4315 Laurel Grove Trace Unit 1 Suwanee, GA 30024

Estimated Value: $1,027,000 - $1,120,000

5

Beds

5

Baths

4,091

Sq Ft

$261/Sq Ft

Est. Value

About This Home

This home is located at 4315 Laurel Grove Trace Unit 1, Suwanee, GA 30024 and is currently estimated at $1,069,780, approximately $261 per square foot. 4315 Laurel Grove Trace Unit 1 is a home located in Gwinnett County with nearby schools including Level Creek Elementary School, North Gwinnett Middle School, and North Gwinnett High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 15, 2000

Sold by

Hahn Mark J and Hahn Laura T

Bought by

Theisen Thomas

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$373,400

Outstanding Balance

$111,997

Interest Rate

6.5%

Mortgage Type

New Conventional

Estimated Equity

$957,783

Purchase Details

Closed on

May 20, 1998

Sold by

Nsc Residential Inc

Bought by

Hahn Mark James and Hahn Laura T

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$296,000

Interest Rate

6.62%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Theisen Thomas | $414,900 | -- | |

| Hahn Mark James | $370,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Theisen Thomas | $373,400 | |

| Closed | Theisen Thomas | $41,000 | |

| Previous Owner | Hahn Mark James | $296,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $10,462 | $408,880 | $60,040 | $348,840 |

| 2024 | $10,306 | $390,520 | $80,000 | $310,520 |

| 2023 | $10,306 | $318,080 | $64,000 | $254,080 |

| 2022 | $8,337 | $295,680 | $64,000 | $231,680 |

| 2021 | $7,182 | $232,760 | $47,000 | $185,760 |

| 2020 | $7,237 | $232,760 | $47,000 | $185,760 |

| 2019 | $7,050 | $232,760 | $47,000 | $185,760 |

| 2018 | $6,836 | $221,840 | $42,800 | $179,040 |

| 2016 | $6,260 | $194,280 | $39,600 | $154,680 |

| 2015 | $6,679 | $210,480 | $45,200 | $165,280 |

| 2014 | $6,517 | $201,600 | $45,200 | $156,400 |

Source: Public Records

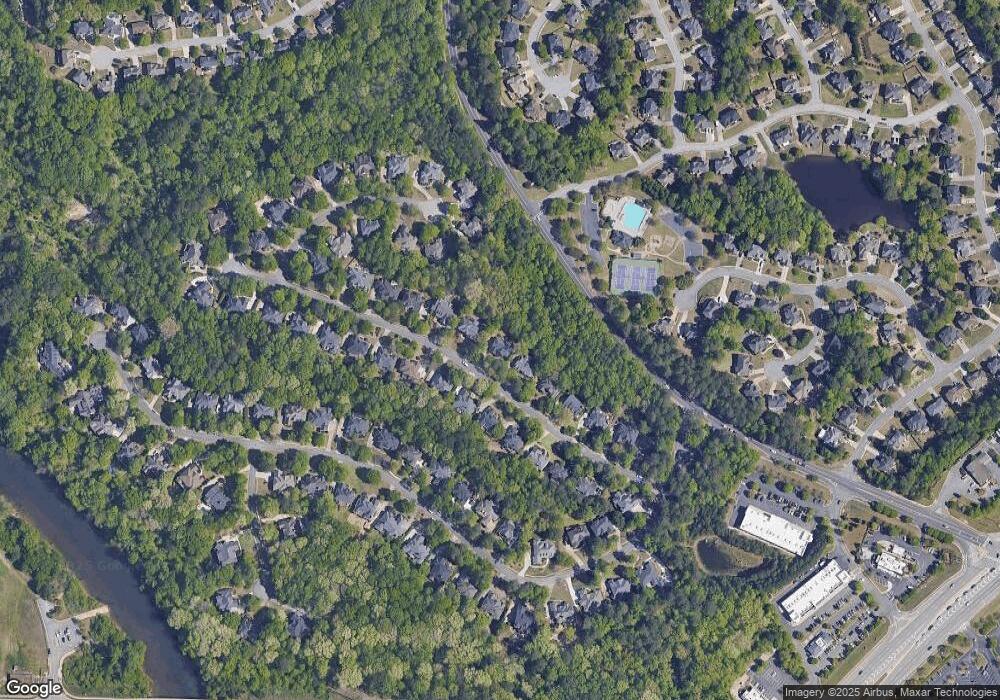

Map

Nearby Homes

- 4270 Laurel Grove Trace

- 1105 River Laurel Dr

- 1145 River Laurel Dr Unit 3

- 1032 Laurel Grove Ct

- 4265 Lansmoore Crossing

- 1900 Chattahoochee Run Dr

- 3301 Bennett Creek Ln

- 3170 Bennett Creek Ln

- 3444 Benedict Place

- 1116 Bartlett Trace

- 4339 Lansfaire Terrace Unit 4

- 1621 Wellborn Walk

- 4282 Goldfield Trace Unit 4

- 1011 Crofton Landing Unit 1

- 1191 Crofton Landing

- 4140 River Bluff Run Way Unit 5B

- 860 Sunset Park Dr

- 858 Red Rock Ct

- 1355 Chattahoochee Run Dr

- 4305 Laurel Grove Trace Unit 1

- 4325 Laurel Grove Trace

- 4295 Laurel Grove Trace

- 4335 Laurel Grove Trace

- 4310 Laurel Grove Trace Unit 1

- 4300 Laurel Grove Trace

- 4320 Laurel Grove Trace

- 4285 Laurel Grove Trace

- 4290 Laurel Grove Trace Unit 1

- 4330 Laurel Grove Trace Unit 1

- 4345 Laurel Grove Trace Unit 1

- 1012 Laurel Grove Ct

- 4275 Laurel Grove Trace Unit 1

- 1002 Laurel Grove Ct

- 4280 Laurel Grove Trace Unit 1

- 4340 Laurel Grove Trace

- 4355 Laurel Grove Trace Unit 1

- 1125 River Laurel Dr Unit 3

- 1135 River Laurel Dr Unit 3

- 4270 Laurel Grove Trace