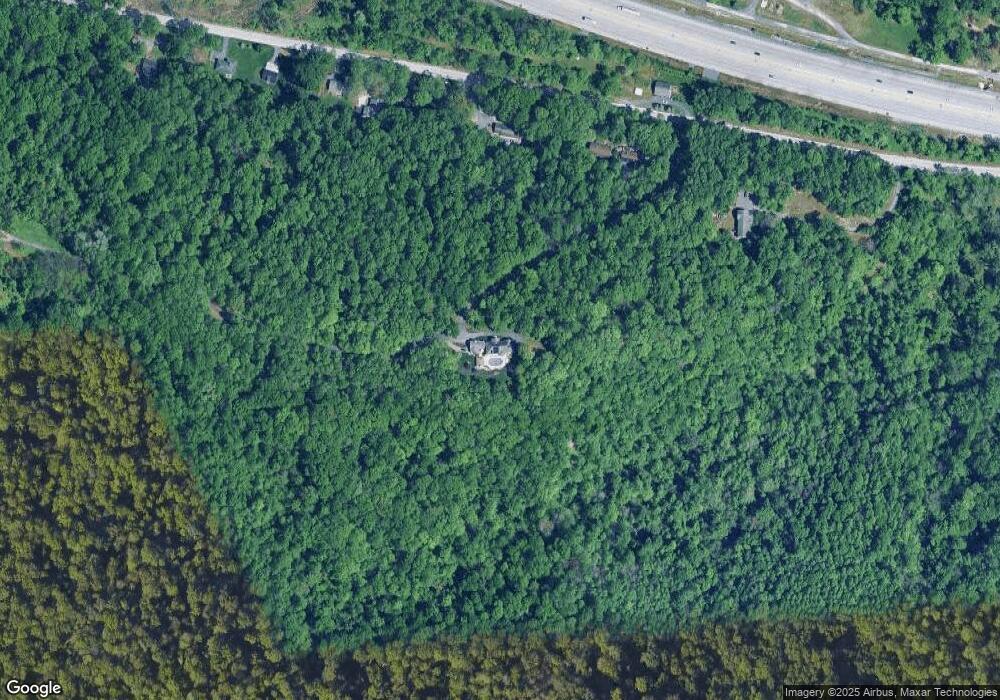

436 Marsh Run Rd New Cumberland, PA 17070

Estimated Value: $915,899 - $1,356,000

4

Beds

3

Baths

4,100

Sq Ft

$261/Sq Ft

Est. Value

About This Home

This home is located at 436 Marsh Run Rd, New Cumberland, PA 17070 and is currently estimated at $1,068,966, approximately $260 per square foot. 436 Marsh Run Rd is a home located in York County with nearby schools including Fishing Creek Elementary School, New Cumberland Middle School, and Red Land Senior High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 18, 2008

Sold by

Sharretts Timothy B and Sharretts Cathilee

Bought by

Rossi John A and Rossi Brenda L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$400,000

Outstanding Balance

$264,907

Interest Rate

6.43%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$804,059

Purchase Details

Closed on

Feb 26, 2003

Sold by

Rose Jeffrey S and Hutton Nancy R

Bought by

Sharretts Timothy B and Sharretts Cathilee G

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$250,000

Interest Rate

5.95%

Mortgage Type

Purchase Money Mortgage

Purchase Details

Closed on

Apr 28, 2000

Sold by

Rose Jeffrey S

Bought by

Rose Jeffrey S and Hutton Nancy R

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$345,000

Interest Rate

8.12%

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Rossi John A | $745,000 | None Available | |

| Sharretts Timothy B | $635,000 | -- | |

| Rose Jeffrey S | $5,009 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Rossi John A | $400,000 | |

| Previous Owner | Sharretts Timothy B | $250,000 | |

| Previous Owner | Rose Jeffrey S | $345,000 | |

| Closed | Sharretts Timothy B | $150,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $9,274 | $354,220 | $2,300 | $351,920 |

| 2024 | $8,782 | $354,220 | $2,300 | $351,920 |

| 2023 | $8,541 | $354,220 | $2,300 | $351,920 |

| 2022 | $8,514 | $354,220 | $2,300 | $351,920 |

| 2021 | $8,011 | $354,220 | $2,300 | $351,920 |

| 2020 | $7,914 | $354,220 | $2,300 | $351,920 |

| 2019 | $7,777 | $354,220 | $2,300 | $351,920 |

| 2018 | $7,624 | $354,220 | $2,300 | $351,920 |

| 2017 | $7,368 | $354,220 | $2,300 | $351,920 |

| 2016 | $0 | $354,220 | $2,300 | $351,920 |

| 2015 | -- | $354,140 | $2,220 | $351,920 |

| 2014 | -- | $354,440 | $2,520 | $351,920 |

Source: Public Records

Map

Nearby Homes

- 0 Thorley Rd Unit PAYK2090566

- 494 Old York Rd

- Lot 101B Elder Trail

- Lot 98 Steuben Rd

- LOT 1 Big Spring Rd

- LOT 2 Big Spring Rd

- 465 Pleasantview Rd

- 502 Skyline Rd

- 104 Sunrise Ave

- 308 Shuey Rd

- Lot #136 Shuey Rd

- Lot #135 Shuey Rd

- 482 Chestnut Way

- 211 Walnut Level Rd

- 131 Pleasantview Terrace

- 330 Braddock Dr

- 31 Springers Ln

- 612 Black Powder Dr

- 709 Fishing Creek Rd

- 600 Musket Ct

- 456 Marsh Run Rd

- 452 Marsh Run Rd

- 446 Marsh Run Rd

- 460 Marsh Run Rd

- 440 Marsh Run Rd

- 430 Marsh Run Rd

- 441 Marsh Run Rd

- 476 Marsh Run Rd

- 482 Marsh Run Rd

- 410 Marsh Run Rd

- 386 Old York Rd

- 396 Old York Rd

- 384 Old York Rd

- 360 Old York Rd

- 378 Old York Rd

- 389 Old York Rd

- 330 Old York Rd

- 390 Marsh Run Rd

- 430 Old York Rd

- 400 Granite Quarry Rd