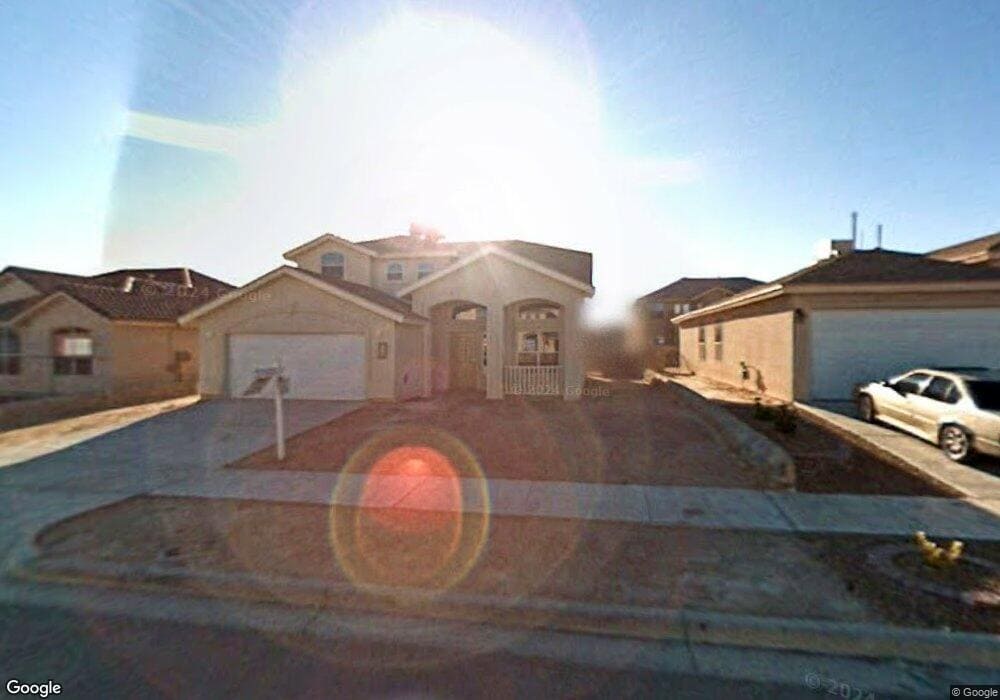

433 Sand Verbena St Unit 14 El Paso, TX 79928

Estimated Value: $279,409 - $306,000

4

Beds

4

Baths

2,159

Sq Ft

$135/Sq Ft

Est. Value

About This Home

This home is located at 433 Sand Verbena St Unit 14, El Paso, TX 79928 and is currently estimated at $290,852, approximately $134 per square foot. 433 Sand Verbena St Unit 14 is a home located in El Paso County with nearby schools including Desert Hills Elementary School, Horizon Middle School, and Horizon High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 29, 2018

Sold by

El Trio Lp

Bought by

Robles Juan Francisco and Robles Sofia Loren

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$6,282

Outstanding Balance

$5,456

Interest Rate

4.6%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$285,396

Purchase Details

Closed on

Mar 2, 2010

Sold by

Fuentes Jose R and Fuentes Blanca

Bought by

El Trio Lp

Purchase Details

Closed on

Aug 15, 2008

Sold by

Carefree Homes Ii Lp

Bought by

Fuentes Jose R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$127,160

Interest Rate

6.29%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Robles Juan Francisco | -- | None Available | |

| El Trio Lp | $130,000 | None Available | |

| Fuentes Jose R | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Robles Juan Francisco | $6,282 | |

| Previous Owner | Fuentes Jose R | $127,160 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,464 | $261,064 | -- | -- |

| 2024 | $6,464 | $237,331 | -- | -- |

| 2023 | $5,662 | $215,755 | $0 | $0 |

| 2022 | $6,360 | $196,141 | $0 | $0 |

| 2021 | $6,363 | $208,396 | $27,578 | $180,818 |

| 2020 | $5,631 | $162,100 | $27,578 | $134,522 |

| 2018 | $5,274 | $157,136 | $27,578 | $129,558 |

| 2017 | $4,951 | $149,112 | $27,578 | $121,534 |

| 2016 | $4,951 | $149,112 | $27,578 | $121,534 |

| 2015 | $4,728 | $149,112 | $27,578 | $121,534 |

| 2014 | $4,728 | $149,657 | $27,578 | $122,079 |

Source: Public Records

Map

Nearby Homes

- 444 Ghost Flower St

- 14117 Highweed Dr

- 14100 Ghost Flower St

- 441 Desert Dandelion St

- 409 Desert Chicory St

- 14052 Highweed Dr

- 475 N Kenazo Ave

- 467 N Kenazo Ave

- 487 N Kenazo Ave

- 14032 Highweed Dr

- 479 N Kenazo Ave

- 469 N Kenazo Ave

- 400 Mura Place

- 14156 Warren Belin Dr

- 317 Jim Knowles Place

- 394 Brill Cir

- 0 Highweed Dr Unit 918787

- 390 Medill Place

- PN-31080 Tbd

- TBD Rodman St

- 433 Sand Verbena St

- 437 Sand Verbena St

- 429 Sand Verbena St

- 432 Ghost Flower St

- 432 Ghost Flower St

- 441 Sand Verbena St

- 441 Sand Verbena St Unit 1

- 441 Sand Verbena St

- 436 Ghost Flower St

- 428 Ghost Flower St

- 425 Sand Verbena St

- 440 Ghost Flower St

- 424 Ghost Flower St

- 432 Sand Verbena St

- 445 Sand Verbena St

- 428 Sand Verbena St

- 436 Sand Verbena St

- 421 Sand Verbena St

- 424 Sand Verbena St

- 440 Sand Verbena St