43 Red Barn Rd Port Deposit, MD 21904

Estimated Value: $287,277 - $371,000

--

Bed

1

Bath

1,368

Sq Ft

$244/Sq Ft

Est. Value

About This Home

This home is located at 43 Red Barn Rd, Port Deposit, MD 21904 and is currently estimated at $333,319, approximately $243 per square foot. 43 Red Barn Rd is a home located in Cecil County with nearby schools including Bainbridge Elementary School, Perryville Middle School, and Perryville High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 23, 2016

Sold by

Porter Terry Raymond and Porter Malinda Lee

Bought by

Grove Harold Lloyd

Current Estimated Value

Purchase Details

Closed on

Apr 26, 1985

Sold by

Niewodowski Mark F and Niewodowski Margo A

Bought by

Porter Jerry R and Porter Melinda L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$51,381

Interest Rate

13.12%

Purchase Details

Closed on

Aug 13, 1982

Sold by

Haley Thomas

Bought by

Niewodowski Mark F and Niewodowski Margo A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$45,600

Interest Rate

16.44%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Grove Harold Lloyd | $5,000 | Attorney | |

| Porter Jerry R | $49,900 | -- | |

| Niewodowski Mark F | $49,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Porter Jerry R | $51,381 | |

| Previous Owner | Niewodowski Mark F | $45,600 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,226 | $207,600 | $0 | $0 |

| 2024 | $1,788 | $194,800 | $0 | $0 |

| 2023 | $1,370 | $182,000 | $60,800 | $121,200 |

| 2022 | $2,067 | $178,233 | $0 | $0 |

| 2021 | $2,026 | $174,467 | $0 | $0 |

| 2020 | $2,029 | $170,700 | $60,800 | $109,900 |

| 2019 | $1,994 | $167,667 | $0 | $0 |

| 2018 | $1,959 | $164,633 | $0 | $0 |

| 2017 | $1,924 | $161,600 | $0 | $0 |

| 2016 | $1,818 | $159,400 | $0 | $0 |

| 2015 | $1,818 | $159,400 | $0 | $0 |

| 2014 | $1,981 | $159,800 | $0 | $0 |

Source: Public Records

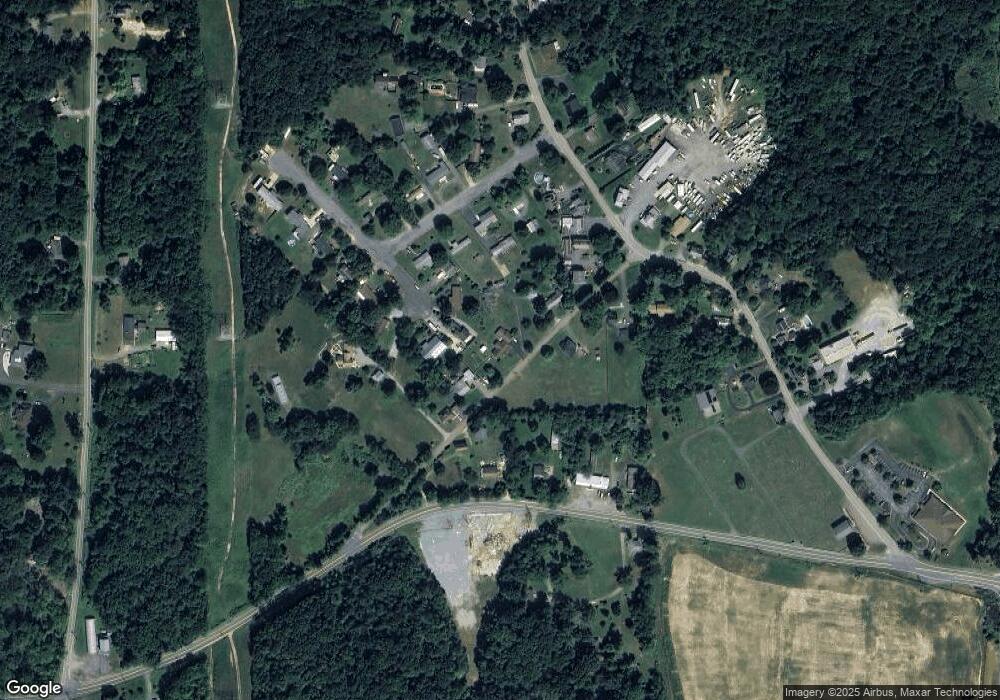

Map

Nearby Homes

- 1103 Bainbridge Rd

- 419 Cokesbury Rd

- 203 Blythedale Rd

- 1755 Frenchtown Rd

- 563 Principio Rd

- 51 Patterson Ave

- 420 Jackson Park Rd

- 120 Beechwood Dr

- 4 Brenda St

- 1436 Frenchtown Rd

- 26 Orchard Dr

- 55 Marian Dr

- Hamilton Plan at Richmond Hills

- New Castle Plan at Richmond Hills

- Roosevelt Plan at Richmond Hills

- Chaucer II Plan at Richmond Hills

- Jefferson Plan at Richmond Hills

- Denver Plan at Richmond Hills

- 21 High St

- 1105 Perryville Rd