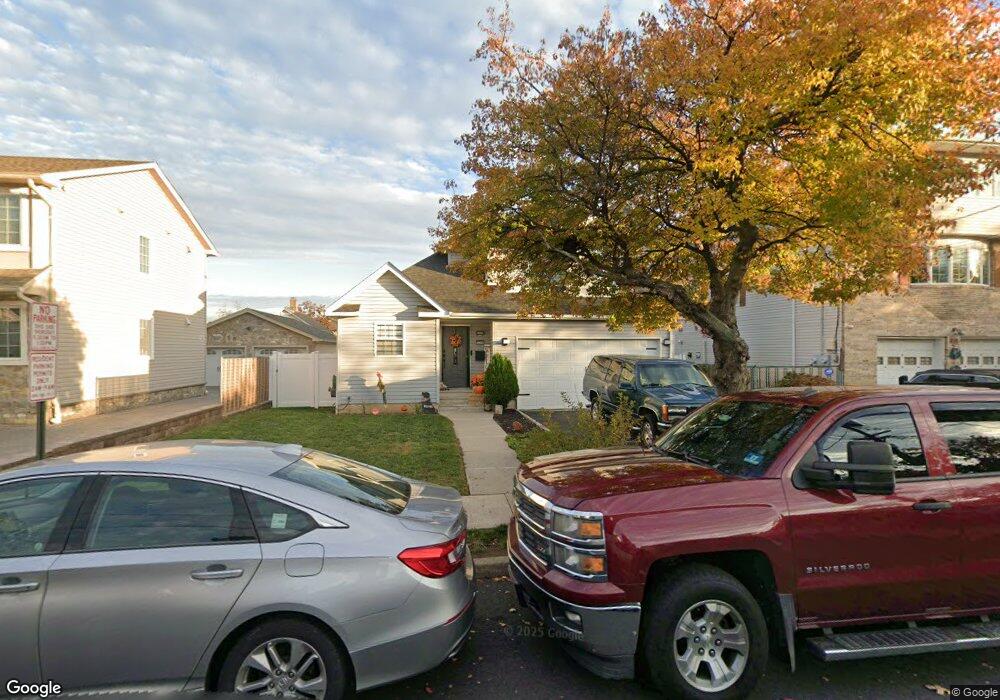

423 8th St Carlstadt, NJ 07072

Estimated Value: $659,476 - $724,000

--

Bed

--

Bath

1,562

Sq Ft

$444/Sq Ft

Est. Value

About This Home

This home is located at 423 8th St, Carlstadt, NJ 07072 and is currently estimated at $693,119, approximately $443 per square foot. 423 8th St is a home located in Bergen County with nearby schools including Carlstadt Public School, Henry P Becton Regional High School, and Montessori School of East Rutherford.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 10, 2024

Sold by

Kronyak Cathy S and Kronyak Kyle

Bought by

Monaco Megan L and Monaco John F

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$627,000

Outstanding Balance

$618,107

Interest Rate

6.82%

Mortgage Type

New Conventional

Estimated Equity

$75,012

Purchase Details

Closed on

Aug 25, 2015

Sold by

Kronyak Cathy S and Kronyak Kyle

Bought by

Kronyak Cathy S and Kronyak Kyle

Purchase Details

Closed on

Mar 26, 2008

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Monaco Megan L | $660,000 | North Bergen Title | |

| Monaco Megan L | $660,000 | North Bergen Title | |

| Kronyak Cathy S | $93,989 | -- | |

| -- | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Monaco Megan L | $627,000 | |

| Closed | Monaco Megan L | $627,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,180 | $574,800 | $247,500 | $327,300 |

| 2024 | $8,325 | $552,700 | $235,000 | $317,700 |

| 2023 | $8,018 | $506,100 | $207,500 | $298,600 |

| 2022 | $8,018 | $475,000 | $190,000 | $285,000 |

| 2021 | $8,169 | $450,600 | $177,500 | $273,100 |

| 2020 | $7,696 | $433,600 | $172,500 | $261,100 |

| 2019 | $7,606 | $414,500 | $170,000 | $244,500 |

| 2018 | $7,871 | $409,500 | $167,500 | $242,000 |

| 2017 | $7,675 | $402,700 | $165,000 | $237,700 |

| 2016 | $8,294 | $390,100 | $150,000 | $240,100 |

| 2015 | $8,075 | $390,100 | $150,000 | $240,100 |

| 2014 | $7,767 | $390,100 | $150,000 | $240,100 |

Source: Public Records

Map

Nearby Homes

- 344 10th St

- 522 9th St

- 426 Broad St

- 451 Hoboken Rd

- 340 Marsan Dr

- 60 Prospect Terrace

- 38 Hackensack St

- 30 Humboldt St

- 327 Madison St

- 53 Hackensack St

- 233 Paterson Ave

- 88 Columbia St

- 409 Washington St

- 507 Washington St

- 592 Central Ave

- 89 Rose St

- 573 Anderson Ave

- 58 Mozart St

- 148 Hackensack St

- 167 Columbia St