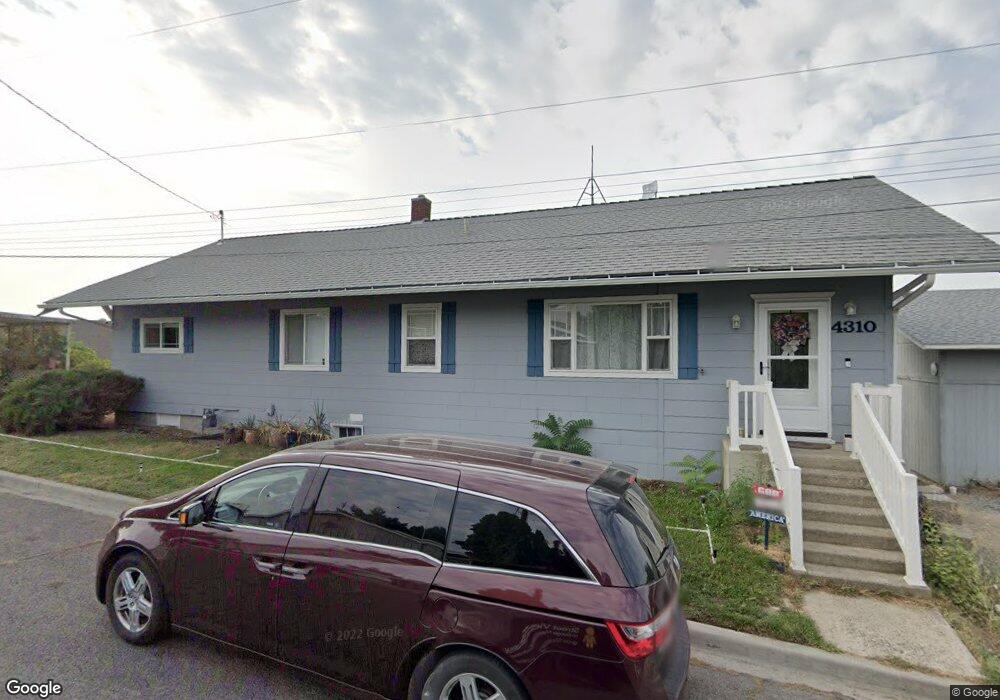

4310 Henning St Yakima, WA 98901

Estimated Value: $418,000 - $656,027

3

Beds

2

Baths

1,877

Sq Ft

$291/Sq Ft

Est. Value

About This Home

This home is located at 4310 Henning St, Yakima, WA 98901 and is currently estimated at $546,007, approximately $290 per square foot. 4310 Henning St is a home located in Yakima County with nearby schools including East Valley High School, Riverside Christian School, and St. Joseph Marquette Catholic School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Nov 9, 2021

Sold by

Lamberton Daniel R and Lamberton Kelli Jo

Bought by

Calvert Robert Curtis

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$141,000

Outstanding Balance

$139,351

Interest Rate

2.88%

Mortgage Type

New Conventional

Estimated Equity

$406,656

Purchase Details

Closed on

Mar 19, 2009

Sold by

Liv Gliddon Leslie A and Liv Leslie A Gliddon Revocable

Bought by

Nowicki Andrew J and Nowicki Melissa S

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$177,622

Interest Rate

5.19%

Mortgage Type

FHA

Purchase Details

Closed on

Feb 15, 2007

Sold by

Gliddon Leslie Ann

Bought by

Gliddon Leslie A and The Gliddon Family Trust

Purchase Details

Closed on

Jan 5, 2006

Sold by

Gliddon Timothy J and Estate Of William Duane Gliddo

Bought by

Gliddon Leslie Ann

Purchase Details

Closed on

Jul 3, 2002

Sold by

Gliddon Hazel Patricia

Bought by

Gliddon William Duane

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Calvert Robert Curtis | $593,089 | Valley Title Guarantee | |

| Nowicki Andrew J | $180,900 | Valley Title Company | |

| Gliddon Leslie A | -- | None Available | |

| Gliddon Leslie Ann | -- | None Available | |

| Gliddon William Duane | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Calvert Robert Curtis | $141,000 | |

| Previous Owner | Nowicki Andrew J | $177,622 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $3,624 | $336,100 | $73,300 | $262,800 |

| 2023 | $3,726 | $254,800 | $50,000 | $204,800 |

| 2022 | $3,036 | $230,300 | $50,000 | $180,300 |

| 2021 | $2,810 | $203,800 | $50,000 | $153,800 |

| 2019 | $2,425 | $172,300 | $50,000 | $122,300 |

| 2018 | $2,344 | $156,300 | $50,000 | $106,300 |

| 2017 | $2,148 | $150,300 | $50,000 | $100,300 |

| 2016 | $2,277 | $151,100 | $50,000 | $101,100 |

| 2015 | $2,277 | $155,400 | $50,000 | $105,400 |

| 2014 | $2,277 | $156,800 | $49,900 | $106,900 |

| 2013 | $2,277 | $156,800 | $49,900 | $106,900 |

Source: Public Records

Map

Nearby Homes

- 530 Follow Through Dr

- 106 Vineyard View Ln

- 108 Roza Vista Dr

- 618 Country Club Dr

- 622 Country Club Dr

- 119 Vineyard View Ln

- 715 Fairway Dr

- 3701 Gun Club Rd Unit 60

- 3701 Gun Club Rd Unit 33

- 3701 Gun Club Rd Unit 115

- 3701 Gun Club Rd Unit 71

- 3701 Gun Club Rd Unit 16

- 3701 Gun Club Rd Unit 43

- 3701 Gun Club Rd Unit 25

- 120 Vineyard View Ln

- 0 Roza Hill Dr N Unit NWM2341929

- 720 Country Club Dr

- 709 Beacon Ave

- 124 Warren Acres Rd

- 610 Titleist Ln

- 426 S 44th St

- 508 Follow Through Dr

- 512 Follow Through Dr

- 506 Follow Through Dr

- 503 S 43rd St

- 514 Follow Through Dr Unit 7

- 422 S 44th St

- 425 S 43rd St

- 4401 Henning St

- 417 S 44th St

- 516 Follow Through Dr

- 421 S 43rd St

- 502 Follow Through Dr

- 521 Justice Dr

- 423 S 44th St

- 518 Follow Through Dr

- 511 S 43rd St

- 520 Follow Through Dr Unit 10

- 419 S 43rd St

- 421 S 44th St