4377 S 1000 E Upland, IN 46989

Estimated Value: $227,000 - $434,007

3

Beds

2

Baths

1,548

Sq Ft

$218/Sq Ft

Est. Value

About This Home

This home is located at 4377 S 1000 E, Upland, IN 46989 and is currently estimated at $337,336, approximately $217 per square foot. 4377 S 1000 E is a home located in Grant County.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Oct 15, 2015

Sold by

Gephart Shawn

Bought by

Orr Amy L and Gephart Amy L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$152,000

Outstanding Balance

$119,714

Interest Rate

3.91%

Mortgage Type

New Conventional

Estimated Equity

$217,622

Purchase Details

Closed on

Apr 1, 2008

Sold by

Secretay Of Hud

Bought by

Gephart Amy L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,750

Interest Rate

6.1%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 11, 2008

Sold by

Us Ban Na

Bought by

Gephart Shawn P and Gephart Amy L

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,750

Interest Rate

6.1%

Mortgage Type

New Conventional

Purchase Details

Closed on

Mar 6, 2008

Sold by

Lopez Jorge L and Lopez Kristie L

Bought by

U S Bank Na

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$175,750

Interest Rate

6.1%

Mortgage Type

New Conventional

Purchase Details

Closed on

Sep 6, 2005

Sold by

Reece Oris L

Bought by

Lopez Jorge L and Lopez Kristie L

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Orr Amy L | -- | None Available | |

| Gephart Amy L | -- | None Available | |

| Gephart Shawn P | -- | None Available | |

| U S Bank Na | $122,400 | None Available | |

| Lopez Jorge L | -- | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Orr Amy L | $152,000 | |

| Previous Owner | Gephart Shawn P | $175,750 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $1,871 | $270,200 | $69,300 | $200,900 |

| 2023 | $1,885 | $247,100 | $67,000 | $180,100 |

| 2022 | $1,726 | $218,900 | $52,000 | $166,900 |

| 2021 | $1,521 | $189,900 | $50,700 | $139,200 |

| 2020 | $1,376 | $182,300 | $48,500 | $133,800 |

| 2019 | $1,291 | $178,500 | $50,200 | $128,300 |

| 2018 | $1,210 | $173,900 | $50,500 | $123,400 |

| 2017 | $1,160 | $174,900 | $52,000 | $122,900 |

| 2016 | $1,118 | $177,200 | $52,700 | $124,500 |

| 2014 | $1,033 | $167,900 | $53,200 | $114,700 |

| 2013 | $1,033 | $181,100 | $51,500 | $129,600 |

Source: Public Records

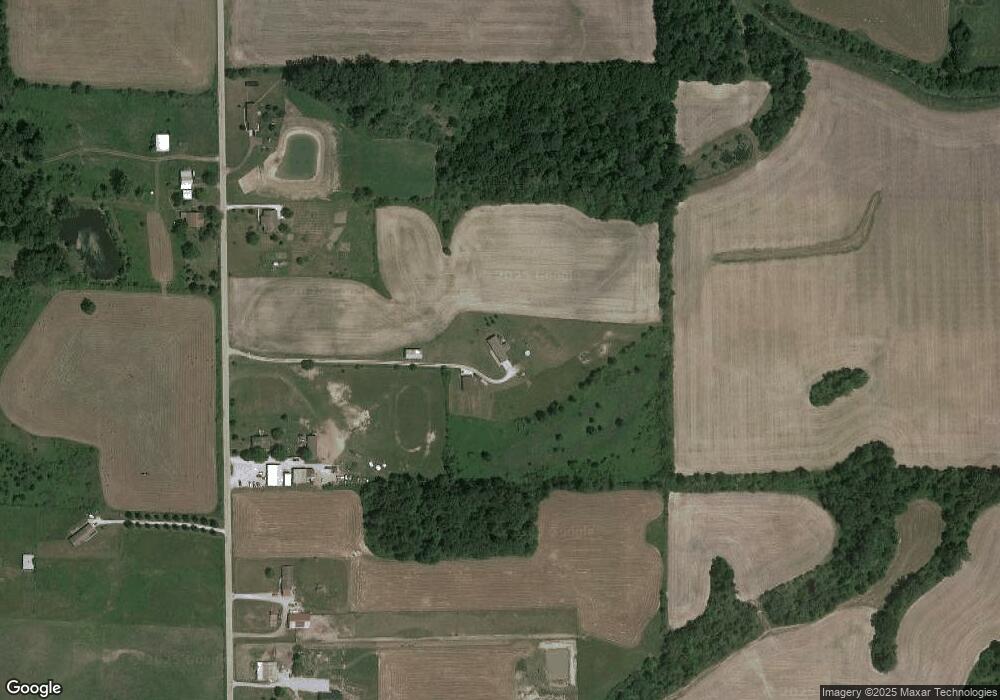

Map

Nearby Homes

- 9810 E 400 S

- 265 N Half St

- 328 W Jefferson St

- Lot 8 W South St

- Lot 7 W South St

- Lot 9 W South St

- 2300 S 8th St

- 7960 S 950 E

- 0 E 200 S Unit 202601439

- 8168 S 700 E

- 2866 W State Road 26

- 6231 E 600 S

- 0 S 950 E Unit 202532105

- 6004 E 200 S

- 300 E S

- 0 S 500 E Unit 202537350

- 1270 S 600 E

- 6611 S 500 E

- 0183 W State Road 18

- 0 County Road 425 S