4333 Kansas St Unit 14-G Combes, TX 78535

Estimated Value: $82,000 - $146,000

2

Beds

2

Baths

967

Sq Ft

$123/Sq Ft

Est. Value

About This Home

This home is located at 4333 Kansas St Unit 14-G, Combes, TX 78535 and is currently estimated at $118,865, approximately $122 per square foot. 4333 Kansas St Unit 14-G is a home located in Cameron County with nearby schools including Dishman Elementary School, Gutierrez Middle School, and Harlingen High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 5, 2021

Sold by

Martinez Domingo C

Bought by

Delos Santos Ruben and Moczygemba Corwin S

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,000

Outstanding Balance

$73,449

Interest Rate

3%

Mortgage Type

New Conventional

Estimated Equity

$45,416

Purchase Details

Closed on

May 27, 2021

Sold by

Sheridan Carmel Marie and Sheridan Charles Howard

Bought by

Moczygemba Corwin Scot and Moczygemba Margarita M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$81,000

Outstanding Balance

$73,449

Interest Rate

3%

Mortgage Type

New Conventional

Estimated Equity

$45,416

Purchase Details

Closed on

Jan 15, 2014

Sold by

Sheridan Janice M

Bought by

Sheridan Carmel Marie and Sheridan Charles Howard

Purchase Details

Closed on

Jan 17, 2000

Sold by

Rathert Leroy H and Rathert Esther M

Bought by

Sheridan Janice M

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Delos Santos Ruben | -- | None Available | |

| Moczygemba Corwin Scot | -- | Rio Grande Valley Abstract C | |

| Sheridan Carmel Marie | -- | None Available | |

| Sheridan Janice M | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Moczygemba Corwin Scot | $81,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,397 | $103,078 | $15,480 | $87,598 |

| 2024 | $2,397 | $106,674 | $16,560 | $90,114 |

| 2023 | $2,402 | $104,372 | $13,000 | $91,372 |

| 2022 | $1,788 | $69,634 | $13,000 | $56,634 |

| 2021 | $1,818 | $70,383 | $13,000 | $57,383 |

| 2020 | $1,899 | $71,131 | $13,000 | $58,131 |

| 2019 | $1,956 | $72,629 | $13,000 | $59,629 |

| 2018 | $2,471 | $90,929 | $13,000 | $77,929 |

| 2017 | $2,492 | $91,897 | $13,000 | $78,897 |

| 2016 | $2,500 | $92,187 | $13,000 | $79,187 |

| 2015 | $612 | $93,146 | $13,000 | $80,146 |

Source: Public Records

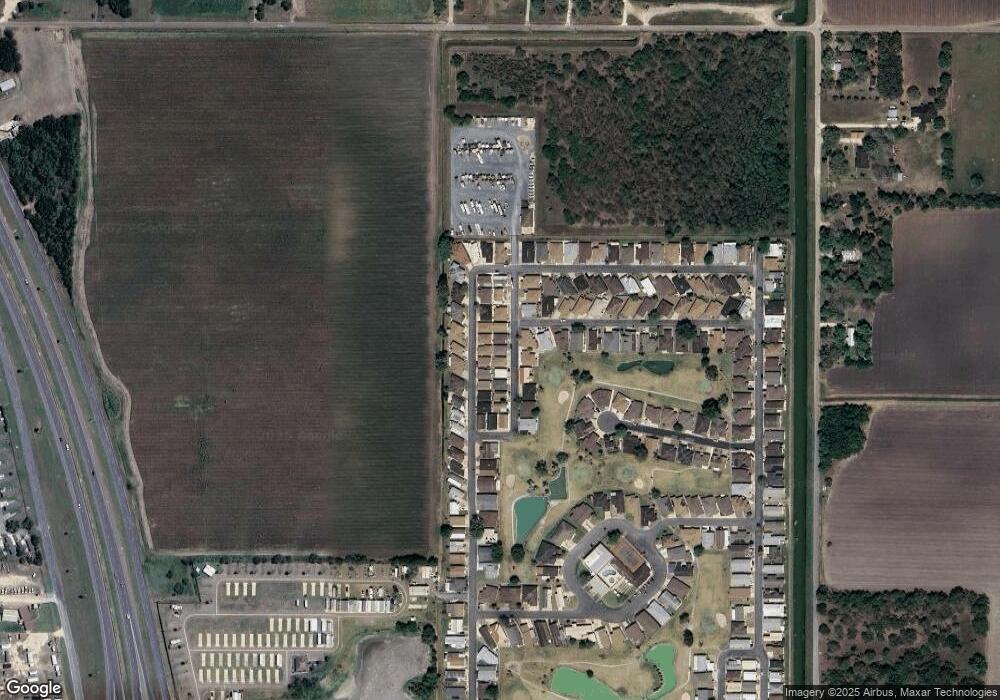

Map

Nearby Homes

- 4345 N Kansas St

- 4336 N Minnesota St

- 4325 Kansas St

- 2008 W Iowa Ave

- 4309 N Minnesota St

- 1941 W Iowa Ave

- 4344 Missouri St

- 4312 Missouri St

- 2029 Michigan Dr

- 2029 W Michigan Dr

- 1905 W Michigan Dr

- 1905 Michigan Dr

- 2029 Montana Ave

- 2005 W Montana Ave

- 4506 N Business 77

- 0000 Us Highway 77

- 22602 Rio Rancho Rd

- 00 Orichid St Unit 17

- 00 Orichid St Unit 16

- 00 Orichid St Unit 14

- 4333 Kansas St

- 4329 Kansas St Unit 16 G

- 4337 N Kansas St

- 4328 N Minnesota St Unit 13-G

- 4332 Minnesota St

- 4332 Minnesota St Unit 11-G

- 4328 N Minnesota St

- 4324 N Minnesota St

- 4341 Kansas St Unit 10-G

- 4341 Kansas St

- 4325 Kansas St Unit 18-G

- 4325 Kansas St Unit 18-G

- 4320 Minnesota St

- 4336 N Minnesota St Unit 9-G

- 4321 Kansas St Unit 20-G

- 4321 Kansas St

- 11936 Wisconsin Dr

- 4316 Minnesota St

- 4324 Kansas St

- 4336 N Kansas St