Estimated Value: $740,000 - $820,000

4

Beds

3

Baths

3,892

Sq Ft

$196/Sq Ft

Est. Value

About This Home

This home is located at 423 Douglas Edward Dr, Ocoee, FL 34761 and is currently estimated at $764,186, approximately $196 per square foot. 423 Douglas Edward Dr is a home located in Orange County with nearby schools including Thornebrooke Elementary School, Gotha Middle School, and Olympia High.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jul 14, 2020

Sold by

Armstead Lloyd Dean

Bought by

Armstead Lloyd Dean and Lloyd Dean Armstead Revocable

Current Estimated Value

Purchase Details

Closed on

Jun 10, 2011

Sold by

Derrick Curtis M and Derrick Dianne J

Bought by

Armstead Lloyd Dean and Armstead Constance Rae

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$300,000

Outstanding Balance

$207,008

Interest Rate

4.65%

Mortgage Type

New Conventional

Estimated Equity

$557,178

Purchase Details

Closed on

Jun 23, 2008

Sold by

Pulte Home Corp

Bought by

Derrick Curtis M and Derrick Dianne J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$210,000

Interest Rate

6.03%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Armstead Lloyd Dean | -- | Attorney | |

| Armstead Lloyd Dean | $390,000 | Dba Pcs Title | |

| Derrick Curtis M | $443,200 | Gulfatlantic Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Armstead Lloyd Dean | $300,000 | |

| Previous Owner | Derrick Curtis M | $210,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,206 | $655,630 | $115,000 | $540,630 |

| 2024 | $9,435 | $614,902 | -- | -- |

| 2023 | $9,435 | $594,269 | $115,000 | $479,269 |

| 2022 | $8,423 | $506,662 | $100,000 | $406,662 |

| 2021 | $7,608 | $419,986 | $90,000 | $329,986 |

| 2020 | $7,275 | $412,824 | $80,000 | $332,824 |

| 2019 | $7,600 | $405,663 | $70,000 | $335,663 |

| 2018 | $7,635 | $397,918 | $70,000 | $327,918 |

| 2017 | $7,396 | $377,337 | $70,000 | $307,337 |

| 2016 | $7,445 | $369,240 | $70,000 | $299,240 |

| 2015 | $7,364 | $355,410 | $70,000 | $285,410 |

| 2014 | $7,070 | $340,160 | $70,000 | $270,160 |

Source: Public Records

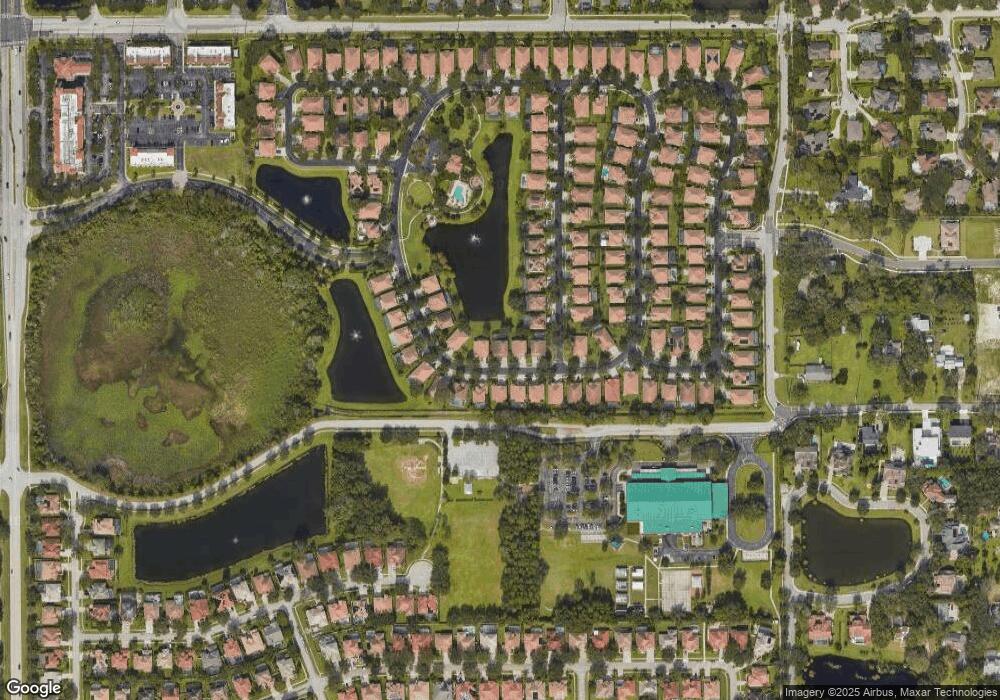

Map

Nearby Homes

- 524 Douglas Edward Dr

- 84 Braelock Dr

- 10199 Brocksport Cir

- 10193 Brocksport Cir

- 438 Drexel Ridge Cir

- 2437 Cliffdale St

- 1361 Whitney Isles Dr

- 1369 Glenwick Dr

- 10442 Birch Tree Ln

- 1077 Lascala Dr

- 11322 Rapallo Ln

- 1804 Maple Leaf Dr

- 272 Longhirst Loop

- 276 Longhirst Loop

- 1803 Glenbay Ct

- 1735 Maple Leaf Dr

- 608 Bridge Creek Blvd

- 1206 Sutter Ave

- 11312 Shandon Park Way

- 11410 Rapallo Ln

- 427 Douglas Edward Dr

- 419 Douglas Edward Dr

- 431 Douglas Edward Dr

- 2838 Valeria Rose Way

- 407 Douglas Edward Dr

- 424 Douglas Edward Dr

- 428 Douglas Edward Dr

- 420 Douglas Edward Dr

- 2830 Valeria Rose Way

- 432 Douglas Edward Dr

- 399 Douglas Edward Dr

- 416 Douglas Edward Dr

- 2822 Valeria Rose Way

- 436 Douglas Edward Dr

- 412 Douglas Edward Dr

- 395 Douglas Edward Dr

- 441 Douglas Edward Dr

- 408 Douglas Edward Dr

- 2839 Valeria Rose Way

- 440 Douglas Edward Dr