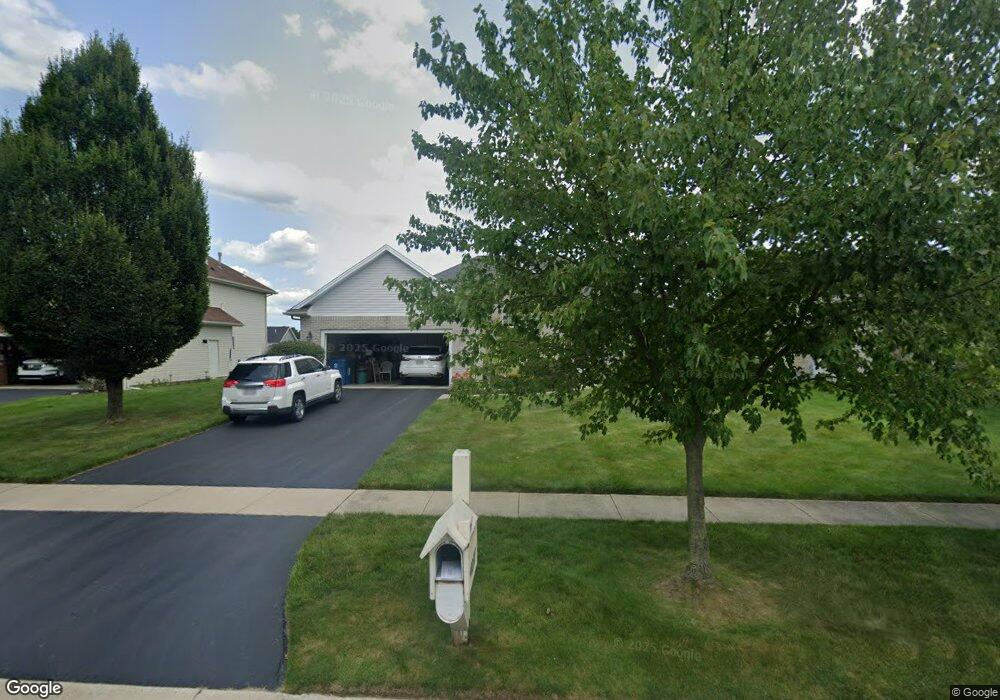

4237 Ranchers Cir Maumee, OH 43537

Estimated Value: $338,000 - $408,000

3

Beds

2

Baths

2,032

Sq Ft

$184/Sq Ft

Est. Value

About This Home

This home is located at 4237 Ranchers Cir, Maumee, OH 43537 and is currently estimated at $374,713, approximately $184 per square foot. 4237 Ranchers Cir is a home located in Lucas County with nearby schools including Anthony Wayne High School, Ohio Digital Learning School, and St Joseph Catholic School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 18, 2016

Sold by

Hanna Patricia S

Bought by

Hanna Patricia S and Patricia S Hanna Trust

Current Estimated Value

Purchase Details

Closed on

Dec 22, 2004

Sold by

Kls Construction Llc

Bought by

Hanna Patricia S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$153,000

Interest Rate

5.78%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 17, 2004

Sold by

Olde Farm Inc

Bought by

Kls Construction Llc

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Hanna Patricia S | -- | None Available | |

| Hanna Patricia S | $240,900 | -- | |

| Kls Construction Llc | $45,500 | Louisville Title Agency For |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | Hanna Patricia S | $153,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,319 | $127,505 | $24,990 | $102,515 |

| 2023 | $5,682 | $96,565 | $19,985 | $76,580 |

| 2022 | $5,713 | $96,565 | $19,985 | $76,580 |

| 2021 | $5,566 | $96,565 | $19,985 | $76,580 |

| 2020 | $5,409 | $84,105 | $16,765 | $67,340 |

| 2019 | $5,258 | $84,105 | $16,765 | $67,340 |

| 2018 | $4,990 | $84,105 | $16,765 | $67,340 |

| 2017 | $4,997 | $75,495 | $16,345 | $59,150 |

| 2016 | $4,949 | $215,700 | $46,700 | $169,000 |

| 2015 | $4,745 | $215,700 | $46,700 | $169,000 |

| 2014 | $4,530 | $73,300 | $15,860 | $57,440 |

| 2013 | $4,530 | $73,300 | $15,860 | $57,440 |

Source: Public Records

Map

Nearby Homes

- 7231 Rolling Meadow Ln

- 4161 Grande Lake Dr

- 4332 Sage St

- 4402 Sage St

- 4351 Sage St

- 4339 Sage St

- 7325 Violet Ln

- 3848 Ravine Hollow Ct

- 4541 Harbour Creek Ct

- 4321 Post Office Cir

- 4369 Post Office Cir

- 4334 Post Office Cir

- 4352 Post Office Cir

- 4346 Post Office Cir

- 6740 Monclova Rd

- 4455 Post Office Cir

- 7055 Nautica Ct

- 4645 Lakeside Dr

- 3556 Stillwater Blvd

- 4731 Cabriolet Ln

- 4231 Ranchers Cir

- 4243 Ranchers Cir

- 4225 Ranchers Cir

- 4236 Waterbend Dr W

- 4249 Ranchers Cir

- 4238 Ranchers Cir

- 7025 Saddleback Rd

- 7001 Southpine Ct

- 4219 Ranchers Cir

- 7007 Southpine Ct

- 7021 Harvester Rd

- 4242 Waterbend Dr W

- 4230 Waterbend Dr W

- 7040 Harvester Rd

- 7031 Saddleback Rd

- 4248 W Waterbend Dr

- 7006 Southpine Ct

- 6975 Southpine Ct

- 4224 Waterbend Dr W

- 4248 Waterbend Dr W