438 James Rd Lewisburg, PA 17837

East Buffalo Township NeighborhoodEstimated Value: $617,737 - $767,000

4

Beds

3

Baths

3,415

Sq Ft

$206/Sq Ft

Est. Value

About This Home

This home is located at 438 James Rd, Lewisburg, PA 17837 and is currently estimated at $704,684, approximately $206 per square foot. 438 James Rd is a home located in Union County with nearby schools including Kelly Elementary School, Linntown Elementary School, and Donald H. Eichhorn Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Jun 14, 2017

Sold by

Komula Robert W and Komula Kelly A

Bought by

Laroya Donna L and Laroya Wildon Romeo

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$531,000

Outstanding Balance

$431,333

Interest Rate

3.37%

Mortgage Type

Adjustable Rate Mortgage/ARM

Estimated Equity

$273,351

Purchase Details

Closed on

Sep 12, 2012

Sold by

Kramm Steven R and Kramm Colleen A

Bought by

Komula Robert W and Komula Kelly A

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$380,000

Interest Rate

3.57%

Mortgage Type

FHA

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Laroya Donna L | $531,000 | Attorney Only | |

| Laroya Ii Romeo Wildon A | $531,000 | None Available | |

| Komula Robert W | $480,000 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Laroya Ii Romeo Wildon A | $531,000 | |

| Closed | Laroya Donna L | $531,000 | |

| Previous Owner | Komula Robert W | $380,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $8,914 | $303,700 | $34,800 | $268,900 |

| 2024 | $8,674 | $303,700 | $34,800 | $268,900 |

| 2023 | $8,412 | $303,700 | $34,800 | $268,900 |

| 2022 | $8,397 | $303,700 | $34,800 | $268,900 |

| 2021 | $8,434 | $303,700 | $34,800 | $268,900 |

| 2020 | $8,440 | $303,700 | $34,800 | $268,900 |

| 2019 | $85,036 | $303,700 | $34,800 | $268,900 |

| 2018 | $8,388 | $303,700 | $34,800 | $268,900 |

| 2017 | $8,388 | $303,700 | $34,800 | $268,900 |

| 2016 | $8,069 | $303,700 | $34,800 | $268,900 |

| 2015 | -- | $303,700 | $34,800 | $268,900 |

| 2014 | -- | $303,700 | $34,800 | $268,900 |

Source: Public Records

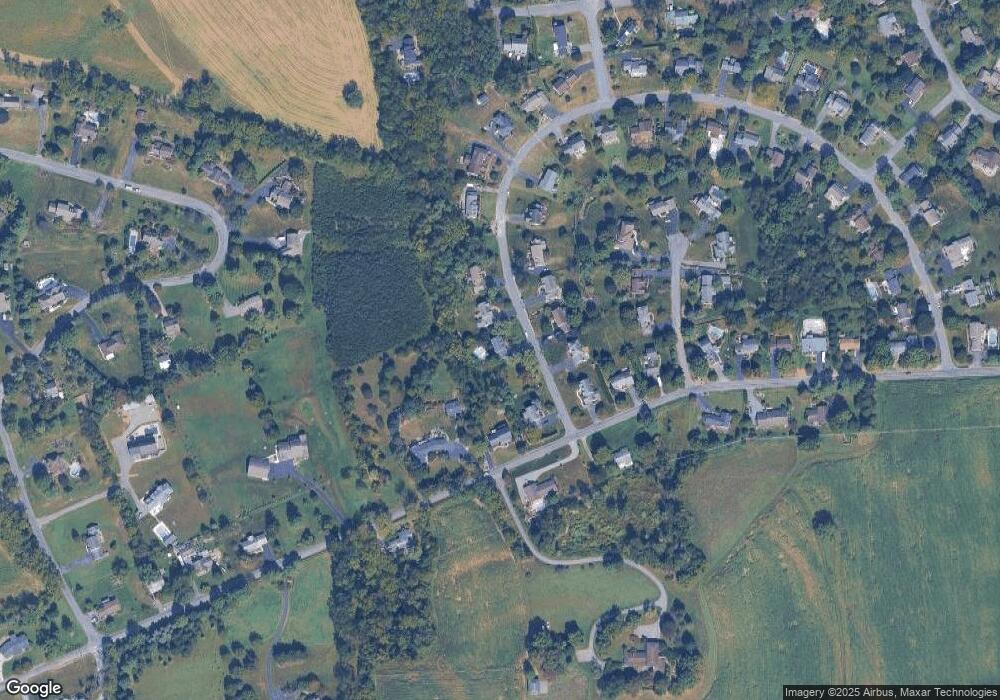

Map

Nearby Homes

- 211 James Rd

- 96 Dogwood Ln

- 223 Country Rd

- 300 Sunnyside Dr

- 36 Classic Hills Dr

- 407 S 20th St

- 169 Windsor Way

- 84 Windsor Way

- 114 Windsor Way

- 2111 Madison Ave

- 217 Hardscrabble Ln

- 237 Hardscrabble Ln

- 692 Beagle Club Rd

- 612 Stein Ln

- 688 Beagle Club Rd

- LOT 3 Smoketown Rd

- 2935 Smoketown Rd

- 137 Valley View Rd

- 609 Hardscrabble Ln

- 85 Poplar Rd

- 418 James Rd

- 478 James Rd

- 402 James Rd

- 340 Pheasant Ridge Rd

- 437 James Rd

- 457 James Rd

- 415 James Rd

- 477 James Rd

- 376 Pheasant Ridge Rd

- 395 James Rd

- 266 Pheasant Ridge Rd

- 400 Pheasant Ridge Rd

- 333 Pheasant Ridge Rd

- 63 Edward Cir

- 43 Edward Cir

- 367 James Rd

- 1 Edward Cir

- 364 James Rd

- 281 Pheasant Ridge Rd

- 21 Edward Cir