4225 Fourth Rail Ln Unit 2A Cumming, GA 30040

Estimated Value: $469,564 - $514,000

4

Beds

3

Baths

3,060

Sq Ft

$160/Sq Ft

Est. Value

About This Home

This home is located at 4225 Fourth Rail Ln Unit 2A, Cumming, GA 30040 and is currently estimated at $489,891, approximately $160 per square foot. 4225 Fourth Rail Ln Unit 2A is a home located in Forsyth County with nearby schools including Coal Mountain Elementary School, North Forsyth Middle School, and North Forsyth High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 22, 2022

Sold by

Offerpad Spe Borrower A Llc

Bought by

Seven Points Borrower Llc

Current Estimated Value

Purchase Details

Closed on

Jul 20, 2022

Sold by

Lori Alaoui

Bought by

Offerpad Spe Borrower A Llc

Purchase Details

Closed on

Apr 11, 2019

Sold by

Rogers Dolores B

Bought by

Rogers Dolores B and Alaoui Lori

Purchase Details

Closed on

Apr 8, 2011

Sold by

Hud & Housing Of Urban Dev

Bought by

Rogers Dolores B

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$147,600

Interest Rate

4.13%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 4, 2010

Sold by

Bank Of America

Bought by

Hud & Housing Of Urban Dev

Purchase Details

Closed on

Nov 30, 2007

Sold by

Homelife Communities Of Northw

Bought by

Mendez Ezequiel E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$218,943

Interest Rate

6.05%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Seven Points Borrower Llc | $406,200 | Selene Title | |

| Offerpad Spe Borrower A Llc | $464,500 | None Listed On Document | |

| Rogers Dolores B | -- | -- | |

| Rogers Dolores B | -- | -- | |

| Hud & Housing Of Urban Dev | -- | -- | |

| Bank Of America | $245,671 | -- | |

| Mendez Ezequiel E | $222,400 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rogers Dolores B | $147,600 | |

| Previous Owner | Mendez Ezequiel E | $218,943 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,842 | $193,828 | $54,000 | $139,828 |

| 2024 | $4,842 | $197,440 | $54,000 | $143,440 |

| 2023 | $3,998 | $162,440 | $36,640 | $125,800 |

| 2022 | $3,619 | $113,764 | $20,000 | $93,764 |

| 2021 | $3,141 | $113,764 | $20,000 | $93,764 |

| 2020 | $2,905 | $105,216 | $20,000 | $85,216 |

| 2019 | $2,869 | $103,748 | $20,000 | $83,748 |

| 2018 | $2,874 | $103,920 | $18,000 | $85,920 |

| 2017 | $2,671 | $96,232 | $18,000 | $78,232 |

| 2016 | $2,452 | $88,352 | $17,200 | $71,152 |

| 2015 | $2,401 | $86,352 | $15,200 | $71,152 |

| 2014 | $1,985 | $74,964 | $10,000 | $64,964 |

Source: Public Records

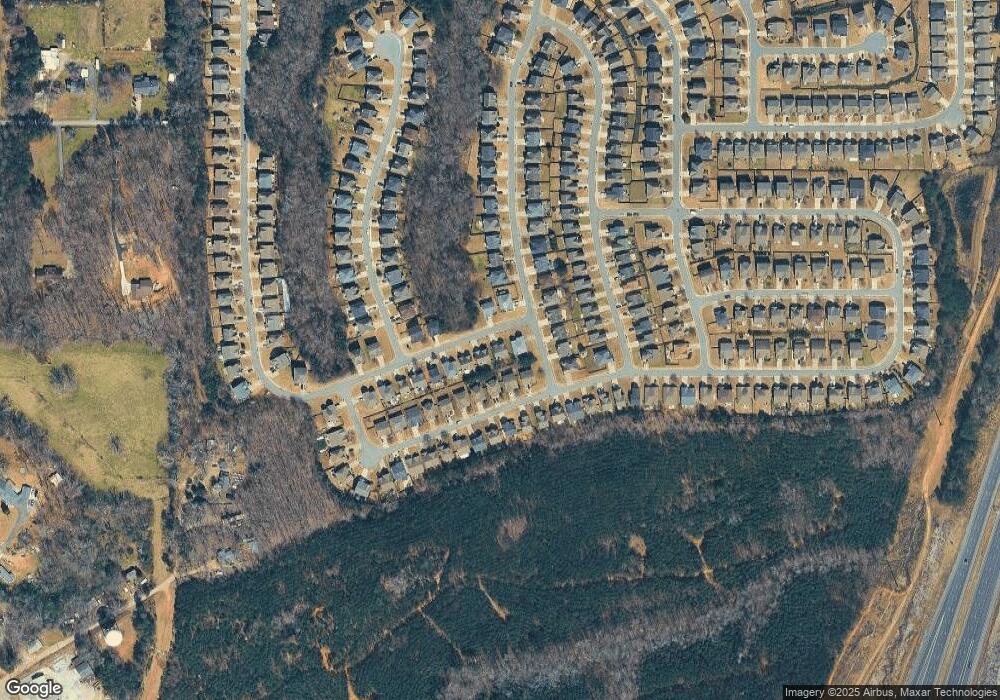

Map

Nearby Homes

- 4595 Fourth Rail Ln

- 5585 Rialto Way

- 3845 New Salem Ct

- 3838 Humber Ct

- 3998 Cutler Donahoe Way

- 3632 Sydney Harbor Ln

- 3990 New Salem Ct

- 3635 Roseman Landing Unit 1A

- 3663 Roseman Landing

- 3925 Cutler Donahoe Way Unit 1B

- 1601 Lexington Green Pines

- 1401 Lexington Green Pines

- 1001 Lexington Green Pines

- 3020 Keith Bridge Rd

- 2960 Bailey Dr

- 2955 Bailey Dr

- 4020 Sierra Knolls Ct

- 4010 Sierra Knolls Ct

- 3770 Falling Leaf Ln

- 3534 Dahlonega Hwy

- 4225 Fourth Rail Ln

- 4235 Fourth Rail Ln

- 4235 Fourth Rail Ln

- 4245 Fourth Rail Ln

- 4210 Pointe Vecchio Cir

- 4220 Fourth Rail Ln Unit 4220

- 4220 Fourth Rail Ln

- 4220 Fourth Rail Ln

- 4150 Pointe Vecchio Cir

- 4565 Roseman Trail

- 4555 Roseman Trail

- 4545 Roseman Trail

- 4545 Roseman Trail

- 4255 Fourth Rail Ln

- 4255 Fourth Rail Ln

- 4255 Fourth Rail Ln Unit 700

- 4215 Pointe Vecchio Cir

- 4270 Fourth Rail Ln

- 4225 Pointe Vecchio Cir

- 4535 Roseman Trail