Estimated Value: $407,000 - $450,346

3

Beds

3

Baths

1,451

Sq Ft

$294/Sq Ft

Est. Value

About This Home

This home is located at 4366 Black Oak Ln Unit 222, Mason, OH 45040 and is currently estimated at $426,337, approximately $293 per square foot. 4366 Black Oak Ln Unit 222 is a home located in Warren County with nearby schools including Mason Intermediate Elementary School, Mason Middle School, and William Mason High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 28, 2025

Sold by

Pulskamp Mary B and Pulskamp James G

Bought by

James And Mary Pulskamp Living Trust and Pulskamp

Current Estimated Value

Purchase Details

Closed on

Jan 17, 2020

Sold by

Robson John and Robson Michelle Byers

Bought by

Pulskamp James and Pulskamp Mary

Purchase Details

Closed on

Jun 18, 2015

Sold by

Anderson Wilson Michelle

Bought by

Byers Robson John and Byers Robson Michelle

Purchase Details

Closed on

Oct 3, 2005

Sold by

Fischer Attached Homes Ii Llc

Bought by

Anderson Wilson Michelle

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$198,400

Interest Rate

5.82%

Mortgage Type

Fannie Mae Freddie Mac

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| James And Mary Pulskamp Living Trust | -- | None Listed On Document | |

| Pulskamp James | $286,000 | None Available | |

| Byers Robson John | -- | Attorney | |

| Anderson Wilson Michelle | $248,433 | Homestead Title |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Anderson Wilson Michelle | $198,400 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $5,292 | $130,400 | $28,000 | $102,400 |

| 2023 | $4,905 | $102,105 | $17,955 | $84,150 |

| 2022 | $4,842 | $102,106 | $17,955 | $84,151 |

| 2021 | $4,587 | $102,106 | $17,955 | $84,151 |

| 2020 | $4,815 | $89,565 | $15,750 | $73,815 |

| 2019 | $4,437 | $89,565 | $15,750 | $73,815 |

| 2018 | $4,452 | $89,565 | $15,750 | $73,815 |

| 2017 | $4,173 | $78,369 | $15,250 | $63,119 |

| 2016 | $4,298 | $78,369 | $15,250 | $63,119 |

| 2015 | $4,188 | $78,369 | $15,250 | $63,119 |

| 2014 | $4,010 | $69,970 | $13,620 | $56,360 |

| 2013 | $4,019 | $80,940 | $15,750 | $65,190 |

Source: Public Records

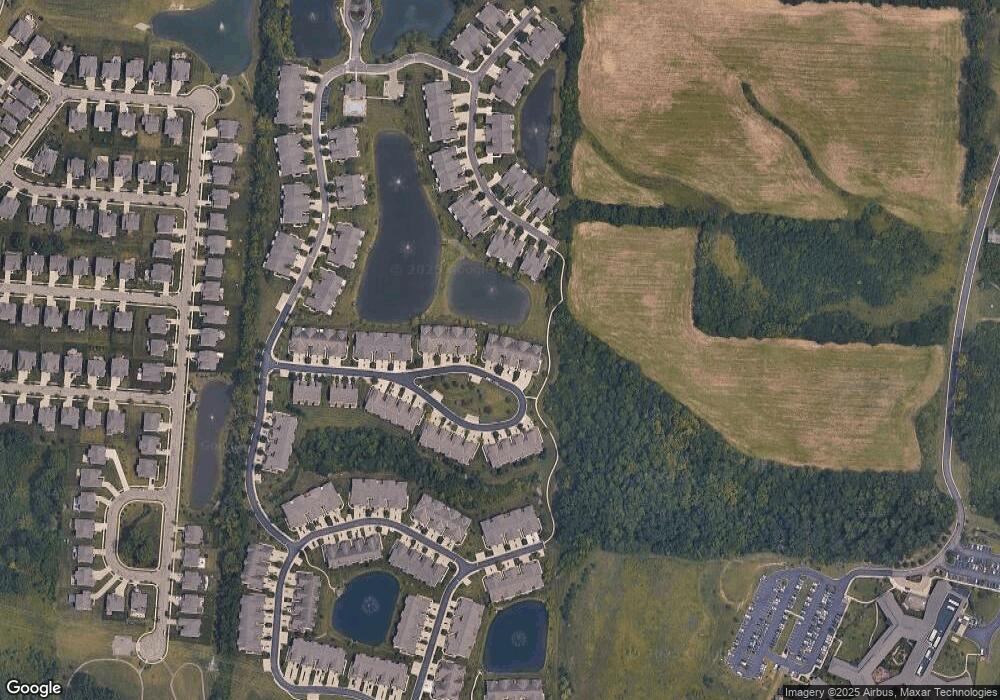

Map

Nearby Homes

- 4465 Black Oak Ln

- 4379 English Oak Ct Unit 38302

- 4431 English Oak Ct

- 7400 Red Oak Ct

- 4467 English Oak Ct

- 7362 Middleton Way

- 4344 North Point

- 4344 N Point Dr

- 4487 N Shore Dr

- 4321 N Shore Dr

- 4451 N Shore Dr

- 7154 Traditions Turn

- 7144 Traditions Turn

- 7174 Traditions Turn

- 7103 Traditions Turn

- 7183 Traditions Turn

- 7164 Traditions Turn

- 7153 Traditions Turn

- 7114 Traditions Turn

- 6788 Summer Field Dr

- 4366 Black Oak Ln

- 4370 Black Oak Ln Unit 221

- 4370 Black Oak Ln

- 4362 Black Oak Ln Unit 223

- 4362 Black Oak Ln Unit 22G3

- 4362 Black Oak Ln

- 4356 Black Oak Ln Unit 224

- 4356 Black Oak Ln Unit 22G4

- 4356 Black Oak Ln

- 4378 Black Oak Ln Unit 216

- 4378 Black Oak Ln Unit 21G6

- 4378 Black Oak Ln

- 4350 Black Oak Ln Unit 225

- 4350 Black Oak Ln Unit 22G5

- 4350 Black Oak Ln

- 4344 Black Oak Ln Unit 226

- 4344 Black Oak Ln

- 4384 Black Oak Ln Unit 215

- 4384 Black Oak Ln Unit 21G5

- 4388 Black Oak Ln Unit 214