43070 Valle Ducale Dr Ashburn, VA 20148

Estimated Value: $1,487,485 - $1,692,000

5

Beds

5

Baths

4,950

Sq Ft

$321/Sq Ft

Est. Value

About This Home

This home is located at 43070 Valle Ducale Dr, Ashburn, VA 20148 and is currently estimated at $1,591,121, approximately $321 per square foot. 43070 Valle Ducale Dr is a home located in Loudoun County with nearby schools including Waxpool Elementary School, Eagle Ridge Middle School, and Briar Woods High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 18, 2022

Sold by

Doble Wangechi J and Doble William

Bought by

Doble William and Doble Joyce Wangechi

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$200,000

Outstanding Balance

$184,925

Interest Rate

2.88%

Mortgage Type

New Conventional

Estimated Equity

$1,406,196

Purchase Details

Closed on

Nov 30, 2004

Sold by

Belmont Ridge L C

Bought by

Doble William and Muthui,Wangechi

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$500,000

Interest Rate

5.69%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Doble William | -- | Old Republic National Title | |

| Doble William | $762,610 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Doble William | $200,000 | |

| Previous Owner | Doble William | $500,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $12,148 | $1,509,100 | $425,500 | $1,083,600 |

| 2024 | $11,586 | $1,339,410 | $425,500 | $913,910 |

| 2023 | $11,281 | $1,289,200 | $400,500 | $888,700 |

| 2022 | $10,620 | $1,193,210 | $315,500 | $877,710 |

| 2021 | $9,560 | $975,530 | $290,500 | $685,030 |

| 2020 | $9,529 | $920,680 | $255,500 | $665,180 |

| 2019 | $9,763 | $934,240 | $255,500 | $678,740 |

| 2018 | $9,228 | $850,530 | $231,500 | $619,030 |

| 2017 | $9,198 | $817,610 | $231,500 | $586,110 |

| 2016 | $9,189 | $802,520 | $0 | $0 |

| 2015 | $9,131 | $572,970 | $0 | $572,970 |

| 2014 | $8,631 | $534,760 | $0 | $534,760 |

Source: Public Records

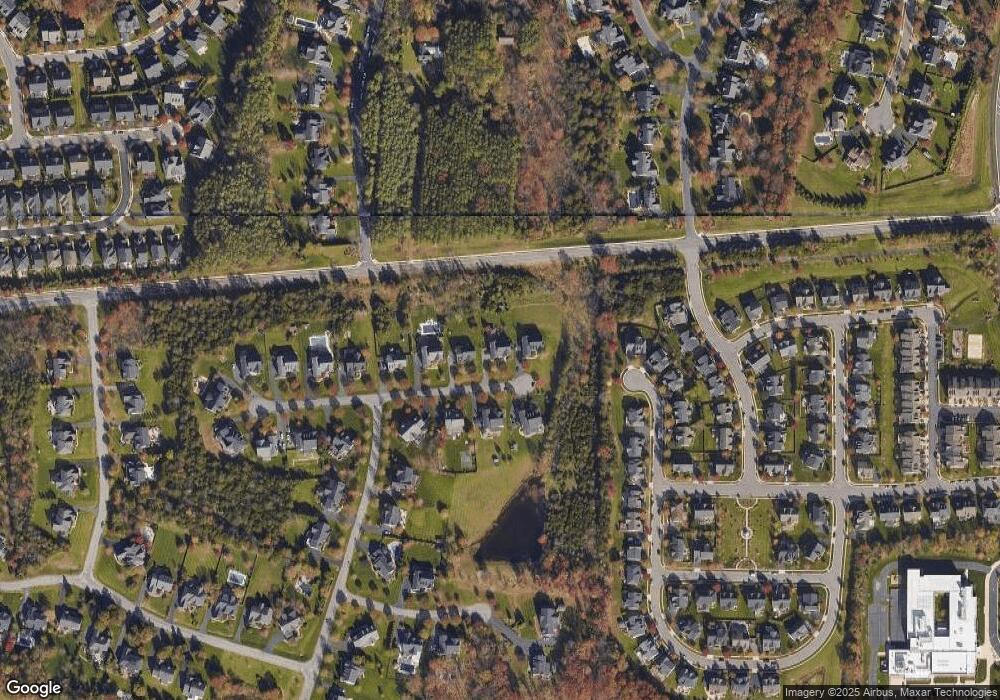

Map

Nearby Homes

- 43157 Clarendon Square

- 42904 Bittner Square

- 22275 Sims Terrace

- 43400 Apple Orchard Square

- 22613 Naugatuck Square

- 43360 Southland St

- 22273 Rampsbeck Terrace

- 43361 Radford Divide Terrace

- 43466 Grandmoore St

- 43437 Monroe Crest Terrace

- 22317 Seabring Terrace

- 22131 Little Mount Terrace

- 42831 Falling Leaf Ct

- 22141 Midmoore Dr

- 22143 Little Mount Terrace

- 22153 Midmoore Dr

- 22116 Little Mount Terrace

- 22122 Little Mount Terrace

- 22133 Little Mount Terrace

- 22130 Little Mount Terrace

- 43066 Valle Ducale Dr

- 43074 Valle Ducale Dr

- 43062 Valle Ducale Dr

- 43075 Valle Ducale Dr

- 43071 Valle Ducale Dr

- 43067 Valle Ducale Dr

- 43058 Valle Ducale Dr

- 43059 Valle Ducale Dr

- 22236 Allspice Ct

- 43054 Monti Cimini Ct

- 22249 Allspice Ct

- 22240 Allspice Ct

- 22340 Belle Terra Dr

- 22253 Allspice Ct

- 43050 Monti Cimini Ct

- 22217 Fairlawn Dr

- 43051 Monti Cimini Ct

- 22244 Allspice Ct

- 22257 Allspice Ct

- 22221 Fairlawn Dr