4223 Terrapin Place New Port Richey, FL 34652

Estimated Value: $103,000 - $147,000

2

Beds

2

Baths

888

Sq Ft

$137/Sq Ft

Est. Value

About This Home

This home is located at 4223 Terrapin Place, New Port Richey, FL 34652 and is currently estimated at $121,365, approximately $136 per square foot. 4223 Terrapin Place is a home located in Pasco County with nearby schools including Mittye P. Locke Elementary School, Gulf Trace Elementary School, and Paul R. Smith Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 11, 2024

Sold by

Pasco County Florida

Bought by

Distribution Usa Inc

Current Estimated Value

Purchase Details

Closed on

Jul 8, 2021

Sold by

Resmondo Debra Ann and Gardens Of Beacon Square Condo

Bought by

Razorback Capital Llc

Purchase Details

Closed on

May 18, 2016

Sold by

Cahill Dennis and Hennecke Jo Ann P

Bought by

Resmondo Debra Ann

Purchase Details

Closed on

Aug 19, 2004

Sold by

Wolff Cora Lee

Bought by

Cahill Josephine

Purchase Details

Closed on

Feb 28, 2003

Sold by

Anthony Robert W and Anthony Esther

Bought by

Wolff Cora Lee

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$41,200

Interest Rate

5.95%

Purchase Details

Closed on

Jun 12, 2001

Sold by

Gagnon Eleanor M

Bought by

Anthony Robert W and Anthony Esther

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$31,600

Interest Rate

7.05%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Distribution Usa Inc | $80,000 | None Listed On Document | |

| Razorback Capital Llc | $40,000 | Attorney | |

| Resmondo Debra Ann | $28,500 | Bay National Title Co | |

| Cahill Josephine | $64,900 | America Title Llc | |

| Wolff Cora Lee | $51,500 | -- | |

| Anthony Robert W | $39,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Wolff Cora Lee | $41,200 | |

| Previous Owner | Anthony Robert W | $31,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,897 | $96,247 | $4,600 | $91,647 |

| 2024 | $1,897 | $111,882 | $4,600 | $107,282 |

| 2023 | $1,676 | $86,660 | $0 | $0 |

| 2022 | $1,403 | $78,788 | $4,600 | $74,188 |

| 2021 | $161 | $21,030 | $4,600 | $16,430 |

| 2020 | $156 | $20,740 | $4,600 | $16,140 |

| 2019 | $150 | $20,280 | $0 | $0 |

| 2018 | $145 | $19,908 | $0 | $0 |

| 2017 | $145 | $19,908 | $0 | $0 |

| 2016 | $510 | $24,199 | $4,600 | $19,599 |

| 2015 | $502 | $24,404 | $4,400 | $20,004 |

| 2014 | $95 | $24,809 | $4,400 | $20,409 |

Source: Public Records

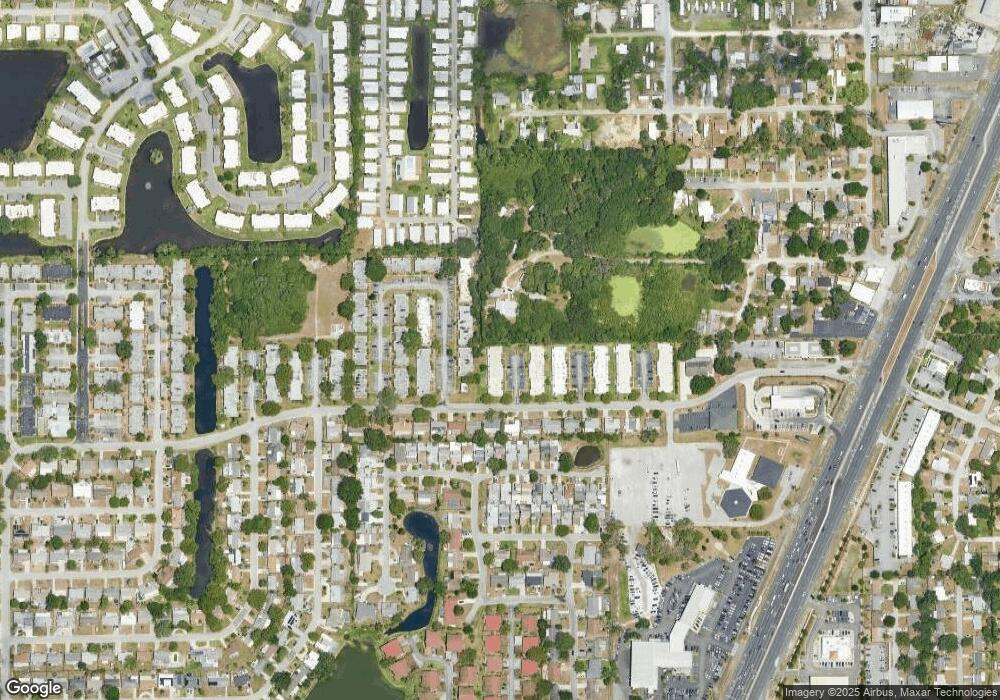

Map

Nearby Homes

- 4219 Terrapin Place

- 4235 Sheldon Place Unit 4235

- 4223 Sheldon Place Unit 23

- 4211 Sheldon Place Unit 4211

- 4218 Terrapin Place Unit D

- 4242 Redcliff Place Unit 4242

- 4443 Tucker Square

- 4237 Redcliff Place

- 4209 Prince Place Unit 4209

- 4434 Tucker Square

- 4451 Tidal Pond Rd

- 4432 Tucker Square

- 4509 Tidal Pond Rd

- 4224 Prince Place

- 4301 Summersun Dr Unit A

- 4220 Touchton Place

- 4210 Touchton Place Unit 2

- 4505 Cottonwood Dr

- 4206 Touchton Place

- 4308 Summersun Dr

- 4223 Terrapin Place

- 4223 Terrapin Place Unit 4223

- 4221 Terrapin Place

- 4219 Terrapin Place Unit 4219

- 4219 Terrapin Place Unit F

- 4219 Terrapin Place Unit 6

- 4217 Terrapin Place Unit 4217

- 4217 Terrapin Place

- 4217 Terrapin Place Unit E

- 4215 Terrapin Place Unit 4215

- 4215 Terrapin Place Unit D

- 4215 Terrapin Place

- 4215 Terrapin Place

- 4215 Terrapin Place Unit 1

- 4213 Terrapin Place Unit C1808

- 4213 Terrapin Place Unit 3

- 4213 Terrapin Place Unit c

- 4226 Sheldon Place

- 4226 Sheldon Place Unit A

- 4228 Sheldon Place