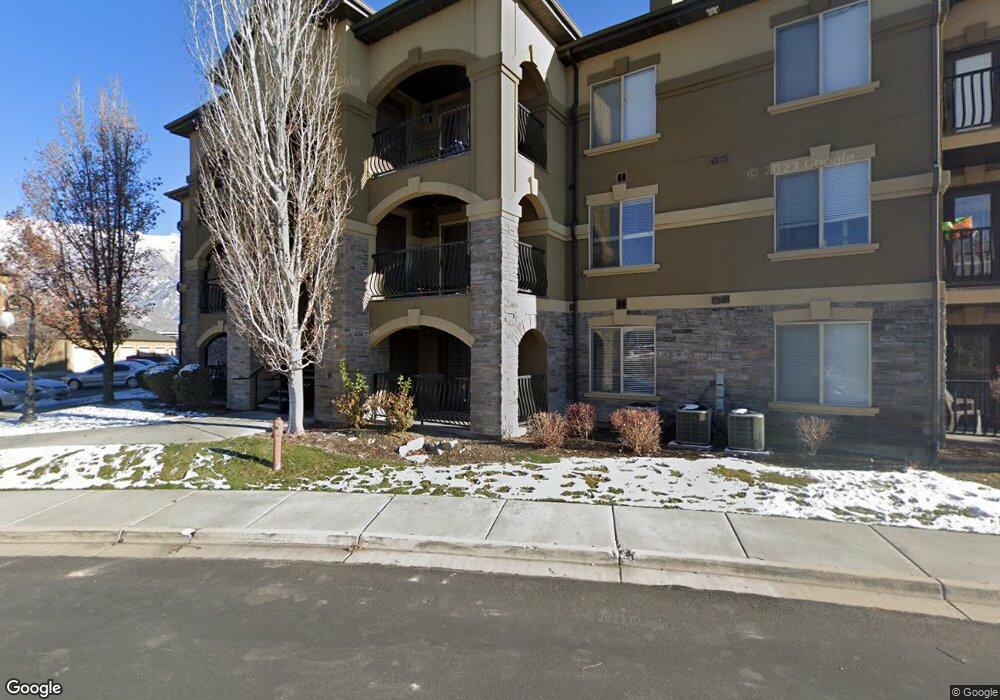

425 S 2220 W Pleasant Grove, UT 84062

Estimated Value: $315,000 - $324,000

3

Beds

2

Baths

1,156

Sq Ft

$276/Sq Ft

Est. Value

About This Home

This home is located at 425 S 2220 W, Pleasant Grove, UT 84062 and is currently estimated at $318,546, approximately $275 per square foot. 425 S 2220 W is a home located in Utah County with nearby schools including Barratt Elementary School, American Fork Junior High School, and American Fork High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 4, 2022

Sold by

Hawkins Jeffrey Todd and Hawkins Tracy

Bought by

Jeffrey And Tracy Hawkins Living Trust and Hawkins

Current Estimated Value

Purchase Details

Closed on

Jan 10, 2019

Sold by

Chick Shellie D

Bought by

Hawkins Jeffrey Todd and Hawkins Tracy

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$98,000

Interest Rate

4.8%

Mortgage Type

New Conventional

Purchase Details

Closed on

Apr 8, 2010

Sold by

Kriser Homes & Communities Inc

Bought by

Chick Shellie D

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$134,012

Interest Rate

5.25%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Jeffrey And Tracy Hawkins Living Trust | -- | None Listed On Document | |

| Hawkins Jeffrey Todd | -- | Lydolph & Weierholt Title In | |

| Chick Shellie D | -- | United West Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Hawkins Jeffrey Todd | $98,000 | |

| Previous Owner | Chick Shellie D | $134,012 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,463 | $315,200 | $35,000 | $280,200 |

| 2024 | $1,463 | $174,515 | $0 | $0 |

| 2023 | $1,401 | $171,215 | $0 | $0 |

| 2022 | $1,390 | $169,015 | $0 | $0 |

| 2021 | $1,221 | $226,000 | $27,100 | $198,900 |

| 2020 | $1,143 | $207,400 | $24,900 | $182,500 |

| 2019 | $1,005 | $188,500 | $22,000 | $166,500 |

| 2018 | $896 | $159,000 | $19,100 | $139,900 |

| 2017 | $850 | $80,300 | $0 | $0 |

| 2016 | $808 | $73,700 | $0 | $0 |

| 2015 | $853 | $73,700 | $0 | $0 |

| 2014 | $739 | $63,250 | $0 | $0 |

Source: Public Records

Map

Nearby Homes

- 518 S 2150 W Unit 202

- 581 S 2220 W Unit 301

- 574 S 2150 W Unit 104

- 684 S 2150 W Unit 203

- 661 S 2220 W Unit 202

- 626 S 2310 W

- 685 S 2220 W Unit 102

- 685 S 2220 W Unit 302

- 1795 W 120 S Unit 52

- The Henley B Plan at Tayside Farm - Single Family Home

- The Hastings Plan at Tayside Farm - Townhome

- The Henley A Plan at Tayside Farm - Single Family Home

- The Denton Plan at Tayside Farm - Townhome

- 1775 W 120 S Unit 54

- 128 S 1700 W Unit 12

- 1765 W 120 S Unit 55

- 29 S 2000 W

- 1597 W 80 S

- 43 S 1630 W

- 1559 W 50 N

- 425 S 2220 W

- 425 S 2220 W

- 425 S 2220 W

- 425 S 2220 W

- 425 S 2220 W

- 425 S 2220 W

- 425 S 2220 W

- 425 S 2220 W

- 425 S 2220 W

- 425 S 2220 W

- 425 S 2220 W

- 425 S 2220 W Unit 301

- 425 S 2220 W Unit 304

- 425 S 2220 W Unit 303

- 425 S 2220 W Unit 204

- 425 S 2220 W Unit 201

- 425 S 2220 W Unit 102

- 425 S 2220 W Unit 302

- 425 S 2220 W Unit 101

- 425 S 2220 W Unit 104