4305 Tyler Way Anacortes, WA 98221

Skyline NeighborhoodEstimated Value: $659,516 - $763,000

2

Beds

2

Baths

1,731

Sq Ft

$410/Sq Ft

Est. Value

About This Home

This home is located at 4305 Tyler Way, Anacortes, WA 98221 and is currently estimated at $709,379, approximately $409 per square foot. 4305 Tyler Way is a home located in Skagit County with nearby schools including Anacortes High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 21, 2007

Sold by

Herrmann Kerstin E

Bought by

Patronsky Robert A and Patronsky Patricia L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$225,000

Outstanding Balance

$141,355

Interest Rate

6.42%

Estimated Equity

$568,024

Purchase Details

Closed on

Apr 27, 2005

Sold by

Bleyhl Harold J and Bleyhl Florence M

Bought by

Herrmann Kerstin E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$56,000

Interest Rate

5.99%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Patronsky Robert A | $325,280 | First American Title | |

| Herrmann Kerstin E | $279,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Patronsky Robert A | $225,000 | |

| Previous Owner | Herrmann Kerstin E | $56,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $4,294 | $598,800 | $240,000 | $358,800 |

| 2023 | $4,294 | $569,100 | $246,500 | $322,600 |

| 2022 | $3,606 | $516,500 | $217,500 | $299,000 |

| 2021 | $3,539 | $421,600 | $166,600 | $255,000 |

| 2020 | $3,473 | $383,500 | $0 | $0 |

| 2019 | $3,202 | $368,800 | $0 | $0 |

| 2018 | $3,183 | $339,300 | $0 | $0 |

| 2017 | $2,587 | $303,700 | $0 | $0 |

| 2016 | $2,562 | $271,700 | $100,600 | $171,100 |

| 2015 | $2,303 | $258,700 | $91,900 | $166,800 |

| 2013 | $2,242 | $220,900 | $0 | $0 |

Source: Public Records

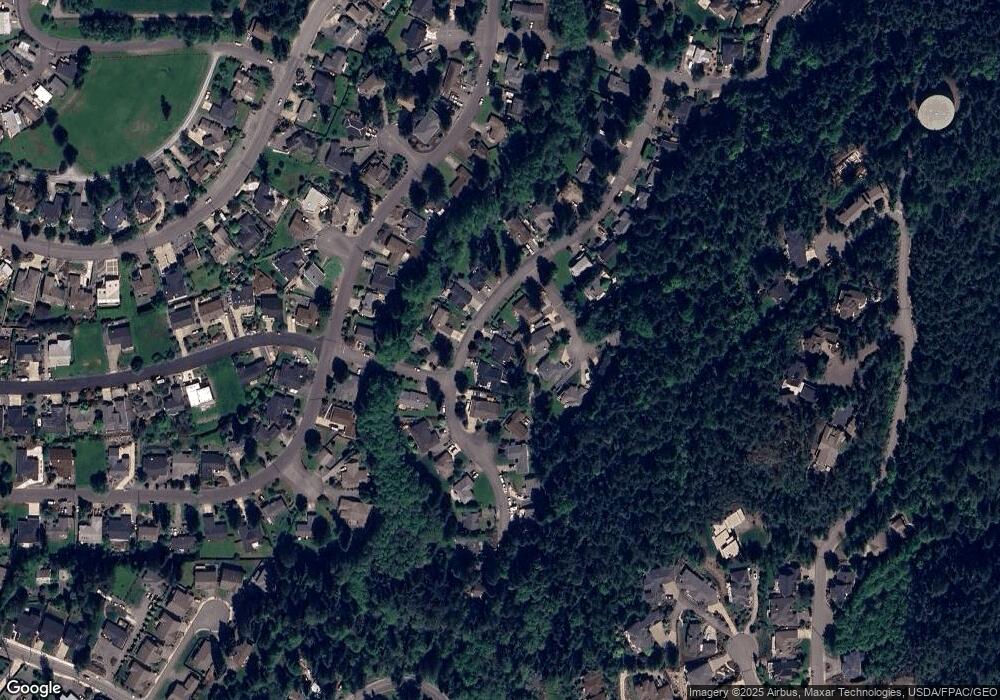

Map

Nearby Homes

- 4205 Tyler Way

- 4201 Kingsway

- 4604 Yorkshire Dr

- 4217 Marine Heights Way

- 2317 Twin Place

- 2016 Piper Cir

- 3939 Rockridge Pkwy

- 3943 Rockridge Pkwy

- 1807 Bradley Dr

- 3951 Rockridge Pkwy

- 3940 A Rockridge Pkwy

- 3901 Rockridge Pkwy

- 2411 Skyline Way Unit 103

- 2507 Berentson Ct

- 2401 Skyline Way Unit 203E

- 3906 Crosswinds Ct

- 3917 Crosswinds Ct

- 3816 Rockridge Pkwy

- 4700 Camano Place

- 4218 Glasgow Way