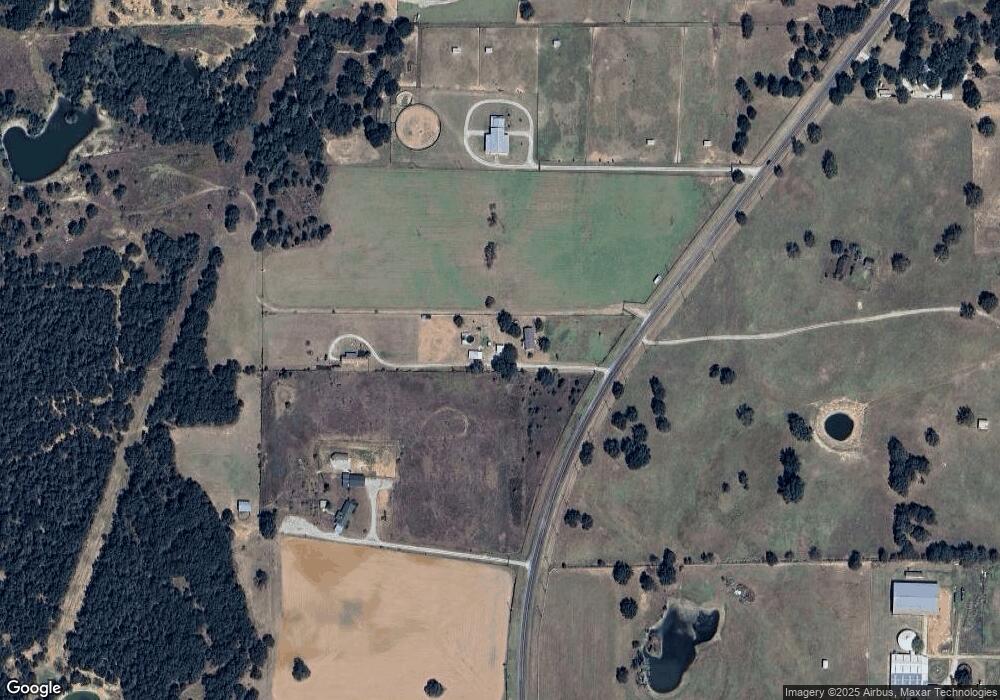

4343 N Fm 113 Weatherford, TX 76088

Estimated Value: $192,784 - $471,000

--

Bed

--

Bath

1,608

Sq Ft

$215/Sq Ft

Est. Value

About This Home

This home is located at 4343 N Fm 113, Weatherford, TX 76088 and is currently estimated at $345,196, approximately $214 per square foot. 4343 N Fm 113 is a home located in Parker County with nearby schools including Garner Elementary School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 5, 2023

Sold by

Jirak Glen Scott

Bought by

Henslee April Estell

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$27,142

Outstanding Balance

$24,214

Interest Rate

5.89%

Mortgage Type

New Conventional

Estimated Equity

$320,982

Purchase Details

Closed on

May 19, 2017

Sold by

Stewart Naomi A Life Estate

Bought by

Jirak April Estell

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$58,500

Interest Rate

3.97%

Mortgage Type

Commercial

Purchase Details

Closed on

Sep 15, 2008

Sold by

Stewart Naomi

Bought by

Jirak April Estell

Purchase Details

Closed on

Dec 16, 2005

Sold by

Stewart Bill M

Bought by

Jirak April Estell

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Henslee April Estell | -- | Elliott & Waldron Abstract | |

| Jirak April Estell | -- | -- | |

| Jirak April Estell | $53,000 | None Available | |

| Jirak April Estell | -- | -- | |

| Simmons April Estell | -- | None Available | |

| Jirak April Estell | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Henslee April Estell | $27,142 | |

| Previous Owner | Jirak April Estell | $58,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $1,026 | $136,428 | -- | -- |

| 2024 | $1,026 | $124,025 | -- | -- |

| 2023 | $1,026 | $112,750 | $0 | $0 |

| 2022 | $1,596 | $145,500 | $134,990 | $10,510 |

| 2021 | $1,625 | $145,500 | $134,990 | $10,510 |

| 2020 | $1,475 | $107,500 | $96,990 | $10,510 |

| 2019 | $1,432 | $107,500 | $96,990 | $10,510 |

| 2018 | $1,310 | $70,010 | $60,000 | $10,010 |

| 2017 | $1,364 | $71,840 | $60,000 | $11,840 |

| 2016 | $1,485 | $78,210 | $60,000 | $18,210 |

| 2015 | $538 | $78,210 | $60,000 | $18,210 |

| 2014 | $643 | $77,010 | $60,000 | $17,010 |

Source: Public Records

Map

Nearby Homes

- 000o Howard Rd

- 1240 Smith Trail

- 2011 Feather Ln

- 2028 Feather Ln

- 2027 Feather Ln

- 255 Maddux Rd

- TBD Ballew Springs Rd

- 108 Stafford Trail

- 905 Ballew Springs Rd

- 1020 Turkey Meadows Ln

- 7211 N Fm 113

- 1403 N Fm 113

- 201 Threatt Ln

- 990 N Fm 113

- 2396 Lamkin Rd

- 501 Grimes Rd

- 6915 Fm 1885

- 0 Tbd Old Authon Rd

- 412 Adell Cir

- 1012 Freedom Ct