4317 Fir Crest Ct Anacortes, WA 98221

Estimated Value: $764,085 - $946,000

3

Beds

3

Baths

2,044

Sq Ft

$417/Sq Ft

Est. Value

About This Home

This home is located at 4317 Fir Crest Ct, Anacortes, WA 98221 and is currently estimated at $851,521, approximately $416 per square foot. 4317 Fir Crest Ct is a home located in Skagit County with nearby schools including Anacortes High School, Secret Harbor, and FIDDLEHEAD MONTESSORI SCHOOL.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 24, 2007

Sold by

Renning John C and Renning Jane A

Bought by

Dixon Brent and Anderson Elizabeth

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$340,000

Outstanding Balance

$205,233

Interest Rate

6.21%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$646,288

Purchase Details

Closed on

Aug 25, 2005

Sold by

Strandberg Construction Co Inc

Bought by

Renning John C and Renning Jane A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$289,300

Interest Rate

4.87%

Mortgage Type

Fannie Mae Freddie Mac

Purchase Details

Closed on

Feb 10, 2005

Sold by

Fir Crest Development Nw Llc

Bought by

Strandberg Construction Co Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$56,480

Interest Rate

5.79%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Dixon Brent | $425,000 | Chicago Title Company Island | |

| Renning John C | $361,665 | Chicago Title Company Island | |

| Strandberg Construction Co Inc | $210,000 | Chicago Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Dixon Brent | $340,000 | |

| Previous Owner | Renning John C | $289,300 | |

| Previous Owner | Strandberg Construction Co Inc | $56,480 | |

| Closed | Renning John C | $72,300 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,380 | $686,300 | $254,100 | $432,200 |

| 2023 | $5,380 | $713,200 | $248,200 | $465,000 |

| 2022 | $4,402 | $642,400 | $220,300 | $422,100 |

| 2021 | $4,247 | $514,700 | $171,900 | $342,800 |

| 2020 | $4,148 | $460,300 | $0 | $0 |

| 2019 | $4,108 | $440,500 | $0 | $0 |

| 2018 | $4,217 | $435,300 | $0 | $0 |

| 2017 | $3,479 | $402,300 | $0 | $0 |

| 2016 | $3,427 | $365,400 | $103,400 | $262,000 |

| 2015 | $2,998 | $346,000 | $97,500 | $248,500 |

| 2013 | $3,008 | $312,100 | $0 | $0 |

Source: Public Records

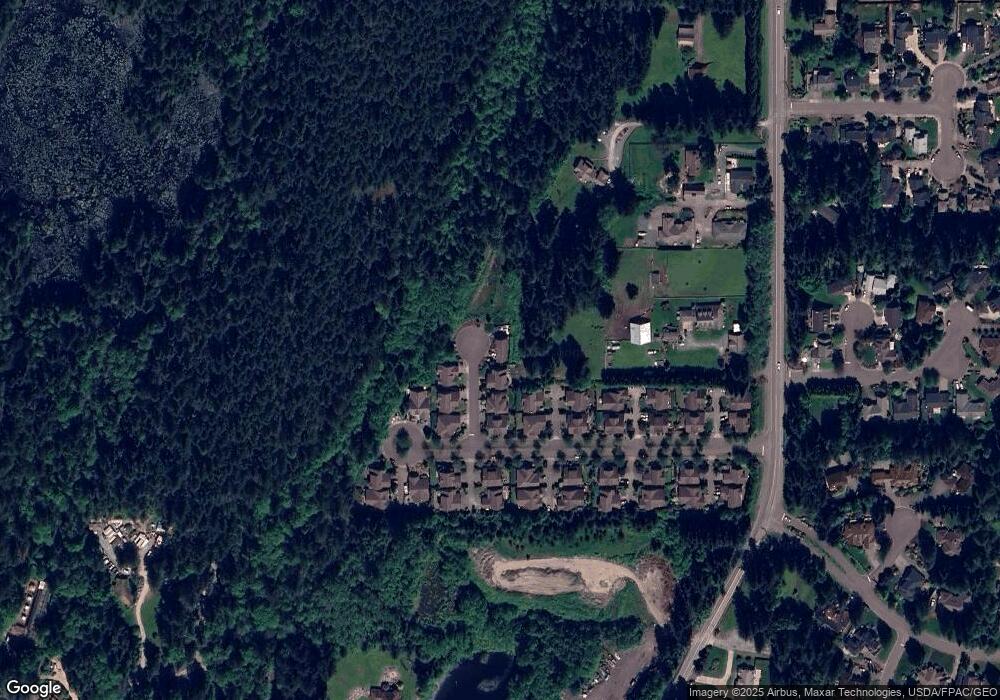

Map

Nearby Homes

- 2617 Fir Crest Blvd

- 2605 Fir Crest Blvd

- 2411 Forest Park Ln

- 4407 Orchard Ave

- 4301 Cherry Ln

- 3706 Portage Ln Unit 103

- 2410 Vista Ln

- 3709 Portage Ln Unit K1

- 2306 Vista Ln

- 3204 D Ave

- 1705 36th St

- 4217 Marine Heights Way

- 2507 Berentson Ct

- 4158 Islander Way

- 3939 Rockridge Pkwy

- 3915 L Ave

- 3810 Beadle Ln

- 1411 38th St

- 3808 Beadle Ln

- 3943 Rockridge Pkwy

- 4401 Fir Crest Ct

- 4405 Fir Crest Ct

- 2608 Fir Crest Blvd

- 4402 Fir Crest Ct

- 2612 Fir Crest Blvd

- 4406 Fir Crest Ct

- 2610 Fir Crest Blvd

- 2618 Fir Crest Blvd

- 2606 Fir Crest Blvd

- 2704 Fir Crest Blvd

- 2604 Fir Crest Blvd

- 2611 Fir Crest Blvd

- 2609 Fir Crest Blvd

- 2619 Fir Crest Blvd

- 2518 Fir Crest Blvd

- 2603 Fir Crest Blvd

- 2615 Fir Crest Blvd

- 2607 Fir Crest Blvd

- 2703 Fir Crest Blvd