437 Tokay Ct Unit 42C Cincinnati, OH 45255

Estimated Value: $216,530 - $244,000

2

Beds

2

Baths

1,280

Sq Ft

$183/Sq Ft

Est. Value

About This Home

This home is located at 437 Tokay Ct Unit 42C, Cincinnati, OH 45255 and is currently estimated at $234,383, approximately $183 per square foot. 437 Tokay Ct Unit 42C is a home located in Clermont County with nearby schools including Withamsville-Tobasco Elementary School, West Clermont Middle School, and West Clermont High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Feb 27, 2006

Sold by

Bail Joshua A

Bought by

Bauer Renee

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$100,000

Outstanding Balance

$57,049

Interest Rate

6.33%

Mortgage Type

Fannie Mae Freddie Mac

Estimated Equity

$177,334

Purchase Details

Closed on

May 19, 2004

Sold by

Green Karen A

Bought by

Bail Joshua A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$111,500

Interest Rate

5.85%

Mortgage Type

Unknown

Purchase Details

Closed on

Aug 6, 1999

Sold by

Drees Co

Bought by

Collins Wanda L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$75,000

Interest Rate

7.68%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bauer Renee | $128,000 | Vintage Title Agency | |

| Bail Joshua A | -- | Huntington Title Services | |

| Green Karen A | $121,500 | Huntington Title Services | |

| Collins Wanda L | $113,600 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bauer Renee | $100,000 | |

| Previous Owner | Bail Joshua A | $111,500 | |

| Previous Owner | Collins Wanda L | $75,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $3,039 | $60,270 | $15,750 | $44,520 |

| 2023 | $3,044 | $60,270 | $15,750 | $44,520 |

| 2022 | $2,808 | $48,200 | $12,600 | $35,600 |

| 2021 | $2,820 | $48,200 | $12,600 | $35,600 |

| 2020 | $2,823 | $48,200 | $12,600 | $35,600 |

| 2019 | $2,243 | $44,770 | $12,600 | $32,170 |

| 2018 | $2,266 | $44,770 | $12,600 | $32,170 |

| 2017 | $2,160 | $44,770 | $12,600 | $32,170 |

| 2016 | $2,086 | $37,310 | $10,500 | $26,810 |

| 2015 | $2,024 | $37,310 | $10,500 | $26,810 |

| 2014 | $2,024 | $37,310 | $10,500 | $26,810 |

| 2013 | $2,046 | $37,310 | $10,500 | $26,810 |

Source: Public Records

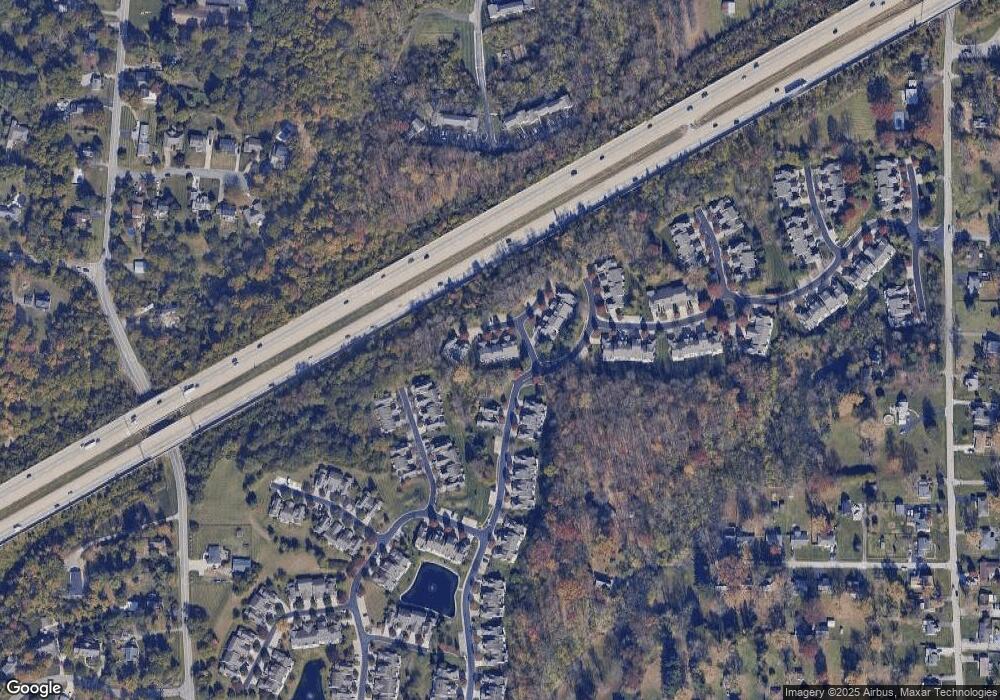

Map

Nearby Homes

- 3910 Vineyard Green Dr

- 854 Nordyke Rd

- 464 Lenkenann Dr

- 3810 Arbor Ln

- 3879 Mark Ct

- 535 Davis Rd

- 537 Davis Rd

- 1007 Nottingham Dr

- 497 Mapleport Way

- 539 Davis Rd

- 3986 Maplefield Ct

- 541 Davis Rd

- 3875 Michael Dr

- 3892 Michael Dr

- 595 Davis Rd

- 1144 White Pine Ct

- 3805 9 Mile Rd

- 8512 Prilla Ln

- 8538 Sunmont Dr

- 604 Legend Hills

- 439 Tokay Ct Unit 42B

- 435 Tokay Ct Unit 42D

- 433 Tokay Ct

- 441 Tokay Ct Unit 42A

- 431 Tokay Ct

- 429 Tokay Ct Unit 43A

- 427 Tokay Ct Unit 43B

- 443 Tokay Ct

- 3820 Hank Woods Ln

- 445 Tokay Ct Unit 41E

- 3911 Vineyard Green Dr

- 447 Tokay Ct Unit 41D

- 3914 Vineyard Green Dr

- 449 Tokay Ct Unit 41C

- 3909 Vineyard Green Dr

- 451 Tokay Ct Unit 41B

- 3912 Vineyard Green Dr

- 3912 Vineyard Green Dr Unit Condo in Anderson CI

- 3914 Beranger Ct

- 3918 Beranger Ct