4311 Bethel Acres Rd Gibson, GA 30810

Estimated Value: $70,000 - $108,000

2

Beds

1

Bath

540

Sq Ft

$163/Sq Ft

Est. Value

About This Home

This home is located at 4311 Bethel Acres Rd, Gibson, GA 30810 and is currently estimated at $87,763, approximately $162 per square foot. 4311 Bethel Acres Rd is a home located in Glascock County with nearby schools including Glascock County Consolidated School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Mar 25, 2022

Sold by

Arab Bethany Grace

Bought by

Mitchell Anthony Julian

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$36,915

Outstanding Balance

$11,842

Interest Rate

3.92%

Mortgage Type

New Conventional

Estimated Equity

$75,921

Purchase Details

Closed on

Aug 20, 2014

Sold by

Arab Bethany Grace

Bought by

Roberts Dennis W and Roberts Cynthia Jeanne

Purchase Details

Closed on

Jun 5, 2013

Sold by

Roberts Dennis W

Bought by

Arab Bethany Grace

Purchase Details

Closed on

May 9, 2007

Sold by

Perry Allison

Bought by

Roberts Dennis W and Roberts Cynthia Jeanne

Purchase Details

Closed on

Dec 18, 1995

Sold by

Perry Allison And

Bought by

Perry Allison And

Purchase Details

Closed on

Sep 1, 1994

Bought by

Poole Melvin D

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mitchell Anthony Julian | $45,000 | -- | |

| Roberts Dennis W | -- | -- | |

| Arab Bethany Grace | -- | -- | |

| Roberts Dennis W | $50,000 | -- | |

| Perry Allison And | $8,500 | -- | |

| Perry Allison And | -- | -- | |

| Poole Melvin D | $10,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mitchell Anthony Julian | $36,915 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $505 | $21,174 | $3,831 | $17,343 |

| 2023 | $421 | $21,174 | $3,831 | $17,343 |

| 2022 | $532 | $21,546 | $4,422 | $17,124 |

| 2021 | $409 | $15,801 | $4,973 | $10,828 |

| 2020 | $395 | $15,801 | $4,973 | $10,828 |

| 2019 | $434 | $15,145 | $4,973 | $10,172 |

| 2018 | $434 | $15,145 | $4,973 | $10,172 |

| 2017 | $376 | $15,145 | $4,973 | $10,172 |

| 2016 | $376 | $15,145 | $4,973 | $10,172 |

| 2015 | -- | $15,145 | $4,973 | $10,172 |

| 2014 | -- | $18,167 | $7,995 | $10,172 |

| 2013 | -- | $18,167 | $7,995 | $10,172 |

Source: Public Records

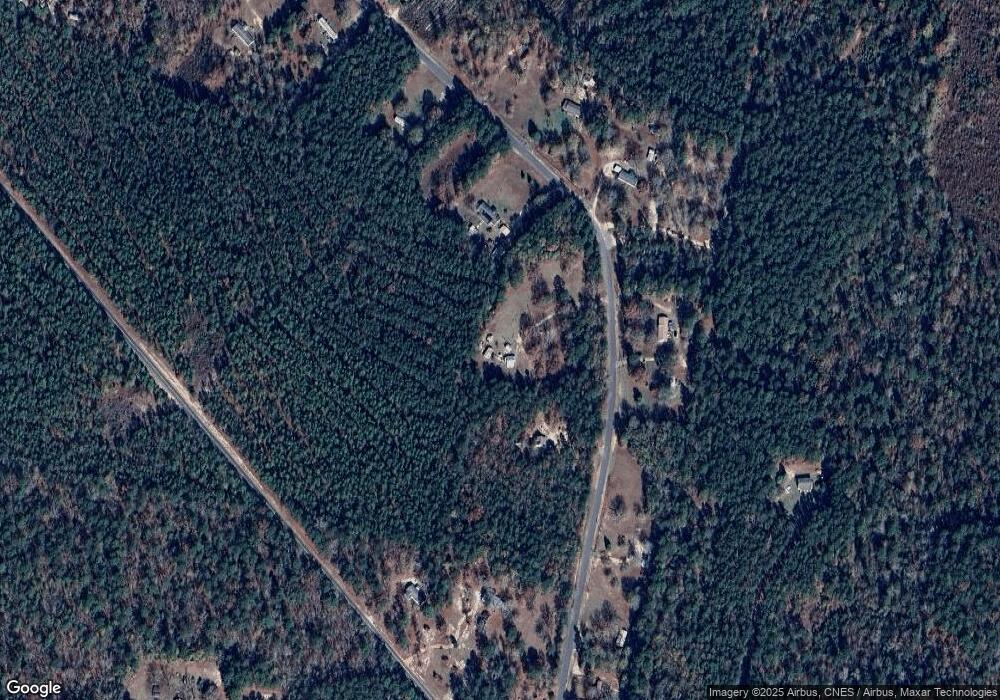

Map

Nearby Homes

- 0 Lampp Rd

- 0 Bastonville Rd Unit (Tract 14)

- 0 Bastonville Rd Unit 548327

- 0 Bastonville Rd Unit 10627311

- 3479 Bastonville Rd

- 2582 Georgia 171

- 99 W Main St

- 0 Lamp Rd Unit 547551

- 1171 Main St

- 3191 Gene Howard Rd

- 218 E Sheppard St

- 169 E Sheppard St

- 0 Highway 296 Unit 545709

- Edford Reese Rd

- Edford Reese Rd

- Edford Reese Rd

- Edford Reese Rd

- Edford Reese Rd

- 1234 Stapleton Acres Rd

- Edford Reese Rd

- 4251 Bethel Acres Rd

- 4398 Bethel Acres Rd

- 4192 Bethel Acres Rd

- 4525 Bethel Acres Rd

- 4500 Bethel Acres Rd

- 4744 Bethel Acres Rd

- 4125 Steephollow Rd

- 4125 Steephollow Rd

- 4146 Bethel Acres Rd

- 4071 Steep Hollow Rd

- 4029 Steephollow Rd

- 3906 Steephollow Rd

- 4154 Bethel Church Rd

- 4285 Steephollow Rd

- 4743 Bethel Acres Rd

- 4250 Steephollow Rd

- 4272 Steephollow Rd

- 4277 Bethel Church Rd

- 4356 Steephollow Rd

- 4321 Bethel Church Rd