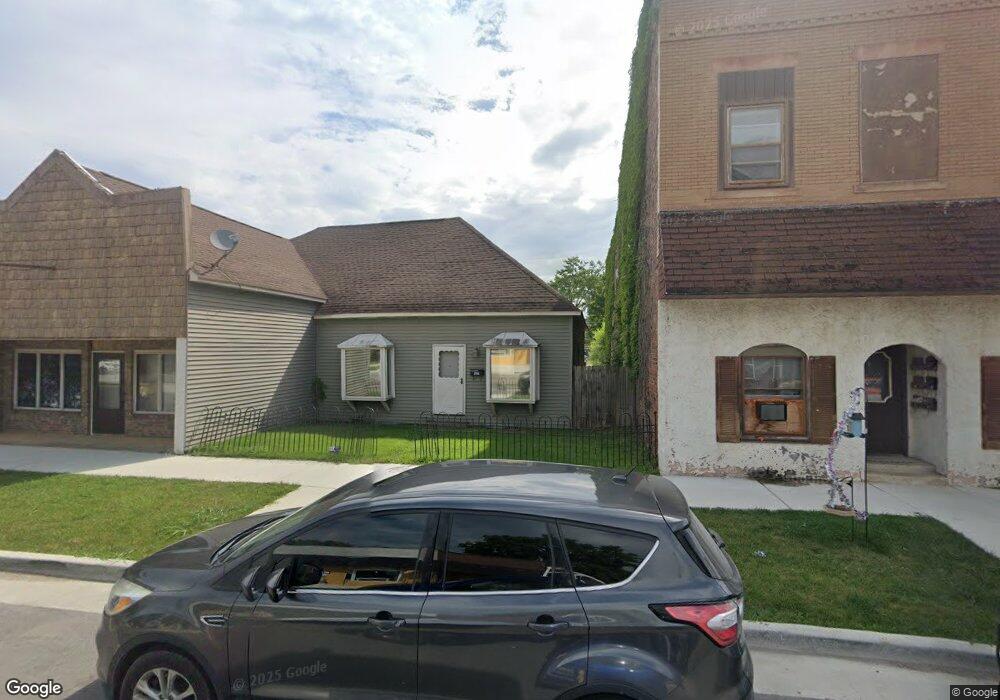

427 N 9th St Clinton, IN 47842

Estimated Value: $124,000 - $164,818

2

Beds

2

Baths

2,220

Sq Ft

$66/Sq Ft

Est. Value

About This Home

This home is located at 427 N 9th St, Clinton, IN 47842 and is currently estimated at $147,205, approximately $66 per square foot. 427 N 9th St is a home located in Vermillion County with nearby schools including South Vermillion High School and Sacred Heart School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 7, 2022

Sold by

Alabaugh Ronald E

Bought by

Foxworthy Stephanie

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$79,900

Outstanding Balance

$69,422

Interest Rate

3.56%

Mortgage Type

Credit Line Revolving

Estimated Equity

$77,783

Purchase Details

Closed on

Jan 6, 2011

Sold by

Not Provided

Bought by

Alabaugh Ronald E

Purchase Details

Closed on

Jan 5, 2011

Sold by

Wyres William

Bought by

Alabaugh Ronald E

Purchase Details

Closed on

Nov 24, 2008

Sold by

Hein Justin C

Bought by

First Financial Bank

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Foxworthy Stephanie | $94,000 | Abstract & Title Of Parke Coun | |

| Foxworthy Eric | $94,000 | None Listed On Document | |

| Alabaugh Ronald E | $75,000 | -- | |

| Alabaugh Ronald E | $75,000 | Hendrich Title Company | |

| First Financial Bank | -- | -- | |

| First Financial Bank | -- | Wilkinson Law Firm |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Foxworthy Eric | $79,900 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,866 | $143,300 | $13,300 | $130,000 |

| 2023 | $2,668 | $133,400 | $13,300 | $120,100 |

| 2022 | $1,626 | $133,200 | $13,300 | $119,900 |

| 2021 | $1,454 | $120,700 | $13,300 | $107,400 |

| 2020 | $1,176 | $100,000 | $16,400 | $83,600 |

| 2019 | $945 | $77,500 | $6,700 | $70,800 |

| 2018 | $935 | $80,900 | $6,700 | $74,200 |

| 2017 | $873 | $79,700 | $6,700 | $73,000 |

| 2016 | $840 | $77,400 | $6,700 | $70,700 |

| 2014 | $787 | $75,700 | $6,700 | $69,000 |

| 2013 | $787 | $75,900 | $6,700 | $69,200 |

Source: Public Records

Map

Nearby Homes

- 945 Morey St

- 821 N 8th St

- 15034 S Willow Grove Ave

- 660 Mulberry St

- 559 Mulberry St

- 1059 Blackman St

- 359 N 3rd St

- 1102 Matthews St

- 522 N Main St

- 1146 Blackman St

- 1108 W Ewing St

- 626 N Main St

- 1162 W Ewing St

- 1245 N 11th St

- 525 S 4th St

- 775 S Lincoln St

- 734 S 6th St

- 548 E 7th St

- 736 S Fulton St

- 1095 Oakridge Dr