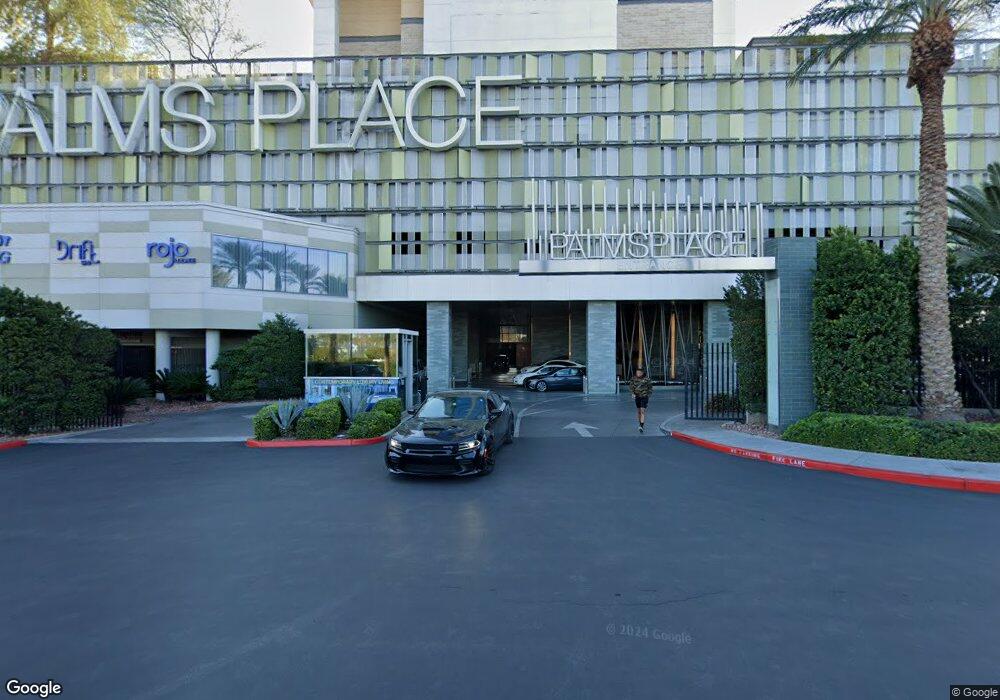

4381 W Flamingo Rd Unit 1210 Las Vegas, NV 89103

West of the Strip NeighborhoodEstimated Value: $241,883 - $265,000

1

Bed

1

Bath

615

Sq Ft

$415/Sq Ft

Est. Value

About This Home

This home is located at 4381 W Flamingo Rd Unit 1210, Las Vegas, NV 89103 and is currently estimated at $255,471, approximately $415 per square foot. 4381 W Flamingo Rd Unit 1210 is a home located in Clark County with nearby schools including Joseph E Thiriot Elementary School, Grant Sawyer Middle School, and Ed W Clark High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Apr 17, 2019

Sold by

Michelman Kenneth T

Bought by

Michelman Kenneth Thomas and Kenneth Michelman Trust

Current Estimated Value

Purchase Details

Closed on

Mar 25, 2014

Sold by

Ko Sam and Ko Francesca

Bought by

Michelman Kenneth T

Purchase Details

Closed on

Nov 8, 2011

Sold by

Jw Equity Llc

Bought by

Ko Sam and Ko Francesca

Purchase Details

Closed on

Oct 7, 2011

Sold by

Mermaidutp Llc

Bought by

J W Equity Llc

Purchase Details

Closed on

Mar 12, 2008

Sold by

Palms Place Llc

Bought by

Mermaidutp Llc

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$412,500

Interest Rate

5.99%

Mortgage Type

Purchase Money Mortgage

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Michelman Kenneth Thomas | -- | None Available | |

| Michelman Kenneth T | $171,500 | Nevada Title Las Vegas | |

| Ko Sam | $145,000 | Noble Title | |

| J W Equity Llc | $110,971 | Nevada Title Las Vegas | |

| Mermaidutp Llc | $539,720 | Stewart Title Of Nevada |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Previous Owner | Mermaidutp Llc | $412,500 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $2,445 | $87,400 | $31,805 | $55,595 |

| 2024 | $2,140 | $87,400 | $31,805 | $55,595 |

| 2023 | $2,069 | $80,679 | $30,513 | $50,166 |

| 2022 | $1,911 | $71,391 | $25,778 | $45,613 |

| 2021 | $1,823 | $68,275 | $23,410 | $44,865 |

| 2020 | $1,881 | $68,595 | $23,410 | $45,185 |

| 2019 | $1,763 | $66,763 | $23,410 | $43,353 |

| 2018 | $1,682 | $60,781 | $17,624 | $43,157 |

| 2017 | $1,805 | $61,533 | $17,624 | $43,909 |

| 2016 | $1,575 | $57,862 | $15,575 | $42,287 |

| 2015 | $1,571 | $53,728 | $15,575 | $38,153 |

| 2014 | $1,522 | $50,426 | $15,575 | $34,851 |

Source: Public Records

Map

Nearby Homes

- 4381 W Flamingo Rd Unit 8304

- 4381 W Flamingo Rd Unit 2309

- 4381 W Flamingo Rd Unit 11308

- 4381 W Flamingo Rd Unit 10038

- 4381 W Flamingo Rd Unit 3616

- 4381 W Flamingo Rd Unit 1508

- 4381 W Flamingo Rd Unit 18320

- 4381 W Flamingo Rd Unit 2716

- 4381 W Flamingo Rd Unit 908

- 4381 W Flamingo Rd Unit 1206

- 4381 W Flamingo Rd Unit 17310

- 4381 W Flamingo Rd Unit 5219

- 4381 W Flamingo Rd Unit 3819

- 4381 W Flamingo Rd Unit 5806

- 4381 W Flamingo Rd Unit 16310

- 4381 W Flamingo Rd Unit 38303

- 4381 W Flamingo Rd Unit 3402/3404

- 4381 W Flamingo Rd Unit 3116

- 4381 W Flamingo Rd Unit 1903

- 4381 W Flamingo Rd Unit 1207

- 4381 W Flamingo Rd Unit 1906

- 4381 W Flamingo Rd Unit 3807

- 4381 W Flamingo Rd Unit 12321

- 4381 W Flamingo Rd Unit 2701

- 4381 W Flamingo Rd Unit 2305

- 4381 W Flamingo Rd Unit 11302&11304

- 4381 W Flamingo Rd Unit 31301

- 4381 W Flamingo Rd Unit 3802

- 4381 W Flamingo Rd Unit 52321

- 4381 W Flamingo Rd Unit 32320

- 4381 W Flamingo Rd Unit 18301

- 4381 W Flamingo Rd Unit 22307

- 4381 W Flamingo Rd Unit 8318

- 4381 W Flamingo Rd Unit 26302

- 4381 W Flamingo Rd Unit 3709

- 4381 W Flamingo Rd Unit 2719

- 4381 W Flamingo Rd Unit 809

- 4381 W Flamingo Rd Unit 31302

- 4381 W Flamingo Rd Unit 5105

- 4381 W Flamingo Rd Unit 52-2&4