- 5003 Bueno Dr

- 5102 Largo Dr

- 3304 White Horse Dr

- 6118 Laredo Ct

- 4116 Fairway Dr

- 4009 Scenic Way

- 4512 Cimmaron Trail

- 4901 Fairway Ct

- 3108 Windcrest Ct

- 5411 Corto Dr

- 6301 Sonora Dr

- 3510 Fountain Way

- 4920 Centre Ct

- 5128 Country Club Dr

- 3218 Fountain Way

- 5710 Cortez Dr

- 6318 Sonora Dr

- 5200 Country Club Dr

- 4212 Cimmaron Trail

- 4212 Cimmaron Trail

- 4208 Cimmaron Trail

- 6516 Circo Dr

- 4214 Cimmaron Trail

- 4211 Cimmaron Trail

- 4209 Cimmaron Trail

- 6514 Circo Dr

- 4206 Cimmaron Trail

- 4206 Cimmaron Trail Unit 20

- 4213 Cimmaron Trail

- 4207 Cimmaron Trail

- 6515 Circo Dr

- 4216 Cimmaron Trail

- 4205 Cimmaron Trail

- 4215 Cimmaron Trail

- 6512 Circo Dr

- 4204 Cimmaron Trail

- 6513 Circo Dr

- 4203 Cimmaron Trail