4245 Coyote Lakes Cir Unit 25B Lake In the Hills, IL 60156

Estimated Value: $587,701 - $802,000

2

Beds

2

Baths

1,701

Sq Ft

$397/Sq Ft

Est. Value

About This Home

This home is located at 4245 Coyote Lakes Cir Unit 25B, Lake In the Hills, IL 60156 and is currently estimated at $674,925, approximately $396 per square foot. 4245 Coyote Lakes Cir Unit 25B is a home located in McHenry County with nearby schools including Mackeben Elementary School, Conley Elementary School, and Heineman Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 17, 2023

Sold by

Ferrante John A and Ferrante Barbara J

Bought by

John A Ferrante And Barbara J Ferrante Irrevo and Ferran

Current Estimated Value

Purchase Details

Closed on

Jul 27, 2018

Sold by

Drake Steven P and Drake Lorraine J

Bought by

Ferrante John A and Ferrante Barbara J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$150,000

Interest Rate

4.5%

Mortgage Type

New Conventional

Purchase Details

Closed on

Aug 1, 2014

Sold by

Plote Homes Llc

Bought by

Drake Steven P and Drake Lorraine J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$413,817

Interest Rate

4.12%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| John A Ferrante And Barbara J Ferrante Irrevo | -- | None Listed On Document | |

| Ferrante John A | $438,000 | Attorney | |

| Drake Steven P | $459,798 | Chicago Title Insurance Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Ferrante John A | $150,000 | |

| Previous Owner | Drake Steven P | $413,817 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $10,391 | $158,439 | $32,607 | $125,832 |

| 2023 | $12,000 | $166,634 | $37,661 | $128,973 |

| 2022 | $12,510 | $161,984 | $34,293 | $127,691 |

| 2021 | $12,322 | $154,984 | $32,297 | $122,687 |

| 2020 | $12,337 | $152,973 | $31,436 | $121,537 |

| 2019 | $12,033 | $149,067 | $30,633 | $118,434 |

| 2018 | $15,122 | $176,123 | $34,474 | $141,649 |

| 2017 | $14,863 | $165,982 | $32,489 | $133,493 |

| 2016 | $15,031 | $157,808 | $30,889 | $126,919 |

Source: Public Records

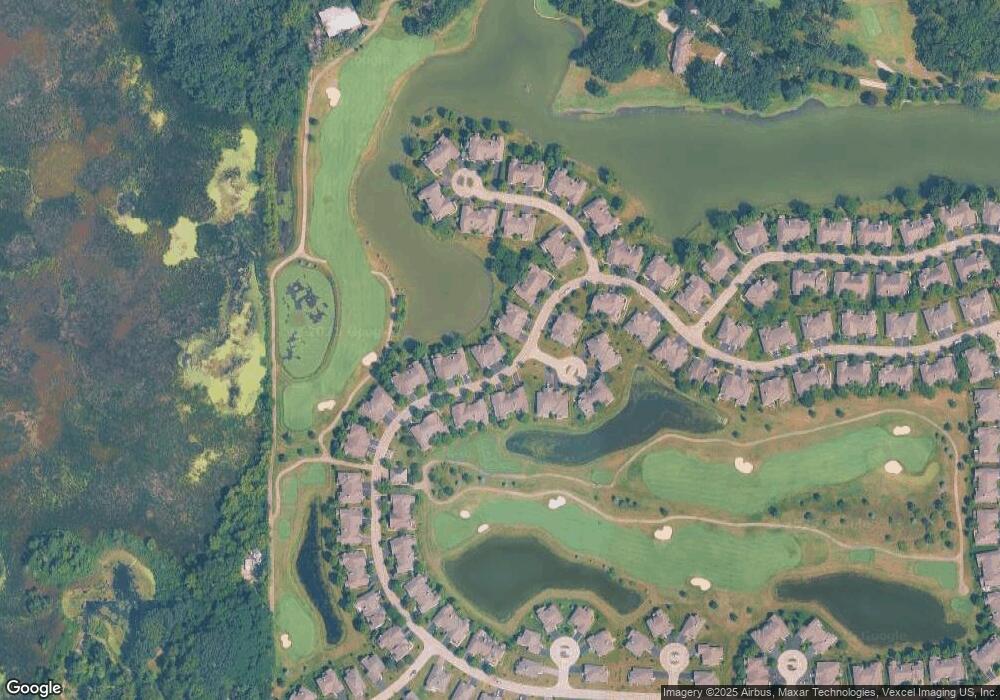

Map

Nearby Homes

- 6 Sugar Maple Ct

- 9105 Algonquin Rd

- 675 White Pine Cir

- 775 White Pine Cir

- 3891 Willow View Dr

- 641 Mason Ln

- 4015 Peartree Dr

- 9103 Miller Rd Unit 2

- 9103 Miller Rd Unit 3

- 9103 Miller Rd Unit 4

- 9103 Miller Rd Unit 1

- 9103 Miller Rd Unit 5

- 4535 Heron Dr

- 10 Barrington Ct

- 4020 Bunker Hill Dr

- 940 Treeline Dr

- 870 Noelle Bend

- 1849 Moorland Ln

- 3260 Nottingham Dr

- 1123 Village Rd

- 4245 Coyote Lakes Cir

- 4235 Coyote Lakes Cir Unit 24A

- 4235 Coyote Lakes Cir

- 4255 Coyote Lakes Cir Unit 25A

- 4225 Coyote Lakes Cir Unit 24B

- 4225 Coyote Lakes Cir

- 4265 Coyote Lakes Cir

- 4200 Coyote Lakes Cir

- 2 White Birch Ct

- 4215 Coyote Lakes Cir

- 4275 Coyote Lakes Cir

- 4220 Coyote Lakes Cir

- 4150 Coyote Lakes Cir

- 4230 Coyote Lakes Cir

- 4 White Birch Ct

- 4205 Coyote Lakes Cir

- 4205 Coyote Lakes Cir Unit 23B

- 4285 Coyote Lakes Cir

- 4240 Coyote Lakes Cir

- 5 White Birch Ct