4225 155th Place SE Unit 62 Bellevue, WA 98006

Eastgate NeighborhoodEstimated Value: $720,000 - $789,006

2

Beds

2

Baths

1,510

Sq Ft

$505/Sq Ft

Est. Value

About This Home

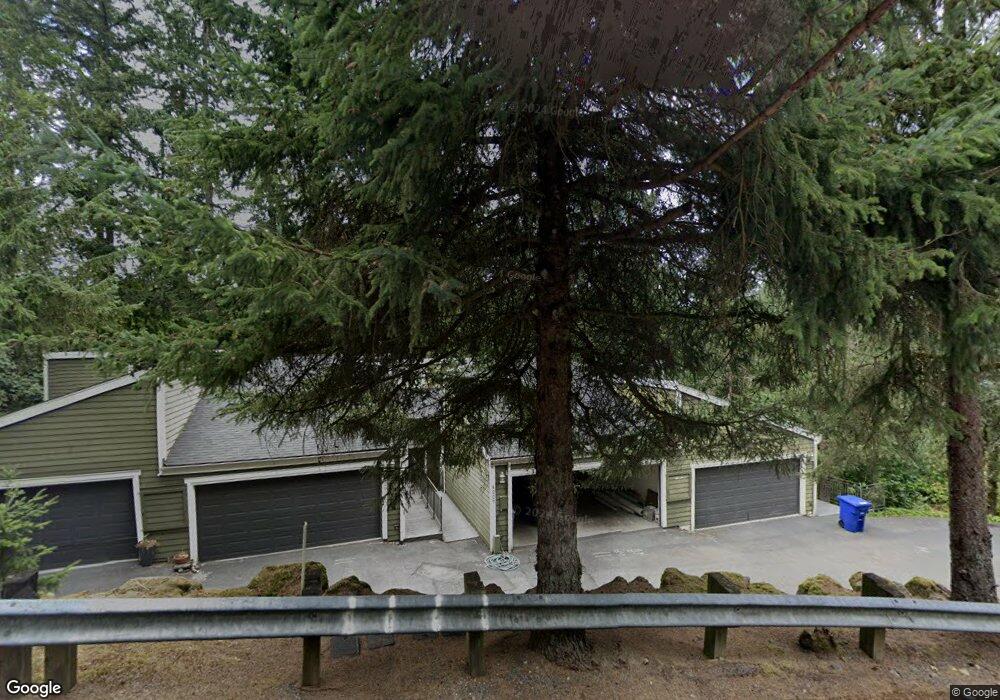

This home is located at 4225 155th Place SE Unit 62, Bellevue, WA 98006 and is currently estimated at $762,502, approximately $504 per square foot. 4225 155th Place SE Unit 62 is a home located in King County with nearby schools including Spiritridge Elementary School, Tillicum Middle School, and Newport High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 11, 2021

Sold by

Ternes Howard M and Herrera Ternes Jocelyn

Bought by

Mahlstede Robert D

Current Estimated Value

Purchase Details

Closed on

Oct 14, 2019

Sold by

Galvin Thomas A and Mcgovern Galvin Patrice

Bought by

Ternes Howard M and Herrera Ternes Jocelyn A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$360,500

Interest Rate

3.4%

Purchase Details

Closed on

Apr 2, 2013

Sold by

Estate Of Jerry W Eakin

Bought by

Galvin Thomas A and Galvin Patrice Mcgovern

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$272,000

Interest Rate

3.54%

Purchase Details

Closed on

Oct 24, 1990

Sold by

Wa Mutual Savings Bank

Bought by

Eakin Jerry W

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mahlstede Robert D | $675,000 | Rainier Title | |

| Ternes Howard M | $610,500 | Fidelity National Title | |

| Galvin Thomas A | $340,000 | Chicago Title | |

| Eakin Jerry W | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ternes Howard M | $360,500 | |

| Previous Owner | Galvin Thomas A | $272,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,891 | $665,000 | $133,100 | $531,900 |

| 2023 | $4,642 | $724,000 | $133,100 | $590,900 |

| 2022 | $4,528 | $654,000 | $129,100 | $524,900 |

| 2021 | $4,944 | $550,000 | $113,000 | $437,000 |

| 2020 | $4,257 | $557,000 | $113,000 | $444,000 |

| 2018 | $3,893 | $471,000 | $100,800 | $370,200 |

| 2017 | $3,466 | $422,000 | $96,800 | $325,200 |

| 2016 | $3,342 | $396,000 | $88,700 | $307,300 |

| 2015 | $3,455 | $379,000 | $80,700 | $298,300 |

| 2014 | -- | $388,000 | $64,500 | $323,500 |

| 2013 | -- | $274,000 | $56,500 | $217,500 |

Source: Public Records

Map

Nearby Homes

- 0 XXX SE Newport Way

- 15604 SE 42nd Place

- 15244 SE 43rd St Unit C202

- 15314 SE Newport Way

- 4131 153rd Ave SE

- 15916 SE 42nd Place

- 15815 SE 43rd Place

- 15025 SE 43rd St

- 4103 151st Ave SE

- 4123 150th Ave SE

- 4017 162nd Ave SE

- 16142 SE 42nd Place

- 14627 SE Newport Way

- 16160 SE 45th St

- 15710 SE 46th Way

- 3978 162nd Place SE

- 15144 SE 46th Way

- 3973 162nd Place SE

- 4626 159th Ave SE

- 4563 162nd Ln SE

- 4225 155th Place SE

- 4225 155th Place SE Unit 11

- 4225 155th Place SE Unit 32

- 4225 155th Place SE Unit 21

- 4225 155th Place SE Unit 33

- 4225 155th Place SE Unit 52

- 4225 155th Place SE Unit 61

- 4225 155th Place SE Unit 51

- 4225 155th Place SE Unit 44

- 4225 155th Place SE Unit 43

- 4225 155th Place SE Unit 42

- 4225 155th Place SE Unit 41

- 4225 155th Place SE Unit 31

- 4225 155th Place SE Unit 24

- 4225 155th Place SE Unit 23

- 4225 155th Place SE Unit 22

- 4225 155th Place SE Unit 14

- 4225 155th Place SE Unit 13

- 4225 155th Place SE Unit 12

- 4246 155th Place SE