4341 Regency Ridge Ct Unit 105 Cincinnati, OH 45248

Estimated Value: $180,000 - $187,000

2

Beds

2

Baths

1,257

Sq Ft

$146/Sq Ft

Est. Value

About This Home

This home is located at 4341 Regency Ridge Ct Unit 105, Cincinnati, OH 45248 and is currently estimated at $183,529, approximately $146 per square foot. 4341 Regency Ridge Ct Unit 105 is a home located in Hamilton County with nearby schools including Oakdale Elementary School, Bridgetown Middle School, and Oak Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 18, 2019

Sold by

Hoffman Eugene David

Bought by

Mock Rodney T and Frazer Nancy M

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$87,200

Outstanding Balance

$76,380

Interest Rate

3.6%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$107,149

Purchase Details

Closed on

Mar 13, 2014

Sold by

Estate Of Wilma R Hoffman

Bought by

Hoffman Eugene David

Purchase Details

Closed on

Aug 15, 2006

Sold by

Doyle Michael L

Bought by

Hoffman Wilma R

Purchase Details

Closed on

Sep 28, 2005

Sold by

Lentz Daniel A

Bought by

Doyle Joan M

Purchase Details

Closed on

Dec 19, 1994

Sold by

Hal Homes Ltd Partnership 2

Bought by

Lentz Adrian J and Lentz Martha F

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Mock Rodney T | $109,000 | None Available | |

| Hoffman Eugene David | -- | None Available | |

| Hoffman Wilma R | -- | None Available | |

| Doyle Joan M | $116,500 | None Available | |

| Lentz Adrian J | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Mock Rodney T | $87,200 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $2,754 | $54,138 | $7,000 | $47,138 |

| 2023 | $2,753 | $54,138 | $7,000 | $47,138 |

| 2022 | $2,291 | $38,150 | $4,445 | $33,705 |

| 2021 | $2,060 | $38,150 | $4,445 | $33,705 |

| 2020 | $2,084 | $38,150 | $4,445 | $33,705 |

| 2019 | $1,637 | $26,474 | $3,500 | $22,974 |

| 2018 | $1,639 | $26,474 | $3,500 | $22,974 |

| 2017 | $1,565 | $26,474 | $3,500 | $22,974 |

| 2016 | $1,546 | $25,830 | $5,166 | $20,664 |

| 2015 | $1,538 | $25,830 | $5,166 | $20,664 |

| 2014 | $973 | $25,830 | $5,166 | $20,664 |

| 2013 | $1,211 | $31,500 | $6,300 | $25,200 |

Source: Public Records

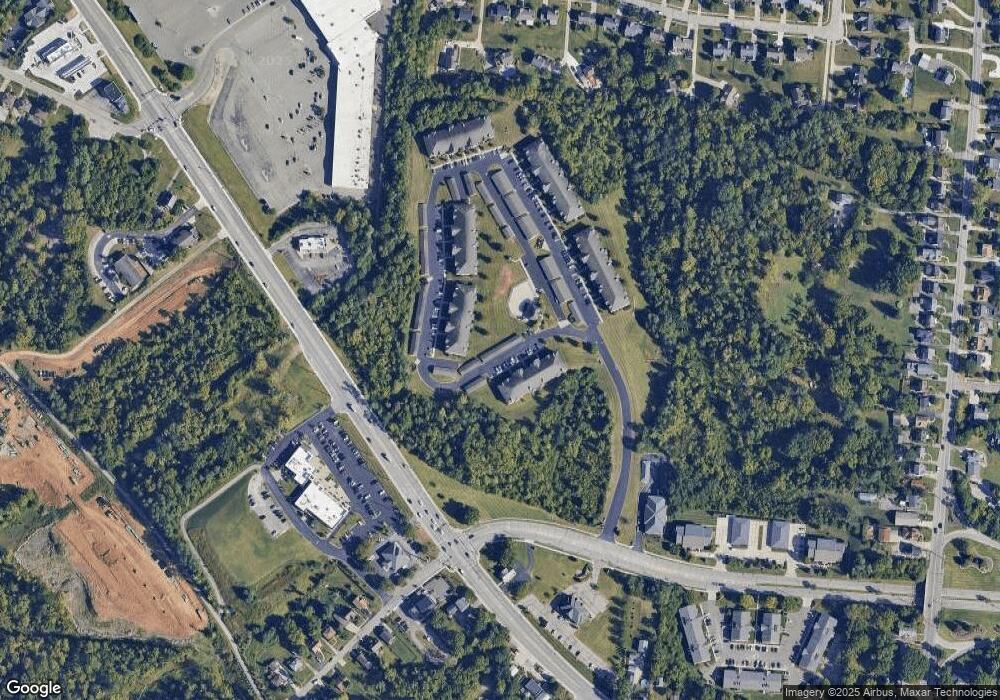

Map

Nearby Homes

- 4008 Trailside Dr

- 4017 Trailside Dr

- 3986 Trailside Dr

- 5648 Ohio Trail

- 5686 Ohio Trail

- 5690 Ohio Trail

- 5694 Ohio Trail

- 4012 Trailside Dr

- 5703 Irwin Dr

- 5682 Ohio Trail

- 4033 Trailside Dr

- 3994 Trailside Dr

- 5636 Ohio Trail

- 5640 Ohio Trail

- 5677 Ohio Trail

- 5689 Ohio Trail

- 5685 Ohio Trail

- 4310 Regency Ridge Ct

- 4341 Regency Ridge Ct Unit 208

- 4341 Regency Ridge Ct Unit 206

- 4341 Regency Ridge Ct Unit 203

- 4341 Regency Ridge Ct Unit 305

- 4341 Regency Ridge Ct

- 4341 Regency Ridge Ct

- 4341 Regency Ridge Ct

- 4341 Regency Ridge Ct

- 4341 Regency Ridge Ct

- 4341 Regency Ridge Ct

- 4341 Regency Ridge Ct

- 4341 Regency Ridge Ct

- 4341 Regency Ridge Ct

- 4341 Regency Ridge Ct

- 4341 Regency Ridge Ct

- 4341 Regency Ridge Ct

- 4341 Regency Ridge Ct

- 4341 Regency Ridge Ct

- 4341 Regency Ridge Ct

- 4341 Regency Ridge Ct