422 W 16th St Tyrone, PA 16686

Estimated Value: $124,031 - $157,000

3

Beds

1

Bath

1,525

Sq Ft

$91/Sq Ft

Est. Value

About This Home

This home is located at 422 W 16th St, Tyrone, PA 16686 and is currently estimated at $138,508, approximately $90 per square foot. 422 W 16th St is a home located in Blair County with nearby schools including Tyrone Area Elementary School, Tyrone Area Middle School, and Tyrone Area High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 29, 2022

Sold by

Allen Hagenbuch Jr Glenn

Bought by

Mazzotta Valerie Marie

Current Estimated Value

Purchase Details

Closed on

Jun 28, 2011

Sold by

Derlin Enterprises Llc

Bought by

Hagenbuch Glen A and Hagenbuch Valerie M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$82,380

Interest Rate

4.62%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 16, 2007

Sold by

Deutsche Bank National Trust Co

Bought by

Derlin Enterprises Llc

Purchase Details

Closed on

Jul 16, 2007

Sold by

Myers Mark D and Myers Gegetta L

Bought by

Deutsche Bank National Trust Co

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mazzotta Valerie Marie | -- | None Listed On Document | |

| Hagenbuch Glen A | $79,900 | Jmc Title Co | |

| Derlin Enterprises Llc | $28,000 | Land Title Services Of Nj In | |

| Deutsche Bank National Trust Co | $1,478 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hagenbuch Glen A | $82,380 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,351 | $82,600 | $11,700 | $70,900 |

| 2024 | $1,261 | $82,600 | $11,700 | $70,900 |

| 2023 | $1,159 | $82,600 | $11,700 | $70,900 |

| 2022 | $1,087 | $82,600 | $11,700 | $70,900 |

| 2021 | $1,090 | $82,600 | $11,700 | $70,900 |

| 2020 | $1,075 | $82,600 | $11,700 | $70,900 |

| 2019 | $1,046 | $82,600 | $11,700 | $70,900 |

| 2018 | $1,027 | $82,600 | $11,700 | $70,900 |

| 2017 | $6,835 | $82,600 | $11,700 | $70,900 |

| 2016 | $428 | $7,950 | $990 | $6,960 |

| 2015 | $428 | $7,950 | $990 | $6,960 |

| 2014 | $428 | $7,950 | $990 | $6,960 |

Source: Public Records

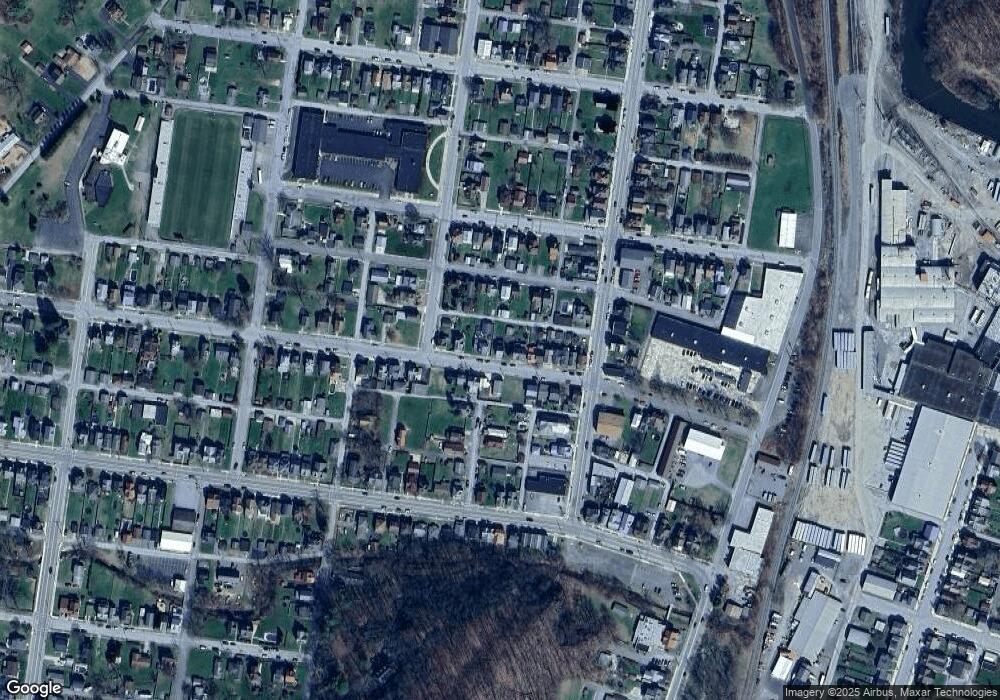

Map

Nearby Homes

- 1655 Columbia Ave

- 306 W 15th St

- 631 W 16th St

- 1465 Logan Ave

- 1320 Cameron Ave

- 1209 Lincoln Ave

- 2230 Hillside Aly

- 1313 Blair Ave

- 100 Meade St

- 1008 Cameron Ave

- 1004 Lincoln Ave

- 1006 Clay Ave

- 850 Jefferson Ave

- 622 Washington Ave

- 0 E Pleasant Valley Blvd Unit LotWP001 19615403

- 424 Covert Ave

- 000 E Pleasant Valley Blvd

- WP001 E Pleasant Valley Blvd

- 5361 E Pleasant Valley Blvd

- 1844 Decker Hollow Rd