Estimated Value: $182,000 - $186,000

3

Beds

1

Bath

1,068

Sq Ft

$171/Sq Ft

Est. Value

About This Home

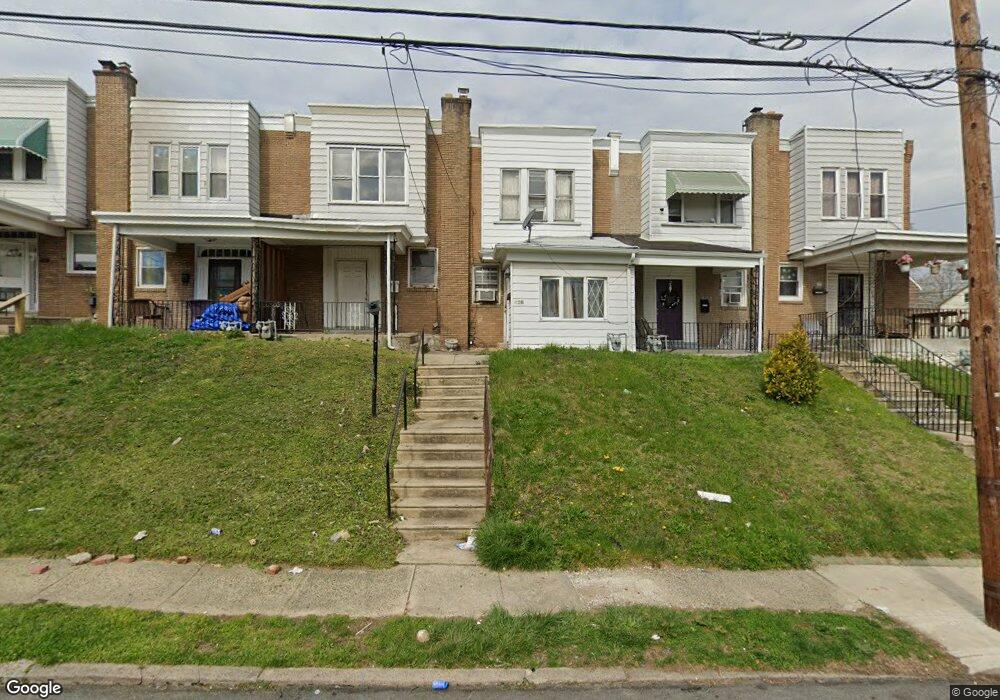

This home is located at 428 S 2nd St Unit B, Darby, PA 19023 and is currently estimated at $183,076, approximately $171 per square foot. 428 S 2nd St Unit B is a home located in Delaware County with nearby schools including Colwyn Elementary School, Penn Wood Middle School, and Penn Wood High School - Cypress Street Campus.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 27, 2024

Sold by

Tore Properties Llc

Bought by

King & Queen Real Estate Llc

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$117,000

Interest Rate

6.94%

Mortgage Type

Construction

Purchase Details

Closed on

Jun 13, 2014

Sold by

Sacker Ali and Kaba Janet M

Bought by

Tore Properties Llc

Purchase Details

Closed on

Oct 7, 2002

Sold by

Thomas Kenneth H and Thomas Catherine M

Bought by

Sacker Ali and Kaba Janet M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,015

Interest Rate

6.24%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| King & Queen Real Estate Llc | $87,500 | None Listed On Document | |

| Tore Properties Llc | $5,328 | None Available | |

| Sacker Ali | $49,900 | Commonwealth Land Title Ins |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Closed | King & Queen Real Estate Llc | $117,000 | |

| Previous Owner | Sacker Ali | $50,015 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,820 | $54,150 | $12,140 | $42,010 |

| 2024 | $2,820 | $54,150 | $12,140 | $42,010 |

| 2023 | $1,730 | $54,150 | $12,140 | $42,010 |

| 2022 | $2,674 | $54,150 | $12,140 | $42,010 |

| 2021 | $3,698 | $54,150 | $12,140 | $42,010 |

| 2020 | $2,636 | $33,900 | $15,780 | $18,120 |

| 2019 | $2,599 | $33,900 | $15,780 | $18,120 |

| 2018 | $2,570 | $33,900 | $0 | $0 |

| 2017 | $2,527 | $33,900 | $0 | $0 |

| 2016 | $190 | $33,900 | $0 | $0 |

| 2015 | $190 | $49,520 | $0 | $0 |

| 2014 | $277 | $49,520 | $0 | $0 |

Source: Public Records

Map

Nearby Homes