4309 Roundup Rd Edmond, OK 73034

Coffee Creek NeighborhoodEstimated Value: $662,678 - $830,000

3

Beds

3

Baths

3,293

Sq Ft

$222/Sq Ft

Est. Value

About This Home

This home is located at 4309 Roundup Rd, Edmond, OK 73034 and is currently estimated at $731,670, approximately $222 per square foot. 4309 Roundup Rd is a home located in Oklahoma County with nearby schools including Centennial Elementary School, Central Middle School, and Memorial High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 2, 2015

Sold by

Underwood Hoyt Duane and Underwood D H

Bought by

Underwood Hoyt Duane and Underwood Kimberly J

Current Estimated Value

Purchase Details

Closed on

Oct 9, 2008

Sold by

French Construction Co

Bought by

Underwood Kim and Underwood D H

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$410,800

Outstanding Balance

$267,470

Interest Rate

6%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$464,200

Purchase Details

Closed on

Oct 12, 2007

Sold by

Ranch Property Co Llc

Bought by

French Homes Llc

Purchase Details

Closed on

Oct 10, 2007

Sold by

French Homes Llc

Bought by

French Construction Co

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Underwood Hoyt Duane | -- | Attorney | |

| Underwood Kim | $513,500 | Stewart Abstract & Title | |

| French Homes Llc | $79,000 | Stewart Abstract & Title Ok | |

| French Construction Co | -- | Stewart Abstract & Title Ok |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Underwood Kim | $410,800 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,085 | $61,159 | $12,163 | $48,996 |

| 2023 | $6,085 | $59,378 | $9,897 | $49,481 |

| 2022 | $5,928 | $57,649 | $11,413 | $46,236 |

| 2021 | $5,725 | $55,970 | $10,645 | $45,325 |

| 2020 | $5,623 | $54,340 | $10,659 | $43,681 |

| 2019 | $5,568 | $53,570 | $11,141 | $42,429 |

| 2018 | $5,724 | $54,725 | $0 | $0 |

| 2017 | $5,762 | $55,329 | $11,141 | $44,188 |

| 2016 | $5,733 | $55,164 | $11,141 | $44,023 |

| 2015 | $5,652 | $54,469 | $9,440 | $45,029 |

| 2014 | $5,477 | $52,884 | $9,593 | $43,291 |

Source: Public Records

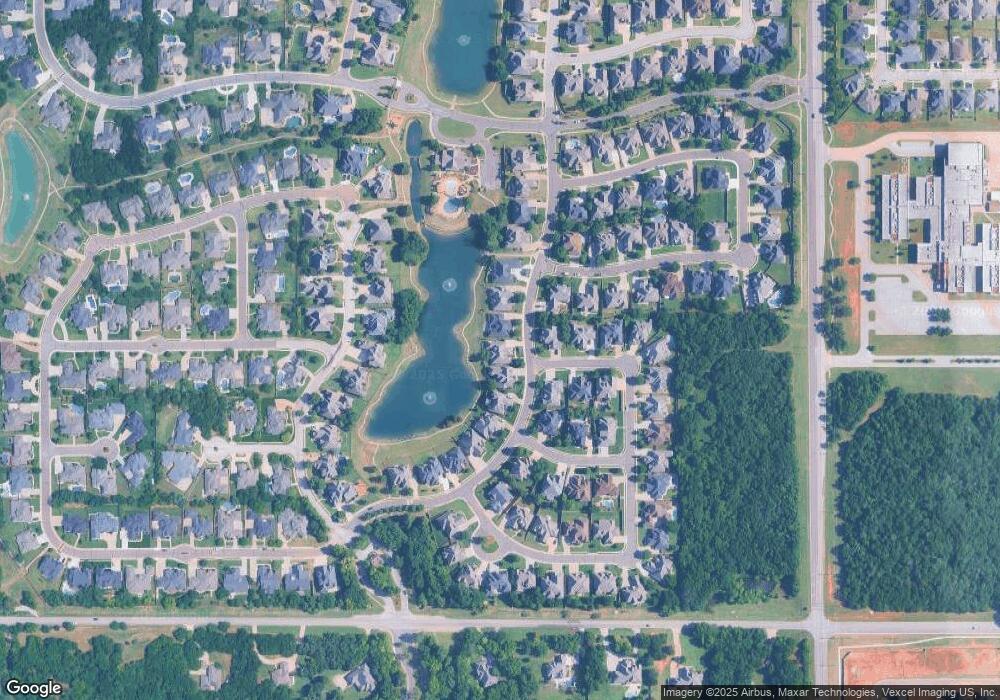

Map

Nearby Homes

- 4400 The Ranch Rd

- 4300 High Range Ln

- 4408 Shorthorn Ln

- 2650 E Coffee Creek Rd

- 7941 Silver Spur Ct

- 2917 Stone Meadow Way

- 3001 Stone Meadow Way

- 4009 Stone Hollow Ln

- Plan 2472 at The Cottages at Iron Horse - Stone Hill Cottages at Iron Horse Ranch

- The Ashton Court Plan at The Cottages at Iron Horse

- The Devonshire Plan at The Cottages at Iron Horse

- The French Chateau Plan at The Cottages at Iron Horse

- PrevNext The Ivy Cottage Plan at The Cottages at Iron Horse

- The Terrace Cottage Plan at The Cottages at Iron Horse

- 4001 Stone Hollow Ln

- 2317 Open Trail Rd

- 2208 Open Trail Dr

- 3924 Stone Hollow Ln

- 3916 Stone Hollow Ln

- 4724 Deerfield Dr

- 4301 Roundup Rd

- 4317 Roundup Rd

- 4241 Roundup Rd

- 4325 Roundup Rd

- 4316 Roundup Rd

- 4300 Roundup Rd

- 4233 Roundup Rd

- 2624 Cattle Dr

- 4333 Roundup Rd

- 2701 Stetson Dr

- 2700 Stetson Dr

- 4240 Roundup Rd

- 4225 Roundup Rd

- 2709 Stetson Dr

- 4401 Roundup Rd

- 2708 Stetson Dr

- 2701 Maverick Rd

- 4217 Roundup Rd

- 4316 The Ranch Rd

- 4308 The Ranch Rd