4335C Madera Rd Unit 2 Irving, TX 75038

Las Brisas Hills NeighborhoodEstimated Value: $210,673 - $231,000

2

Beds

2

Baths

1,034

Sq Ft

$216/Sq Ft

Est. Value

About This Home

This home is located at 4335C Madera Rd Unit 2, Irving, TX 75038 and is currently estimated at $223,168, approximately $215 per square foot. 4335C Madera Rd Unit 2 is a home located in Dallas County with nearby schools including Lee Elementary School, Sam Houston Middle School, and Macarthur High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 7, 2008

Sold by

Drogin Christian St Paul

Bought by

Las Brisas Hills Condominiums Assn

Current Estimated Value

Purchase Details

Closed on

May 23, 2007

Sold by

Muir Mark T and Muir Tiffany M

Bought by

Drogin Christian St Paul

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$63,900

Interest Rate

6.22%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Jun 12, 2002

Sold by

Harvey Sandra R

Bought by

Muir Mark T and Muir Tiffany M

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$63,920

Interest Rate

6.33%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Dec 4, 1998

Sold by

Saxton Jerry D

Bought by

Harvey Sandra R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$56,700

Interest Rate

6.81%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Las Brisas Hills Condominiums Assn | $4,500 | None Available | |

| Drogin Christian St Paul | -- | Stnt | |

| Muir Mark T | -- | -- | |

| Harvey Sandra R | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Drogin Christian St Paul | $63,900 | |

| Previous Owner | Muir Mark T | $63,920 | |

| Previous Owner | Harvey Sandra R | $56,700 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $4,377 | $227,480 | $37,160 | $190,320 |

| 2024 | $4,377 | $227,480 | $37,160 | $190,320 |

| 2023 | $4,377 | $170,610 | $37,160 | $133,450 |

| 2022 | $3,935 | $170,610 | $37,160 | $133,450 |

| 2021 | $3,376 | $139,590 | $37,160 | $102,430 |

| 2020 | $3,502 | $139,590 | $37,160 | $102,430 |

| 2019 | $3,290 | $124,080 | $37,160 | $86,920 |

| 2018 | $2,995 | $111,670 | $10,070 | $101,600 |

| 2017 | $2,507 | $93,060 | $10,070 | $82,990 |

| 2016 | $2,145 | $79,620 | $10,070 | $69,550 |

| 2015 | $1,810 | $72,380 | $10,070 | $62,310 |

| 2014 | $1,810 | $67,220 | $10,070 | $57,150 |

Source: Public Records

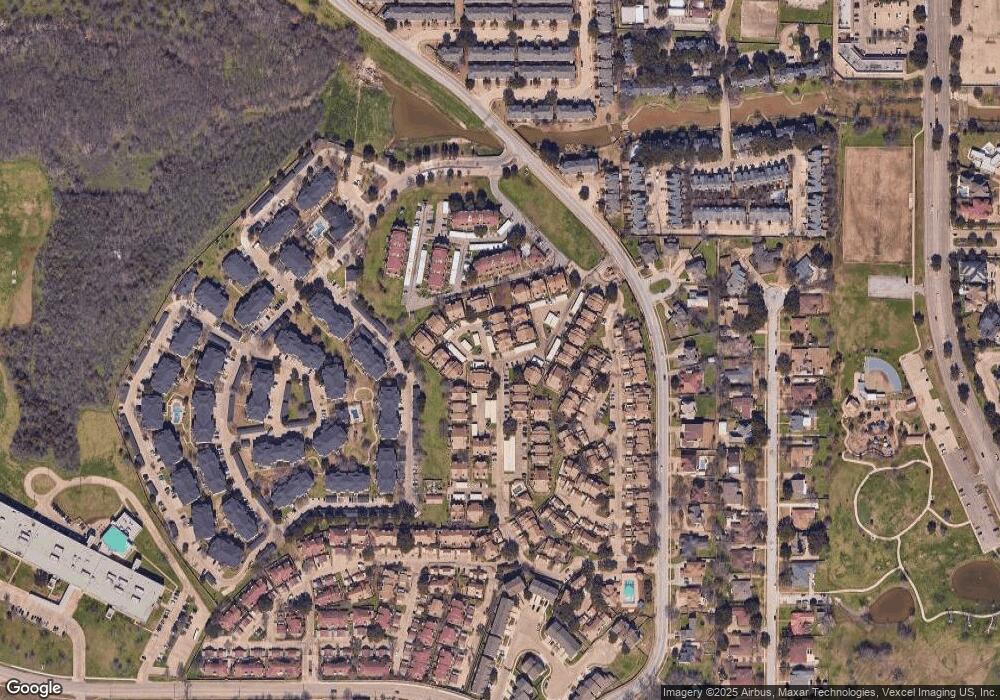

Map

Nearby Homes

- 4325 Madera Rd

- 4341 Madera Rd

- 4269 Madera Rd Unit 2

- 4245 Madera Rd

- 4252 Madera Rd Unit 2

- 4250 Madera Rd Unit 3

- 4220 Madera Rd Unit 2

- 4234 Cuesta Dr

- 2639 Entrada Blvd Unit 3

- 2407 Northlake Ct

- 4419 Westminster Dr

- 2344 Southcourt Cir

- 4304 Westminster Dr

- 4421 Westminster Dr

- 4222 Nia Dr

- 2700 Stonehaven Ct

- 4414 Westminster Dr

- 2415 Skyline Dr

- 2171 Hogan Dr

- 2425 W Northgate Dr

- 4333C Madera Rd Unit 1

- 4337C Madera Rd Unit 3

- 4339 Madera Rd Unit CQ

- 4323C Madera Rd Unit 4

- 4337 Madera Rd Unit 3

- 4333 Madera Rd

- 4345 Madera Rd Unit 3

- 4343 Madera Rd Unit 2

- 4343C Madera Rd Unit 2

- 4341C Madera Rd Unit 1

- 4341 Madera Rd Unit 353

- 4341 Madera Rd Unit 1

- 4329C Madera Rd Unit 3

- 4327C Madera Rd Unit 2

- 4347 Madera Rd Unit 4

- 4347 Madera Rd

- 4347 Madera Rd Unit CP

- 4345C Madera Rd Unit 3

- 4353C Madera Rd Unit 3

- 4327 Madera Rd