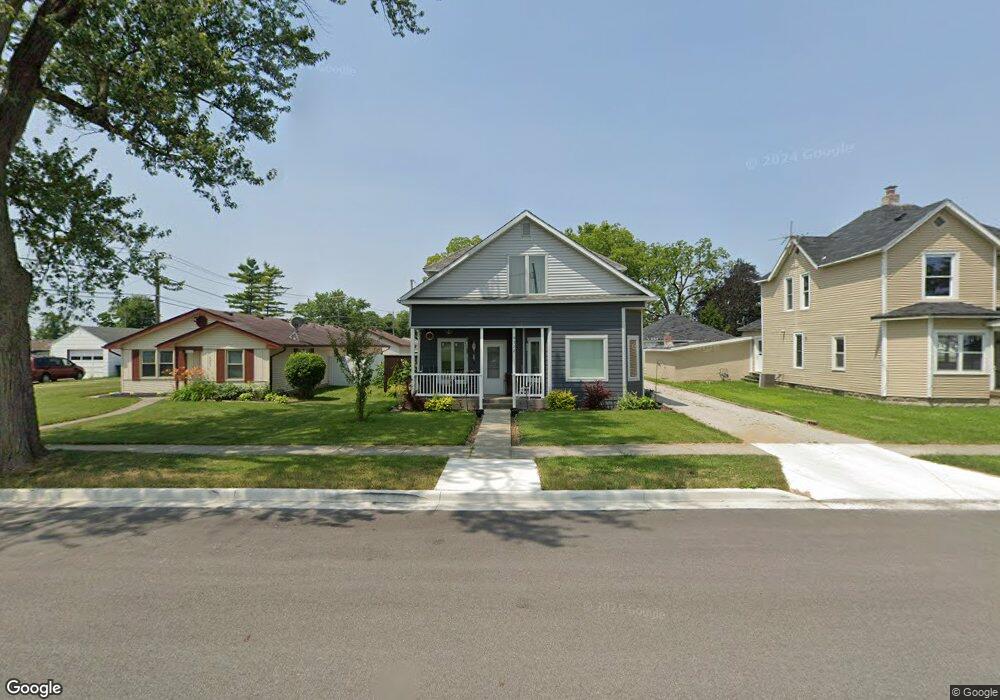

4327 Carl St Woodburn, IN 46797

Estimated Value: $138,000 - $207,483

5

Beds

2

Baths

2,352

Sq Ft

$78/Sq Ft

Est. Value

About This Home

This home is located at 4327 Carl St, Woodburn, IN 46797 and is currently estimated at $184,121, approximately $78 per square foot. 4327 Carl St is a home located in Allen County with nearby schools including Woodlan Junior/Senior High School and Woodburn Lutheran School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 22, 2023

Sold by

Anderson Christopher R

Bought by

Anderson Christopher R and Fackler Jessica

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,000

Outstanding Balance

$124,577

Interest Rate

6.39%

Mortgage Type

New Conventional

Estimated Equity

$59,544

Purchase Details

Closed on

Jun 8, 2023

Sold by

Anderson Christie L and Johnson Christie L

Bought by

Anderson Christopher R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$128,000

Outstanding Balance

$124,577

Interest Rate

6.39%

Mortgage Type

New Conventional

Estimated Equity

$59,544

Purchase Details

Closed on

Apr 27, 2020

Sold by

Sieger N Randall

Bought by

Anderson Christopher R and Anderson Christie L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$115,600

Interest Rate

3.6%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 7, 2012

Sold by

Ash Richard A

Bought by

Sieger N Randall

Purchase Details

Closed on

Mar 24, 2006

Sold by

Malfait Mark D and Malfait Carolyn

Bought by

Ash Richard A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$99,000

Interest Rate

10.4%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Anderson Christopher R | -- | None Listed On Document | |

| Anderson Christopher R | -- | None Listed On Document | |

| Anderson Christopher R | $110,774 | Meridian Title | |

| Sieger N Randall | -- | None Available | |

| Ash Richard A | -- | Progressive Land Title Of In |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Anderson Christopher R | $128,000 | |

| Previous Owner | Anderson Christopher R | $115,600 | |

| Previous Owner | Ash Richard A | $99,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,079 | $131,000 | $21,600 | $109,400 |

| 2022 | $885 | $119,200 | $10,200 | $109,000 |

| 2021 | $747 | $101,200 | $10,200 | $91,000 |

| 2020 | $195 | $45,400 | $4,700 | $40,700 |

| 2019 | $1,088 | $54,400 | $6,100 | $48,300 |

| 2018 | $960 | $48,000 | $6,000 | $42,000 |

| 2017 | $800 | $40,000 | $5,100 | $34,900 |

| 2016 | $796 | $39,800 | $5,300 | $34,500 |

| 2014 | $764 | $38,200 | $5,500 | $32,700 |

| 2013 | $760 | $38,000 | $5,600 | $32,400 |

Source: Public Records

Map

Nearby Homes

- 22428 Ash St Unit 25

- 22489 Ash St Unit 21

- 22457 Ash St Unit 22

- 22476 Ash St Unit 29

- 22445 Ash St

- 22433 Ash St Unit 24

- 22724 Maumee Meadows Dr Unit 38

- 22727 Maumee Meadows Dr Unit 1

- 5111 Chickadee Dr Unit 15

- 5123 Chickadee Dr Unit 14

- 5099 Chickadee Dr Unit 16

- 4971 Chickadee Dr

- 5173 Meadowlark Ln Unit 7

- 5186 Meadowlark Ln Unit 5

- 22662 Maumee Meadows Dr Unit 37

- 4962 Chickadee Dr Unit 32

- 4950 Chickadee Dr Unit 31

- 22665 Maumee Meadows Dr Unit 10

- 22238 Travertine Run

- 4974 Chickadee Dr