4379 E Harbors Edge Dr Unit 133 Port Clinton, OH 43452

Estimated Value: $734,000 - $851,012

3

Beds

3

Baths

2,185

Sq Ft

$367/Sq Ft

Est. Value

About This Home

This home is located at 4379 E Harbors Edge Dr Unit 133, Port Clinton, OH 43452 and is currently estimated at $802,503, approximately $367 per square foot. 4379 E Harbors Edge Dr Unit 133 is a home located in Ottawa County with nearby schools including Bataan Memorial Primary School, Bataan Memorial Intermediate School, and Port Clinton Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 1, 2011

Sold by

French Maureen A and French Charles J

Bought by

Meteer Trent L

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$249,600

Outstanding Balance

$174,121

Interest Rate

5.04%

Mortgage Type

New Conventional

Estimated Equity

$628,382

Purchase Details

Closed on

Apr 25, 2007

Sold by

Harbors Edge Development Ltd

Bought by

French Maureen A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$286,500

Interest Rate

6.2%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Meteer Trent L | $312,000 | Hartung Title | |

| French Maureen A | $358,200 | County Title Co |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Meteer Trent L | $249,600 | |

| Previous Owner | French Maureen A | $286,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $6,635 | $204,660 | $61,030 | $143,630 |

| 2023 | $6,635 | $146,098 | $46,946 | $99,152 |

| 2022 | $5,205 | $146,098 | $46,946 | $99,152 |

| 2021 | $5,196 | $146,100 | $46,950 | $99,150 |

| 2020 | $4,381 | $118,490 | $36,110 | $82,380 |

| 2019 | $4,337 | $118,490 | $36,110 | $82,380 |

| 2018 | $4,330 | $118,490 | $36,110 | $82,380 |

| 2017 | $4,022 | $108,460 | $32,830 | $75,630 |

| 2016 | $4,031 | $108,460 | $32,830 | $75,630 |

| 2015 | $4,047 | $108,460 | $32,830 | $75,630 |

| 2014 | $1,978 | $108,460 | $32,830 | $75,630 |

| 2013 | $3,968 | $108,460 | $32,830 | $75,630 |

Source: Public Records

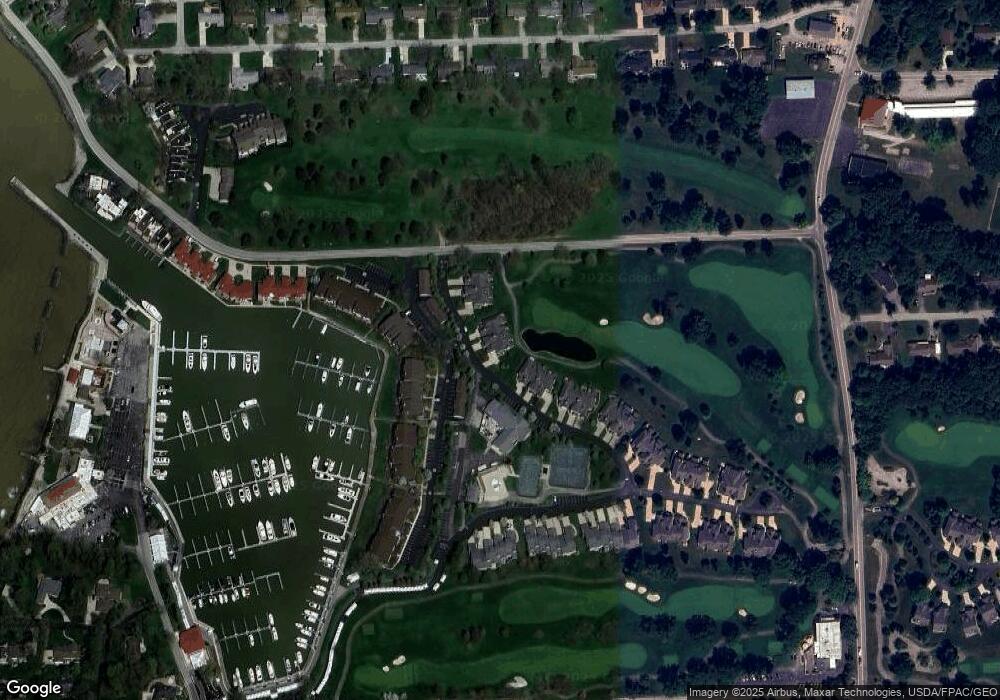

Map

Nearby Homes

- 4434 E Harbors Edge Dr Unit 25

- 4520 E Harbors Edge Dr Unit 61

- 3305 N Stonehouse Dr Unit 7

- 4866 Westwinds Dr

- 2950 N Bluff Ridge Dr

- 3737 N Karwood Dr

- 4862 Tradewinds Dr

- 2855 N Canterbury Cir Unit A

- 2901 Villa Ct Unit C

- 2750 Canterbury Cir Unit C

- 2769 Canterbury Cir

- 2769 N Canterbury Cir Unit B

- 3778 N Cliff Rd

- 3983 Coachmans Trail

- 2369 N Peachtree Ln Unit Sublot 10

- 2397 N Peachtree Ln Unit Sublot 9

- 2621 N Peachtree Ln Unit Sublot 1

- 2537 N Peachtree Ln Unit Sublot 4

- 2593 N Peachtree Ln Unit Sublot 2

- 2509 N Peachtree Ln Unit Sublot 5

- 4373 E Harbors Edge Dr Unit 132

- 4367 E Harbors Edge Dr Unit 131

- 4389 E Harbors Edge Dr Unit 121

- 4395 E Harbors Edge Dr Unit 122

- 4357 E Harbors Edge Dr Unit 143

- 4401 E Harbors Edge Dr Unit 123

- 4351 E Harbors Edge Dr Unit 142

- 3192 N Marina View Dr Unit 6

- 3190 N Marina View Dr

- 4345 E Harbors Edge Dr Unit 141

- 3172 N Marina View Dr

- 3166 N Marina View Dr Unit 5

- 3186 N Marina View Dr

- 3184 N Marina View Dr

- 4411 E Harbors Edge Dr Unit 111

- 3204 N Marina View Dr

- 3178 N Marina View Dr

- 3202 N Marina View Dr

- 3174 N Marina View Dr Unit 9

- 3168 N Marina View Dr Unit G19