Estimated Value: $180,000 - $206,000

2

Beds

2

Baths

1,487

Sq Ft

$129/Sq Ft

Est. Value

About This Home

This home is located at 422 Country Club Dr, Alamo, TX 78516 and is currently estimated at $192,153, approximately $129 per square foot. 422 Country Club Dr is a home located in Hidalgo County with nearby schools including Capt. D. Salinas Elementary School, Dora M. Sauceda Middle School, and Donna North High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 12, 2020

Sold by

Talbot Terri and Talbot Richard Anthony

Bought by

Talbot Terri

Current Estimated Value

Purchase Details

Closed on

Oct 13, 2011

Sold by

Mclaughlin Charles and Mclaughlin Mary

Bought by

Talbot Richard Anthony

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$137,425

Outstanding Balance

$94,063

Interest Rate

4.25%

Mortgage Type

FHA

Estimated Equity

$98,090

Purchase Details

Closed on

May 27, 2008

Sold by

Mclaughlin Charles and Mclaughlin Mary

Bought by

Mclaughlin Charles and Mclaughlin Mary

Purchase Details

Closed on

Oct 5, 1998

Sold by

Valerius Laurie and Estate Of Lavera Mckearney

Bought by

Mclaughlin Charles and Mclaughlin Mary

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Talbot Terri | -- | None Available | |

| Talbot Richard Anthony | -- | Edwards Abstract & Title Co | |

| Mclaughlin Charles | -- | None Available | |

| Mclaughlin Charles | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Talbot Richard Anthony | $137,425 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,128 | $179,000 | $65,000 | $114,000 |

| 2024 | $3,128 | $171,302 | -- | -- |

| 2023 | $3,964 | $155,729 | $0 | $0 |

| 2022 | $3,688 | $141,572 | $0 | $0 |

| 2021 | $3,377 | $128,702 | $36,563 | $104,811 |

| 2020 | $3,172 | $117,002 | $36,563 | $93,071 |

| 2019 | $2,917 | $106,365 | $36,563 | $69,802 |

| 2018 | $2,897 | $106,365 | $36,563 | $69,802 |

| 2017 | $2,934 | $106,365 | $36,563 | $69,802 |

| 2016 | $2,934 | $106,365 | $36,563 | $69,802 |

| 2015 | $3,084 | $108,693 | $36,563 | $72,130 |

Source: Public Records

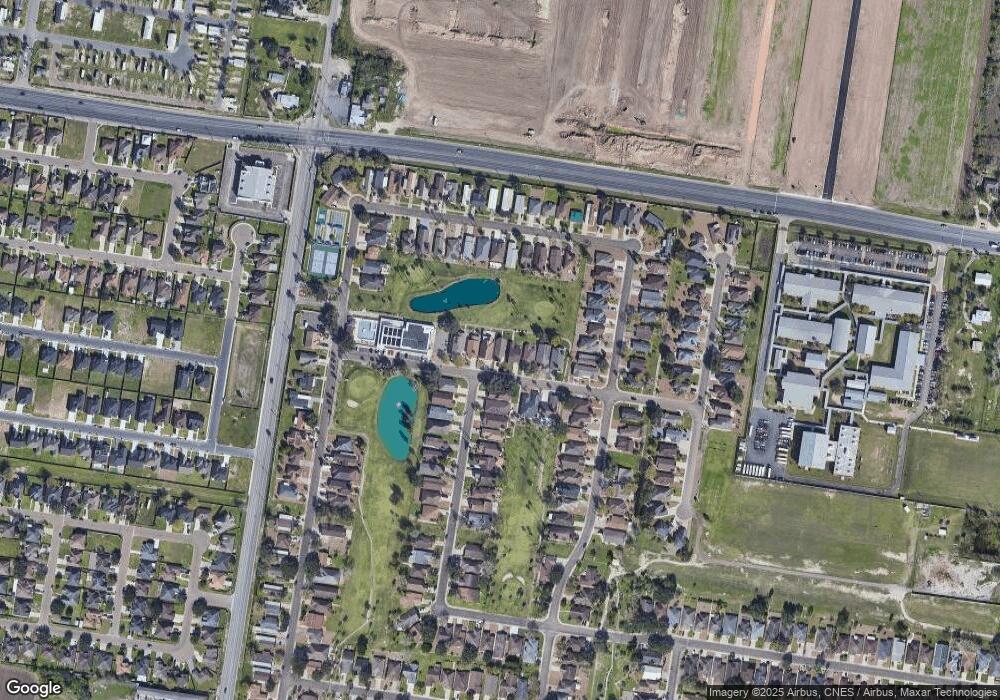

Map

Nearby Homes

- 1016 Palm Dr

- 419 Country Club Dr

- 912 Palm Dr

- 917 Citrus Dr

- 1233 Country Club Dr

- 912 Santa Anna Dr

- 928 Katrin Dr

- 421 Diana Dr

- Sophora Plan at Las Cruces

- Valencia Plan at Las Cruces

- Tularosa Plan at Las Cruces

- Clovis Plan at Las Cruces

- Duranta Plan at Las Cruces

- 510 Greystone Cir

- 731 N Tower Rd

- 516 Hunter Dr

- 520 Country Club Dr

- 517 Hunter Dr

- 821 Nada Dr

- 101 Kansas Rd

- 420 Country Club Dr

- 424 Country Club Dr

- 418 Country Club Dr

- 426 Country Club Dr

- Country Club Country Club Dr

- 416 Country Club Dr

- 428 Country Club Dr

- 428 Country Club Dr Unit Lot 61 Phase 1

- 1040 Palm Dr Unit 4

- 1040 Palm Dr Unit 3

- 1036 Palm Dr Unit 4

- 1036 Palm Dr Unit 3

- 1036 Palm Dr Unit 1

- 1032 Palm Dr Unit 2

- 1032 Palm Dr Unit 1

- 1020 Palm Dr Unit 2

- 1020 Palm Dr Unit 1

- 1016 Palm Dr Unit 3

- 1016 Palm Dr Unit 2

- 1040 Palm Dr Unit 1