42722 Whitney Rd Lagrange, OH 44050

Estimated Value: $336,000 - $378,000

4

Beds

2

Baths

1,680

Sq Ft

$218/Sq Ft

Est. Value

About This Home

This home is located at 42722 Whitney Rd, Lagrange, OH 44050 and is currently estimated at $365,936, approximately $217 per square foot. 42722 Whitney Rd is a home located in Lorain County with nearby schools including Keystone Elementary School, Keystone Middle School, and Keystone High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 6, 2004

Sold by

Eggers Mark W

Bought by

Volpe Carlo I and Volpe Gail C

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,018

Interest Rate

4.25%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

May 26, 2000

Sold by

Chervenak James J and Chervenak Tricia A

Bought by

Eggers Mark W

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$45,400

Interest Rate

8.13%

Purchase Details

Closed on

Jan 9, 1998

Sold by

Stewart Robert W and Stewart Donna R

Bought by

Chervenak James J and Chervenak Tricia A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$30,000

Interest Rate

7.12%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Volpe Carlo I | $190,000 | Quality Title Agency Inc | |

| Eggers Mark W | $55,000 | Midland Title | |

| Chervenak James J | $40,000 | Lorain County Title Co Inc |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Volpe Carlo I | $175,018 | |

| Previous Owner | Eggers Mark W | $45,400 | |

| Previous Owner | Chervenak James J | $30,000 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,320 | $105,203 | $35,816 | $69,388 |

| 2023 | $4,002 | $81,550 | $30,608 | $50,943 |

| 2022 | $3,972 | $81,550 | $30,608 | $50,943 |

| 2021 | $3,973 | $81,550 | $30,610 | $50,940 |

| 2020 | $3,647 | $66,740 | $25,050 | $41,690 |

| 2019 | $3,625 | $66,740 | $25,050 | $41,690 |

| 2018 | $3,536 | $66,740 | $25,050 | $41,690 |

| 2017 | $3,351 | $59,250 | $22,980 | $36,270 |

| 2016 | $3,327 | $59,250 | $22,980 | $36,270 |

| 2015 | $3,322 | $59,250 | $22,980 | $36,270 |

| 2014 | $2,899 | $59,250 | $22,980 | $36,270 |

| 2013 | $2,809 | $59,250 | $22,980 | $36,270 |

Source: Public Records

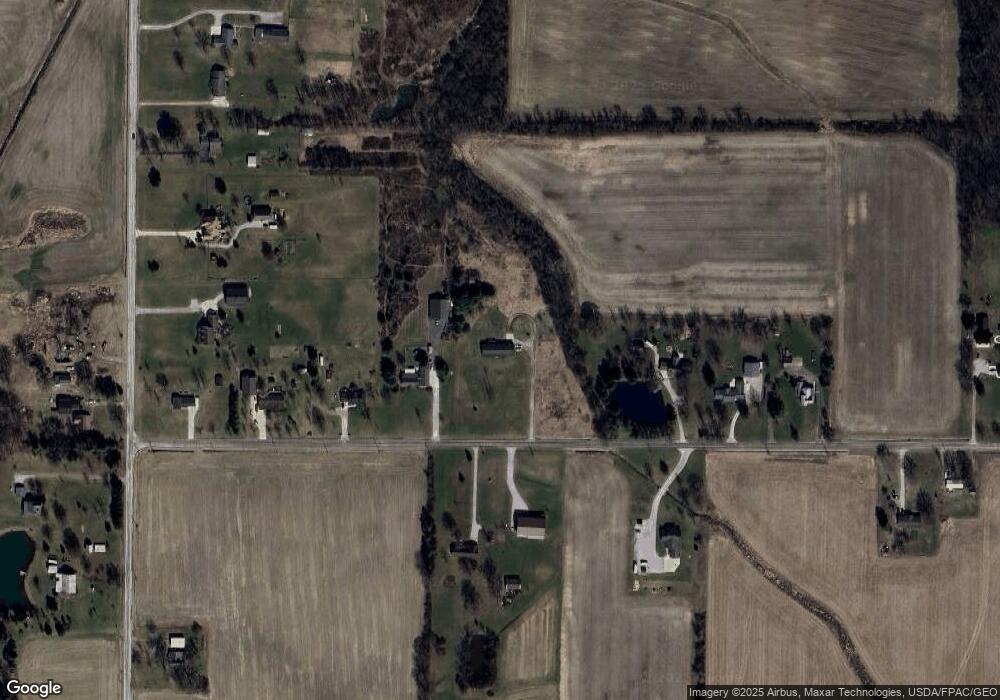

Map

Nearby Homes

- 704 Black Bear Run

- 42113 Meadow Ln

- 476 Stallion Ct

- 510 Arabian Ct

- 43902 State Route 303

- 468 Stallion Ct

- 305 W Main St

- 110 Railroad St

- 0 West Rd Unit 5125531

- 16974 Hawley Rd

- 317 Church St

- 43311 Peck Wadsworth Rd

- 0 Dill Ct Unit 5072837

- 567 Vicksburg Ct

- 516 Appomattox Ct

- 40260 Whitney Rd

- 548 William St

- 340 Granger Dr

- 829 Robinson Dr

- 808 Buckingham Dr

- 42826 Whitney Rd

- 42755 Whitney Rd

- 42660 Whitney Rd

- 42872 Whitney Rd

- 42783 Whitney Rd

- 42630 Whitney Rd

- 42920 Whitney Rd

- 42691 Whitney Rd

- 42584 Whitney Rd

- 18019 Diagonal Rd

- 17985 Diagonal Rd

- 42980 Whitney Rd

- 17801 Diagonal Rd

- 17775 Diagonal Rd

- 17747 Diagonal Rd

- 42559 Whitney Rd

- 18030 Diagonal Rd

- 18113 Diagonal Rd

- 0 Whitney Rd Unit 3239305

- 0 Whitney Rd Unit 3361609

Your Personal Tour Guide

Ask me questions while you tour the home.