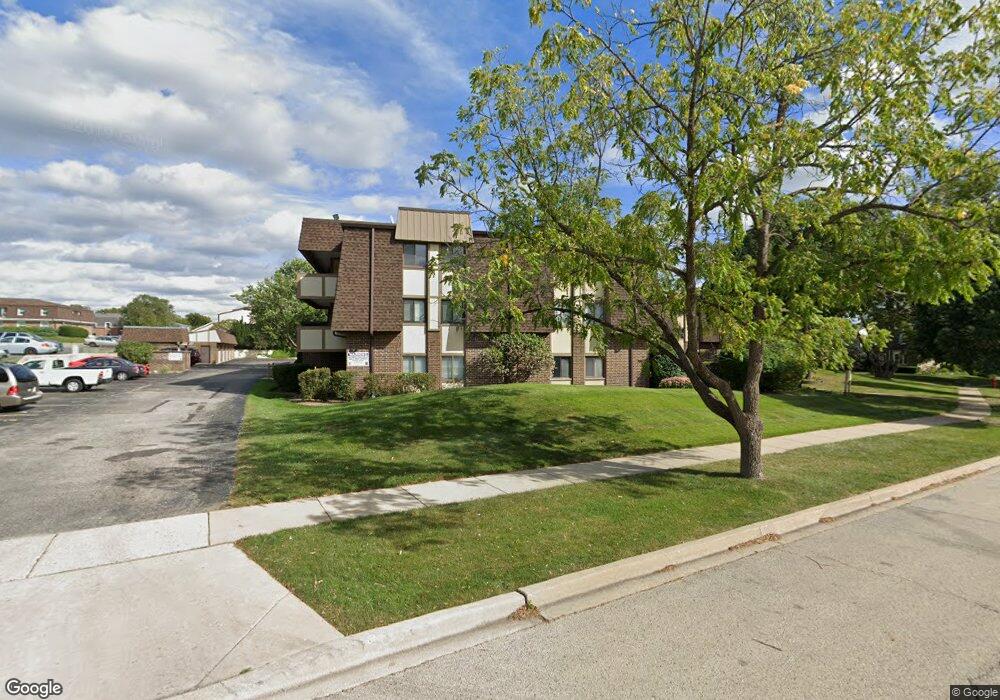

433 Cavalier Ct Unit 30 West Dundee, IL 60118

Estimated Value: $165,000 - $176,180

2

Beds

--

Bath

981

Sq Ft

$173/Sq Ft

Est. Value

About This Home

This home is located at 433 Cavalier Ct Unit 30, West Dundee, IL 60118 and is currently estimated at $169,795, approximately $173 per square foot. 433 Cavalier Ct Unit 30 is a home located in Kane County with nearby schools including Dundee Highlands Elementary School, Dundee Middle School, and West Prairie Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jan 17, 2023

Sold by

Detorres Vilma P and Detorres Mario R

Bought by

Shangraw Skye A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$119,200

Outstanding Balance

$115,446

Interest Rate

6.5%

Mortgage Type

New Conventional

Estimated Equity

$54,349

Purchase Details

Closed on

Nov 26, 2019

Sold by

Pena Laurie L

Bought by

Osorio Mario R Torres and Detorres Vilma P

Purchase Details

Closed on

Jun 17, 1998

Sold by

Rabe Ralph W

Bought by

Bentley Melva Jan

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$52,500

Interest Rate

7.27%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Shangraw Skye A | $149,000 | Old Republic Title | |

| Osorio Mario R Torres | $79,000 | Baird & Warner Ttl Svcs Inc | |

| Bentley Melva Jan | $70,000 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Shangraw Skye A | $119,200 | |

| Previous Owner | Bentley Melva Jan | $52,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,071 | $45,673 | $8,371 | $37,302 |

| 2023 | $2,832 | $41,095 | $7,532 | $33,563 |

| 2022 | $2,304 | $32,154 | $7,532 | $24,622 |

| 2021 | $2,201 | $30,360 | $7,112 | $23,248 |

| 2020 | $2,151 | $29,677 | $6,952 | $22,725 |

| 2019 | $972 | $28,173 | $6,600 | $21,573 |

| 2018 | $998 | $26,005 | $6,469 | $19,536 |

| 2017 | $1,021 | $24,326 | $6,051 | $18,275 |

| 2016 | $1,077 | $23,554 | $5,859 | $17,695 |

| 2015 | -- | $22,071 | $5,490 | $16,581 |

| 2014 | -- | $21,461 | $5,338 | $16,123 |

| 2013 | -- | $22,118 | $5,501 | $16,617 |

Source: Public Records

Map

Nearby Homes

- 849 Hemlock Dr

- 512 Lisa Rd

- 606 Edwards Ave

- 560 S 5th St

- 1042 Chateau Bluff Ln

- 0000 Strom Dr

- 305 Oregon Ave

- 842 Winmoor Dr

- Lot 1 View St

- 7 King William St

- 104 Thorobred Ln

- 1 S Lincoln Ave

- 2 Adams St

- 812 Lindsay Ln

- 822 Lindsay Ln

- 814 Lindsay Ln

- 816 Lindsay Ln

- 813 Lindsay Ln

- 825 Lindsay Ln

- 818 Lindsay Ln

- 433 Cavalier Ct Unit 303B

- 433 Cavalier Ct Unit 104C

- 433 Cavalier Ct Unit 102A

- 433 Cavalier Ct Unit 201A

- 433 Cavalier Ct Unit 204C

- 433 Cavalier Ct Unit 203B

- 433 Cavalier Ct Unit 301A

- 433 Cavalier Ct Unit 103B

- 433 Cavalier Ct Unit 304C

- 433 Cavalier Ct Unit 101A

- 433 Cavalier Ct Unit 302

- 435 Cavalier Ct Unit 105C

- 435 Cavalier Ct Unit 308A

- 435 Cavalier Ct Unit 107A

- 435 Cavalier Ct Unit 3

- 435 Cavalier Ct Unit 108A

- 435 Cavalier Ct Unit 208

- 435 Cavalier Ct Unit 106B

- 435 Cavalier Ct Unit 305

- 435 Cavalier Ct Unit 205C