4314 Secluded Wood Ct Columbus, OH 43230

Gould Park NeighborhoodEstimated Value: $344,000 - $394,000

3

Beds

3

Baths

1,872

Sq Ft

$202/Sq Ft

Est. Value

About This Home

This home is located at 4314 Secluded Wood Ct, Columbus, OH 43230 and is currently estimated at $377,633, approximately $201 per square foot. 4314 Secluded Wood Ct is a home located in Franklin County with nearby schools including Wilder Elementary School, Blendon Middle School, and Westerville-North High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 26, 2023

Sold by

Rieves Latresa Jean

Bought by

Vo Christopher

Current Estimated Value

Purchase Details

Closed on

Jul 19, 2013

Sold by

Bray Earl

Bought by

Rieves Latresa Jean

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,539

Interest Rate

4.87%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 13, 1999

Sold by

Martin Lasonia C

Bought by

Bray Earl and Bray Latresa J

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$153,656

Interest Rate

7.69%

Purchase Details

Closed on

Oct 29, 1991

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Vo Christopher | $330,000 | Northwest Advantage Title Agen | |

| Rieves Latresa Jean | -- | Meppowell Title | |

| Bray Earl | $154,100 | Chicago Title West | |

| -- | $116,500 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Rieves Latresa Jean | $128,539 | |

| Previous Owner | Bray Earl | $153,656 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,712 | $108,960 | $28,000 | $80,960 |

| 2023 | $5,299 | $108,960 | $28,000 | $80,960 |

| 2022 | $3,862 | $60,620 | $14,000 | $46,620 |

| 2021 | $3,900 | $60,620 | $14,000 | $46,620 |

| 2020 | $3,887 | $60,620 | $14,000 | $46,620 |

| 2019 | $4,222 | $62,830 | $14,000 | $48,830 |

| 2018 | $4,169 | $60,620 | $14,000 | $46,620 |

| 2017 | $4,170 | $60,620 | $14,000 | $46,620 |

| 2016 | $4,347 | $60,200 | $14,070 | $46,130 |

| 2015 | $4,356 | $60,200 | $14,070 | $46,130 |

| 2014 | $4,360 | $60,200 | $14,070 | $46,130 |

| 2013 | $2,172 | $60,200 | $14,070 | $46,130 |

Source: Public Records

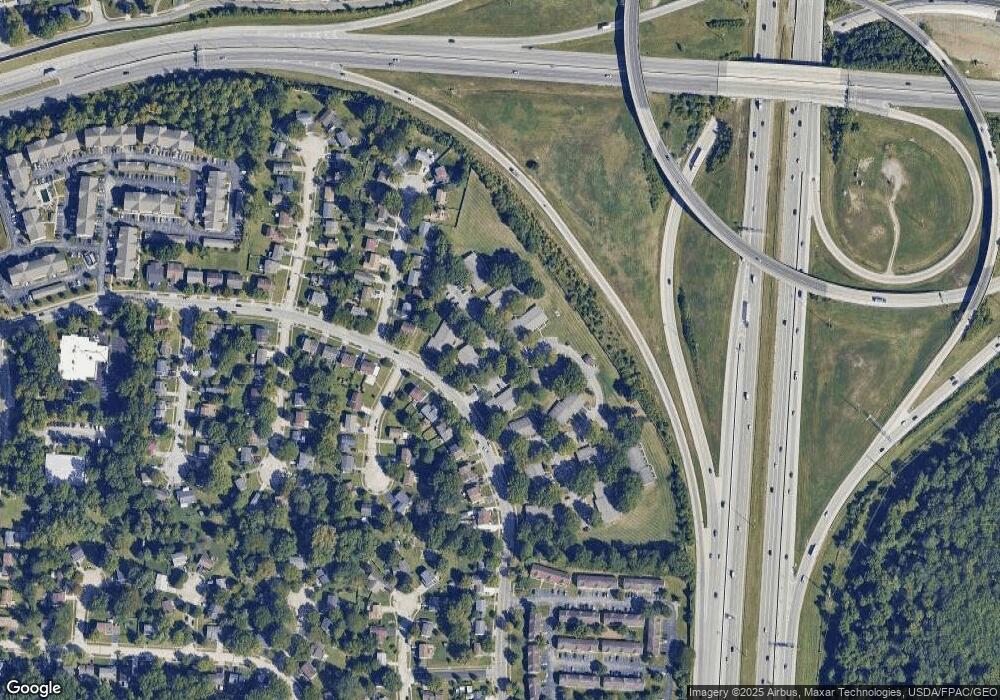

Map

Nearby Homes

- 5564 Echo Rd

- 4849 Pleasant Woods Ct

- 5042 Magnolia Blossom Blvd

- 4088 Willow Hollow Dr

- 4519 Woodstream Dr

- 3955 Daffodil Dr

- 4495 Shady Blossom Ln

- 4881 Pear Tree Ct

- 4073 Forest Edge Dr

- 5080 Strawberry Farms Blvd

- 4960 Honeysuckle Blvd

- 3738 Pendlestone Dr

- 4561 Alps Ct

- 6006 Carnation Dr

- 4485 Christina Ln

- 3800 Mount Hood Ct

- 3860 Julia Ct

- 6412 Angelica Way

- 3900 Cliff Ridge Ct

- 4533 Raccoon Dr

- 4314 Secludedwood Ct

- 4322 Secludedwood Ct

- 4306 Secludedwood Ct

- 4300 Secludedwood Ct

- 4330 Secludedwood Ct

- 5552 Echo Rd

- 4315 Secludedwood Ct

- 4323 Secludedwood Ct

- 4336 Secludedwood Ct

- 4315 Secluded Wood Ct

- 4323 Secluded Wood Ct

- 4294 Secluded Wood Ct

- 4307 Secludedwood Ct

- 4294 Secludedwood Ct

- 5540 Echo Rd

- 4299 Secludedwood Ct

- 4293 Secludedwood Ct

- 4286 Secludedwood Ct

- 4334 Woodstream Dr

- 4352 Woodstream Dr