4350 Regency Ridge Ct Cincinnati, OH 45248

Estimated Value: $202,000 - $210,573

2

Beds

2

Baths

1,404

Sq Ft

$147/Sq Ft

Est. Value

About This Home

This home is located at 4350 Regency Ridge Ct, Cincinnati, OH 45248 and is currently estimated at $205,893, approximately $146 per square foot. 4350 Regency Ridge Ct is a home located in Hamilton County with nearby schools including Oakdale Elementary School, Bridgetown Middle School, and Oak Hills High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 19, 2014

Sold by

Heim Megan E

Bought by

Tewel James

Current Estimated Value

Purchase Details

Closed on

May 20, 2011

Sold by

Clark Estella C

Bought by

Heim Megan E

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$84,075

Interest Rate

4.96%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Aug 12, 1995

Sold by

Gessner William K and Gessner June R

Bought by

Clark James W and Clark Estella C

Purchase Details

Closed on

May 15, 1995

Sold by

Hal Homes Ltd Partnership 2

Bought by

Gessner William K and Gessner June R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Interest Rate

8.39%

Purchase Details

Closed on

Jun 2, 1994

Sold by

Hal Homes Ltd Partnership 2

Bought by

Gessner William K and Gessner June R

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Tewel James | $92,000 | Chicago Title Company Llc | |

| Heim Megan E | $88,500 | Attorney | |

| Clark James W | -- | -- | |

| Gessner William K | -- | -- | |

| Gessner William K | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Heim Megan E | $84,075 | |

| Previous Owner | Gessner William K | $100,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,120 | $58,373 | $7,000 | $51,373 |

| 2023 | $3,067 | $58,373 | $7,000 | $51,373 |

| 2022 | $2,416 | $39,081 | $4,445 | $34,636 |

| 2021 | $2,219 | $39,081 | $4,445 | $34,636 |

| 2020 | $2,193 | $39,081 | $4,445 | $34,636 |

| 2019 | $1,902 | $30,772 | $3,500 | $27,272 |

| 2018 | $1,903 | $30,772 | $3,500 | $27,272 |

| 2017 | $1,742 | $30,772 | $3,500 | $27,272 |

| 2016 | $1,824 | $32,200 | $5,166 | $27,034 |

| 2015 | $1,839 | $32,200 | $5,166 | $27,034 |

| 2014 | $1,841 | $32,200 | $5,166 | $27,034 |

| 2013 | $1,657 | $30,975 | $6,300 | $24,675 |

Source: Public Records

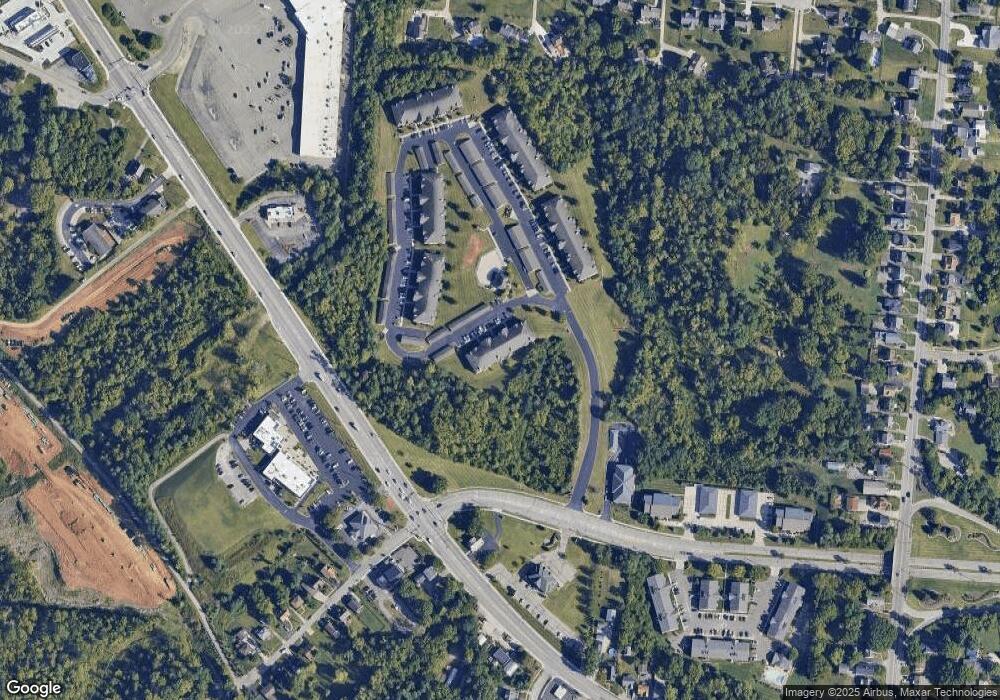

Map

Nearby Homes

- 4341 Regency Ridge Ct

- 5636 Ohio Trail

- 5640 Ohio Trail

- 5648 Ohio Trail

- 5682 Ohio Trail

- 5686 Ohio Trail

- 5690 Ohio Trail

- 5694 Ohio Trail

- Cheswicke Plan at Trailside Village - Classic Series

- Serenity Plan at Trailside Village - Classic Series

- Cooke Plan at Trailside Village - Classic Series

- Hyde Park Plan at Trailside Village - Classic Series

- Covedale Plan at Trailside Village - Neo Traditional

- Morrison Plan at Trailside Village - Classic Series

- Faulkner Plan at Trailside Village - Classic Series

- Green Plan at Trailside Village - Neo Traditional

- Hampton Plan at Trailside Village - Classic Series

- Oak Hill Plan at Trailside Village - Neo Traditional

- Clayton Plan at Trailside Village - Classic Series

- Melville II Plan at Trailside Village - Classic Series

- 4350 Regency Ridge Ct Unit 305

- 4350 Regency Ridge Ct Unit 102

- 4350 Regency Ridge Ct Unit 304

- 4350 Regency Ridge Ct Unit 308

- 4350 Regency Ridge Ct Unit 107

- 4350 Regency Ridge Ct

- 4350 Regency Ridge Ct

- 4350 Regency Ridge Ct

- 4350 Regency Ridge Ct

- 4350 Regency Ridge Ct

- 4350 Regency Ridge Ct

- 4350 Regency Ridge Ct

- 4350 Regency Ridge Ct

- 4350 Regency Ridge Ct

- 4350 Regency Ridge Ct

- 4350 Regency Ridge Ct

- 4350 Regency Ridge Ct

- 4350 Regency Ridge Ct

- 4350 Regency Ridge Ct

- 4350 Regency Ridge Ct