4323 Buford Valley Way Buford, GA 30518

Estimated Value: $332,863 - $350,000

3

Beds

3

Baths

1,739

Sq Ft

$197/Sq Ft

Est. Value

About This Home

This home is located at 4323 Buford Valley Way, Buford, GA 30518 and is currently estimated at $341,716, approximately $196 per square foot. 4323 Buford Valley Way is a home located in Gwinnett County with nearby schools including Sugar Hill Elementary School, Lanier Middle School, and Lanier High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 9, 2024

Sold by

Newmes Julie Lynn

Bought by

Ratton Jason Lee and Ratton Julie Lynn

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$135,000

Outstanding Balance

$133,707

Interest Rate

6.84%

Mortgage Type

New Conventional

Estimated Equity

$208,009

Purchase Details

Closed on

Oct 28, 2011

Sold by

Ramos Donald R

Bought by

Newmes Julie Lynn

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$97,465

Interest Rate

5.5%

Mortgage Type

FHA

Purchase Details

Closed on

Jul 31, 2006

Sold by

Homeland Legacy Builders

Bought by

Ramos Donald R and Ramos Thomasina

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$50,000

Interest Rate

6.68%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 9, 2006

Sold by

Homeland Legacy Inc

Bought by

Homeland Legacy Builders Lp

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ratton Jason Lee | -- | -- | |

| Newmes Julie Lynn | $100,000 | -- | |

| Ramos Donald R | $189,100 | -- | |

| Homeland Legacy Builders Lp | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ratton Jason Lee | $135,000 | |

| Previous Owner | Newmes Julie Lynn | $97,465 | |

| Previous Owner | Newmes Julie Lynn | $5,000 | |

| Previous Owner | Ramos Donald R | $50,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,857 | $141,680 | $32,200 | $109,480 |

| 2024 | $4,467 | $133,360 | $20,000 | $113,360 |

| 2023 | $4,467 | $135,440 | $20,000 | $115,440 |

| 2022 | $4,160 | $109,680 | $18,000 | $91,680 |

| 2021 | $3,225 | $82,080 | $12,800 | $69,280 |

| 2020 | $3,146 | $79,400 | $12,800 | $66,600 |

| 2019 | $2,935 | $76,600 | $12,800 | $63,800 |

| 2018 | $2,714 | $70,280 | $12,800 | $57,480 |

| 2016 | $2,146 | $53,560 | $8,840 | $44,720 |

| 2015 | $2,172 | $53,560 | $8,840 | $44,720 |

| 2014 | $2,183 | $53,560 | $8,840 | $44,720 |

Source: Public Records

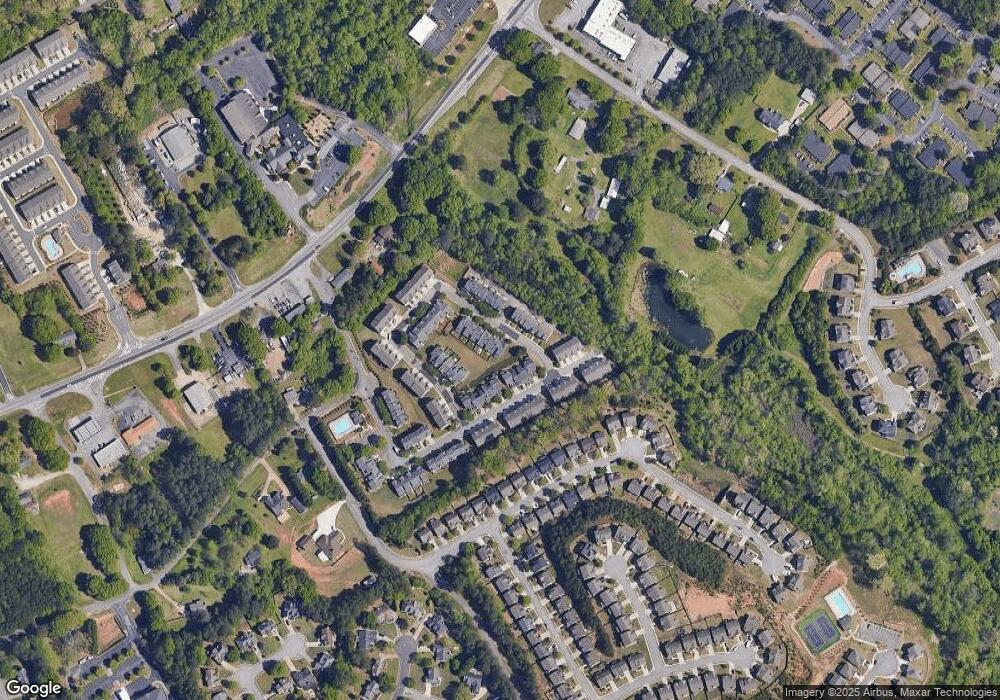

Map

Nearby Homes

- 4173 Chatham Ridge Dr

- 4264 Buford Valley Way

- 4128 Brynhill Ln

- 1179 Chatham Rd

- 1264 Brynhill Ct

- 742 Kimball Ln

- 1717 Castleberry Ln

- 1182 Edwin Ln

- 1669 Centerville Dr

- 998 Poplar Mill Ct

- 4225 Hidden Meadow Cir

- 1402 Frontier Dr

- 3835 Creekview Ridge Dr

- 4506 Magnolia Club Cir

- 870 Creekview Bluff Way

- 4295 Suwanee Mill Dr

- 4548 Duncan Dr

- 4557 Duncan Dr

- 4519 Cheeley Dr

- 4321 Buford Valley Way Unit 90

- 4321 Buford Valley Way

- 4319 Buford Valley Way

- 4189 Chatham Ridge Dr

- 4187 Chatham Ridge Dr

- 4191 Chatham Ridge Dr Unit 85

- 4185 Chatham Ridge Dr Unit 88

- 4185 Chatham Ridge Dr

- 4317 Buford Valley Way Unit 4317

- 4317 Buford Valley Way Unit 92

- 4317 Buford Valley Way

- 4193 Chatham Ridge Dr Unit 4193

- 4193 Chatham Ridge Dr Unit 84

- 4193 Chatham Ridge Dr

- 4324 Buford Valley Way Unit 41

- 4315 Buford Valley Way

- 4326 Buford Valley Way Unit 40

- 4195 Chatham Ridge Dr

- 4247 Buford Valley Way

- 4322 Buford Valley Way Unit 42