Estimated Value: $47,000 - $321,000

--

Bed

1

Bath

734

Sq Ft

$248/Sq Ft

Est. Value

About This Home

This home is located at 43 Griffin Rd SW, Rome, GA 30165 and is currently estimated at $182,265, approximately $248 per square foot. 43 Griffin Rd SW is a home located in Floyd County with nearby schools including Coosa Middle School and Coosa High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 4, 2019

Sold by

Vasser Betty J

Bought by

Henderson Charles Ralph

Current Estimated Value

Purchase Details

Closed on

Oct 28, 2013

Sold by

Davis Debra Ann

Bought by

Vasser Betty J

Purchase Details

Closed on

Mar 8, 2013

Sold by

Henderson Charles Ralph

Bought by

Davis Debra Ann

Purchase Details

Closed on

Jul 8, 2011

Sold by

Henderson Charles Ralph

Bought by

Davis Debra

Purchase Details

Closed on

Nov 18, 1999

Bought by

P and R

Purchase Details

Closed on

Sep 17, 1999

Bought by

P and R

Purchase Details

Closed on

Aug 25, 1999

Sold by

Henderson Helen Veal

Bought by

Henderson Charles Ralph

Purchase Details

Closed on

Aug 20, 1998

Bought by

P and R

Purchase Details

Closed on

May 22, 1991

Sold by

Henderson Charles Ralph

Bought by

Henderson Helen Veal

Purchase Details

Closed on

Jan 1, 1987

Bought by

Henderson Charles Ralph

Purchase Details

Closed on

Jan 1, 1901

Bought by

P and R

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Henderson Charles Ralph | -- | -- | |

| Vasser Betty J | -- | -- | |

| Davis Debra Ann | -- | -- | |

| Davis Debra | -- | -- | |

| P | -- | -- | |

| P | -- | -- | |

| Henderson Charles Ralph | -- | -- | |

| P | -- | -- | |

| Henderson Helen Veal | -- | -- | |

| Henderson Charles Ralph | -- | -- | |

| P | -- | -- |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,354 | $63,699 | $46,596 | $17,103 |

| 2023 | $1,256 | $58,881 | $42,360 | $16,521 |

| 2022 | $1,112 | $46,896 | $35,286 | $11,610 |

| 2021 | $1,039 | $41,452 | $31,982 | $9,470 |

| 2020 | $910 | $29,899 | $20,956 | $8,943 |

| 2019 | $668 | $29,363 | $20,956 | $8,407 |

| 2018 | $639 | $27,744 | $19,960 | $7,784 |

| 2017 | $605 | $25,959 | $18,482 | $7,477 |

| 2016 | $608 | $25,709 | $18,480 | $7,229 |

| 2015 | $500 | $25,709 | $18,480 | $7,229 |

| 2014 | $500 | $25,709 | $18,480 | $7,229 |

Source: Public Records

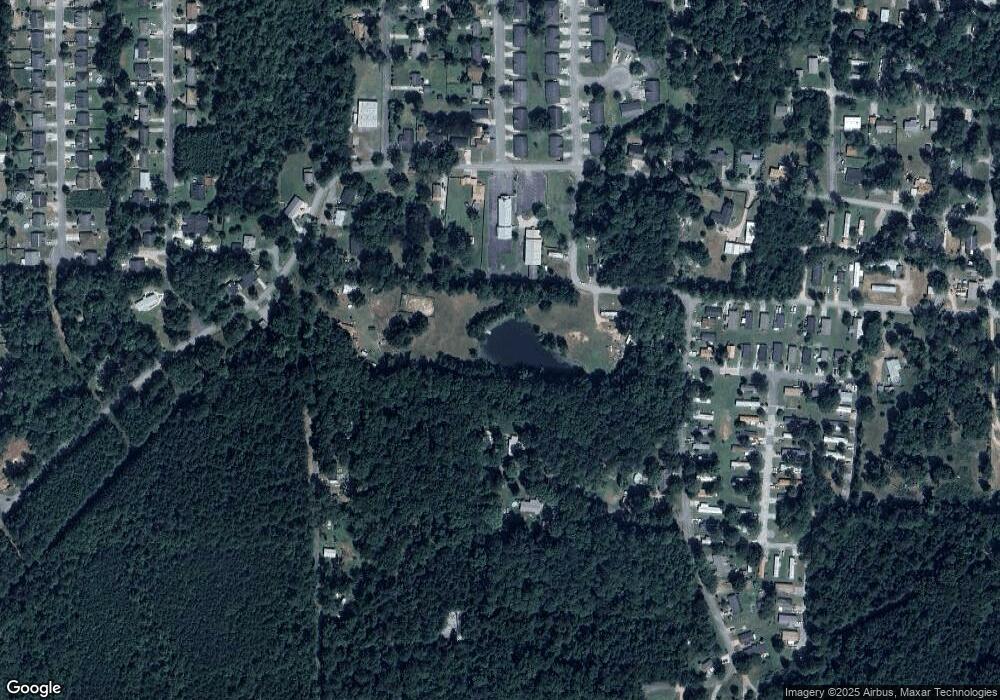

Map

Nearby Homes

- 438 Wilkerson Rd SW

- 506 Wilkerson Rd SW

- 40 Hawk Spring Dr SW

- 28 Southfork Dr

- 3 Pebble Bend Ct

- 31 Southfork Dr

- 110 Williamson St SW

- 0 E Clinton Dr SW Unit 7497950

- 0 E Clinton Dr SW Unit 10427155

- 50 Melton Ave SW

- 40 Paris Dr SW

- 103 Wooten Dr SW

- 17 Wilkerson Rd SW

- 16 Wilkerson Rd SW

- 3 Walker Dr SW

- 0 Brookvalley Ct SW Unit 10444714

- 0 Brookvalley Ct SW Unit 7512814

- 8 Leon St SW

- 0 Leafmore Rd SW Unit 10562671

- 0 Cedartown Rd Unit 10479932

- 9 Griffin Rd SW

- 9 Griffin Rd SW

- 75 Griffin Rd SW

- 75 Griffin Rd SW

- 7 Griffin Rd SW

- 456 Wilkerson Rd SW

- 456 Wilkerson Rd SW

- 3 April Dr SW

- 3 April Dr SW

- 0 Griffin Rd SW Unit 7415328

- 0 Griffin Rd SW

- 415 Wilkerson Rd SW

- 93 Griffin Rd SW

- 424 Wilkerson Rd SW

- 424 Wilkerson Rd SW

- 424 Wilkerson Rd SW

- 424 Wilkerson Rd SW

- 424 Wilkerson Rd SW

- 424 Wilkerson Rd SW

- 424 Wilkerson Rd SW