433 Fox Run Ln Hampshire, IL 60140

Estimated Value: $443,000 - $473,000

4

Beds

3

Baths

2,244

Sq Ft

$205/Sq Ft

Est. Value

About This Home

This home is located at 433 Fox Run Ln, Hampshire, IL 60140 and is currently estimated at $460,237, approximately $205 per square foot. 433 Fox Run Ln is a home located in Kane County with nearby schools including Hampshire Elementary School, Hampshire Middle School, and Hampshire High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Dec 14, 1998

Sold by

Dolores Homes Inc

Bought by

Alberth Gregory J and Alberth Kimberly A

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,000

Outstanding Balance

$44,054

Interest Rate

7.02%

Estimated Equity

$416,183

Purchase Details

Closed on

Oct 19, 1998

Sold by

Obermueller Steven J and Obermueller Julie A

Bought by

Dolores Homes Inc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$190,000

Outstanding Balance

$44,054

Interest Rate

7.02%

Estimated Equity

$416,183

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Alberth Gregory J | $215,000 | First American Title Ins Co | |

| Dolores Homes Inc | $69,000 | First American Title Ins Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Alberth Gregory J | $190,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $9,104 | $131,999 | $34,541 | $97,458 |

| 2023 | $8,687 | $118,736 | $31,070 | $87,666 |

| 2022 | $8,298 | $109,122 | $28,554 | $80,568 |

| 2021 | $7,653 | $100,105 | $26,935 | $73,170 |

| 2020 | $7,527 | $97,369 | $26,199 | $71,170 |

| 2019 | $7,450 | $94,185 | $25,342 | $68,843 |

| 2018 | $7,281 | $88,988 | $23,944 | $65,044 |

| 2017 | $7,062 | $85,467 | $22,997 | $62,470 |

| 2016 | $6,888 | $79,871 | $21,148 | $58,723 |

| 2015 | -- | $74,236 | $19,656 | $54,580 |

| 2014 | -- | $71,788 | $19,008 | $52,780 |

| 2013 | -- | $76,378 | $20,223 | $56,155 |

Source: Public Records

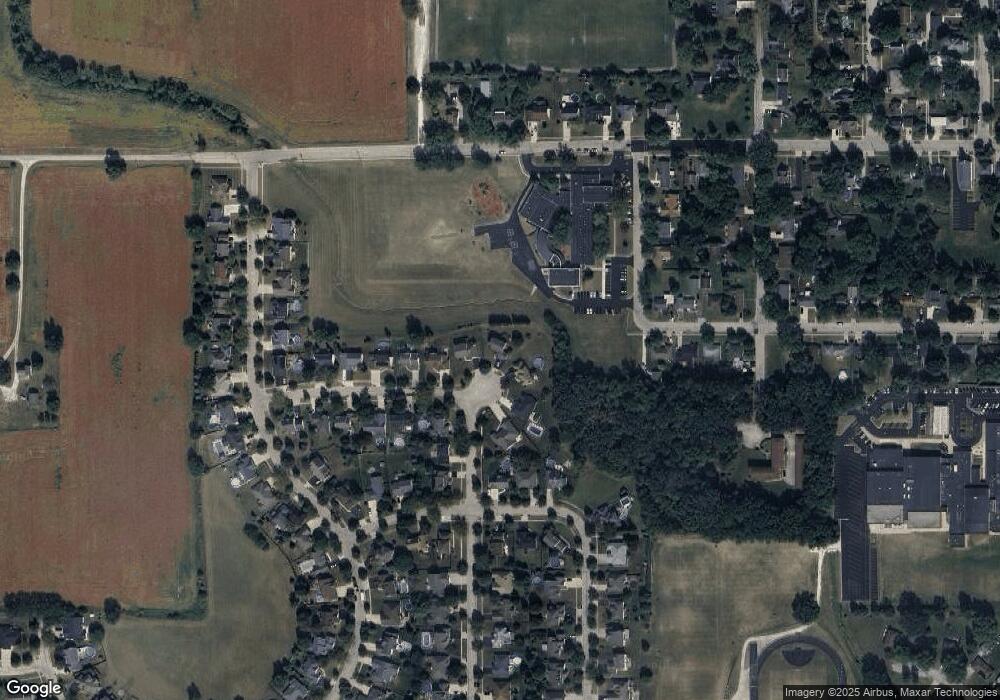

Map

Nearby Homes

- 602 Woodside Terrace

- 704 S State St

- LOT 37 W Oak Knoll Dr

- 190 Grove Ave

- 125 Mill Ave

- 895 S State St

- 244 Panama Ave

- 120 Jack Dylan Dr

- 804 Briar Glen Ct

- 820 Briar Glen Ct

- 862 Briar Glen Ct

- 263 E Jackson Ave

- 286 Wild Prairie Pointe

- 284 Wild Prairie Pointe

- 283 Wild Prairie Pointe

- 282 Wild Prairie Pointe

- Lot 0 N State St

- 318 Old Mill Ln

- 699 Centennial Dr

- 222 White Oak St

- 435 Fox Run Ln

- 431 Fox Run Ln

- 428 Fox Run Ln

- 437 Fox Run Ln

- 439 Fox Run Ln

- 426 Fox Run Ln

- 430 Fox Run Ln

- 424 Fox Run Ln

- 434 Fox Run Ln

- 427 Fox Run Ln

- 512 Whitetail Cir

- 514 Whitetail Cir

- 422 Fox Run Ln

- 291 Edgewood Ave

- 436 Fox Run Ln

- 425 Fox Run Ln

- 292 Edgewood Ave

- 516 Whitetail Cir

- 506 Whitetail Cir

- 423 Fox Run Ln