Estimated Value: $146,000 - $177,793

2

Beds

2

Baths

1,134

Sq Ft

$144/Sq Ft

Est. Value

About This Home

This home is located at 436 Rexine Dr, Alamo, TX 78516 and is currently estimated at $163,198, approximately $143 per square foot. 436 Rexine Dr is a home located in Hidalgo County with nearby schools including Capt. D. Salinas Elementary School, Dora M. Sauceda Middle School, and Donna North High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 29, 2023

Sold by

Pushman Shirley and Pushman Andrew

Bought by

Ramirez Alfredo P and Ramirez Dorian Evans

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$99,400

Outstanding Balance

$96,847

Interest Rate

6.39%

Mortgage Type

New Conventional

Estimated Equity

$66,351

Purchase Details

Closed on

Apr 28, 2016

Sold by

Mitchell Joan I

Bought by

Pushman Dale and Pushman Shirley

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$106,240

Interest Rate

4.12%

Mortgage Type

FHA

Purchase Details

Closed on

Oct 12, 2006

Sold by

Mitchell Joseph A and Estate Of Jack A Mitchell

Bought by

Mitchell Joan I

Purchase Details

Closed on

Oct 30, 1997

Sold by

Colvin Forrest M and Colvin Dolores

Bought by

Mitchell Jack A and Mitchell Joan I

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Ramirez Alfredo P | -- | Corporation Service | |

| Pushman Dale | -- | None Available | |

| Mitchell Joan I | -- | None Available | |

| Mitchell Jack A | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Ramirez Alfredo P | $99,400 | |

| Previous Owner | Pushman Dale | $106,240 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,592 | $152,956 | $43,200 | $109,756 |

| 2024 | $2,592 | $142,000 | $43,200 | $98,800 |

| 2023 | $3,722 | $146,235 | $0 | $0 |

| 2022 | $3,463 | $132,941 | $0 | $0 |

| 2021 | $3,171 | $120,855 | $31,725 | $89,130 |

| 2020 | $3,006 | $110,876 | $31,725 | $79,151 |

| 2019 | $2,955 | $107,765 | $35,539 | $72,226 |

| 2018 | $2,989 | $109,744 | $35,539 | $74,205 |

| 2017 | $2,864 | $103,807 | $35,539 | $68,268 |

| 2016 | $2,652 | $96,125 | $35,539 | $60,586 |

| 2015 | $1,643 | $97,831 | $35,539 | $62,292 |

Source: Public Records

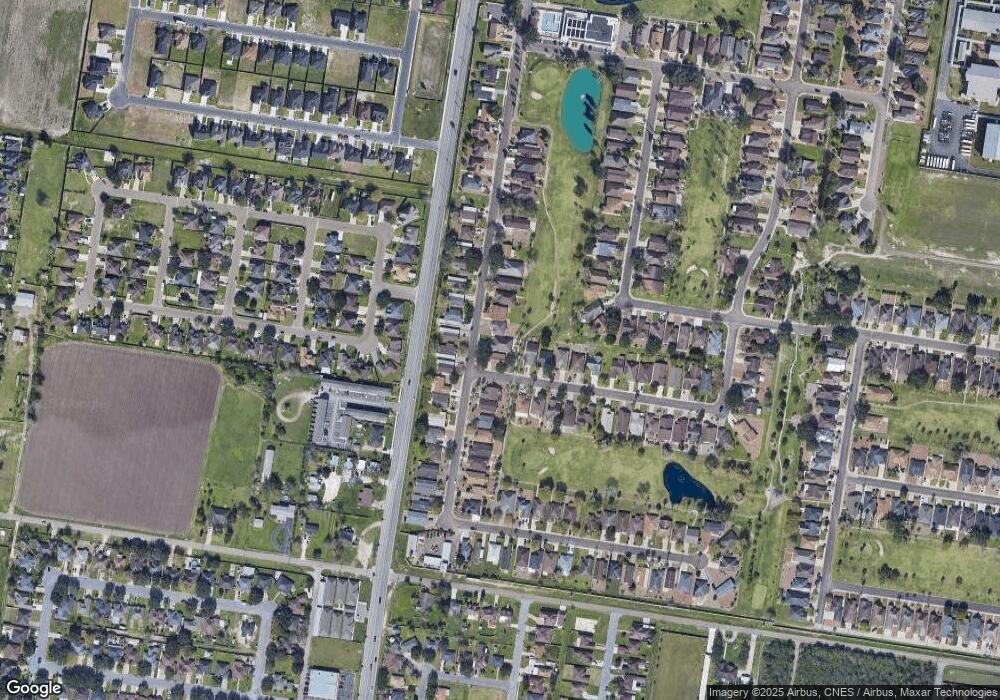

Map

Nearby Homes

- 810 Santa Anna Dr

- 421 Diana Dr

- 731 N Tower Rd

- 417 Belinda Dr

- 510 Greystone Cir

- 721 N Margret St

- 912 Santa Anna Dr

- 821 Nada Dr

- 912 Palm Dr

- 818 Nada Dr

- 843 Brady Ave

- 1016 Palm Dr

- 419 Country Club Dr

- 719 N Margret St

- 517 Hunter Dr

- 1233 Country Club Dr

- 917 Citrus Dr

- 516 Hunter Dr

- 503 Shea Dr

- 520 Country Club Dr

- 436 Rexine Dr Unit LOT 155

- 832 Santa Anna Dr

- 834 Santa Anna Dr

- 846 Santa Anna Dr

- 434 Rexine Dr

- 826 Santa Anna Dr

- 826 Santa Anna Dr Unit 227 of PHASE 2

- 836 Santa Anna Dr

- 432 Rexine Dr

- 432 Rexine Dr Unit 153

- 831 Santa Anna Dr

- 824 Santa Anna Dr

- 829 Santa Anna Dr

- 827 Santa Anna Dr Unit 174

- 435 Rexine Dr

- 838 Santa Anna Dr

- 822 Santa Anna Dr

- 825 Santa Anna Dr

- 825 Santa Anna Dr Unit Lot 175

- 433 Rexine Dr