44 Willow Springs New Milford, CT 06776

Estimated Value: $314,000 - $362,000

2

Beds

2

Baths

1,651

Sq Ft

$201/Sq Ft

Est. Value

About This Home

This home is located at 44 Willow Springs, New Milford, CT 06776 and is currently estimated at $331,372, approximately $200 per square foot. 44 Willow Springs is a home located in Litchfield County with nearby schools including Hill And Plain Elementary School, Sarah Noble Intermediate School, and Schaghticoke Middle School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 13, 2025

Sold by

Rosa Joe

Bought by

Conrad Dustin

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$305,550

Outstanding Balance

$304,466

Interest Rate

6.64%

Mortgage Type

Purchase Money Mortgage

Estimated Equity

$26,906

Purchase Details

Closed on

Mar 6, 2014

Sold by

Vondle Morgan D and Vondle Kristine K

Bought by

Rosa Joe

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$103,000

Interest Rate

4.39%

Mortgage Type

New Conventional

Purchase Details

Closed on

May 23, 2006

Sold by

Vaughn Dru G

Bought by

Vondle Morgan D and Kvondle Kristine

Purchase Details

Closed on

May 19, 2003

Sold by

Mam-Hin Bunnarg and Than Silom

Bought by

Vaugh Dru

Purchase Details

Closed on

Jun 1, 2001

Sold by

Dodson Melissa

Bought by

Mam-Hin Bunnang and Than Silom

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Conrad Dustin | $315,000 | None Available | |

| Conrad Dustin | $315,000 | None Available | |

| Rosa Joe | $138,500 | -- | |

| Rosa Joe | $138,500 | -- | |

| Vondle Morgan D | $245,000 | -- | |

| Vondle Morgan D | $245,000 | -- | |

| Vaugh Dru | $175,000 | -- | |

| Vaugh Dru | $175,000 | -- | |

| Mam-Hin Bunnang | $131,900 | -- | |

| Mam-Hin Bunnang | $131,900 | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Conrad Dustin | $305,550 | |

| Closed | Conrad Dustin | $305,550 | |

| Previous Owner | Mam-Hin Bunnang | $103,000 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $6,633 | $140,140 | $0 | $140,140 |

| 2024 | $4,172 | $140,140 | $0 | $140,140 |

| 2023 | $4,061 | $140,140 | $0 | $140,140 |

| 2022 | $3,973 | $140,140 | $0 | $140,140 |

| 2021 | $3,920 | $140,140 | $0 | $140,140 |

| 2020 | $3,339 | $116,410 | $0 | $116,410 |

| 2019 | $3,341 | $116,410 | $0 | $116,410 |

| 2018 | $3,279 | $116,410 | $0 | $116,410 |

| 2017 | $3,172 | $116,410 | $0 | $116,410 |

| 2016 | $3,116 | $116,410 | $0 | $116,410 |

| 2015 | $3,663 | $136,920 | $0 | $136,920 |

| 2014 | $3,601 | $136,920 | $0 | $136,920 |

Source: Public Records

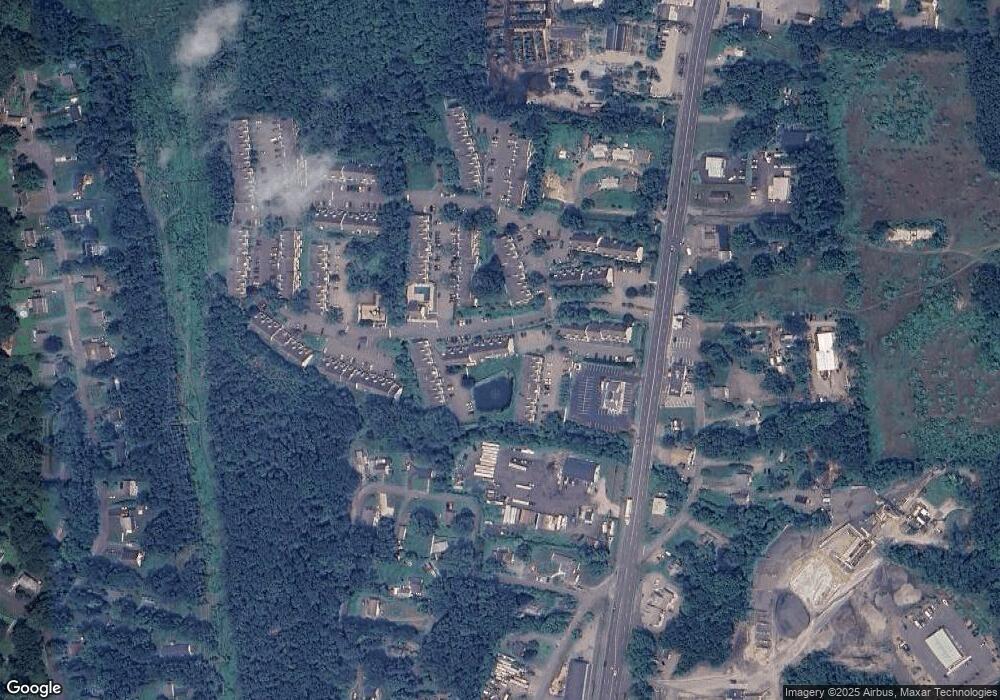

Map

Nearby Homes

- 331 Willow Springs Unit 331

- 86 Willow Springs Unit 86

- 80 Perry Dr

- 440 Candlewood Lake Rd N

- 8 Wampum Dr

- 47 Valley View Ln

- 57 Valley View Ln

- 34 Sherry Ln

- 60 Erickson Rd

- 192 Pickett District Rd

- 4 Beachside Dr

- 145 Sherry Ln

- 7 Morey Rd

- 31 Sullivan Farm

- 5 Lake Lillinonah Rd N

- 2 Sullivan Farm Unit 2

- 98 Sullivan Farm

- 466 Danbury Rd Unit 4

- 262 Candlewood Lake Rd N

- 254 Candlewood Lake Rd N

- 68 Willow Springs

- 68 Willow Springs Unit 68

- 38 Willow Springs

- 43 Willow Springs

- 37 Willow Springs

- 37 Willow Springs Unit 37

- 66 Willow Springs

- 66 Willow Springs Unit 66

- 48 Willow Springs

- 48 Willow Springs Unit 48

- 65 Willow Springs

- 65 Willow Springs Unit 65

- 51 Willow Springs

- 51 Willow Springs Unit 51

- 29 Willow Springs

- 47 Willow Springs

- 47 Willow Springs Unit 47

- 18 Willow Springs

- 72 Willow Springs

- 72 Willow Springs Unit 72