Estimated Value: $284,000 - $417,426

3

Beds

3

Baths

2,095

Sq Ft

$180/Sq Ft

Est. Value

About This Home

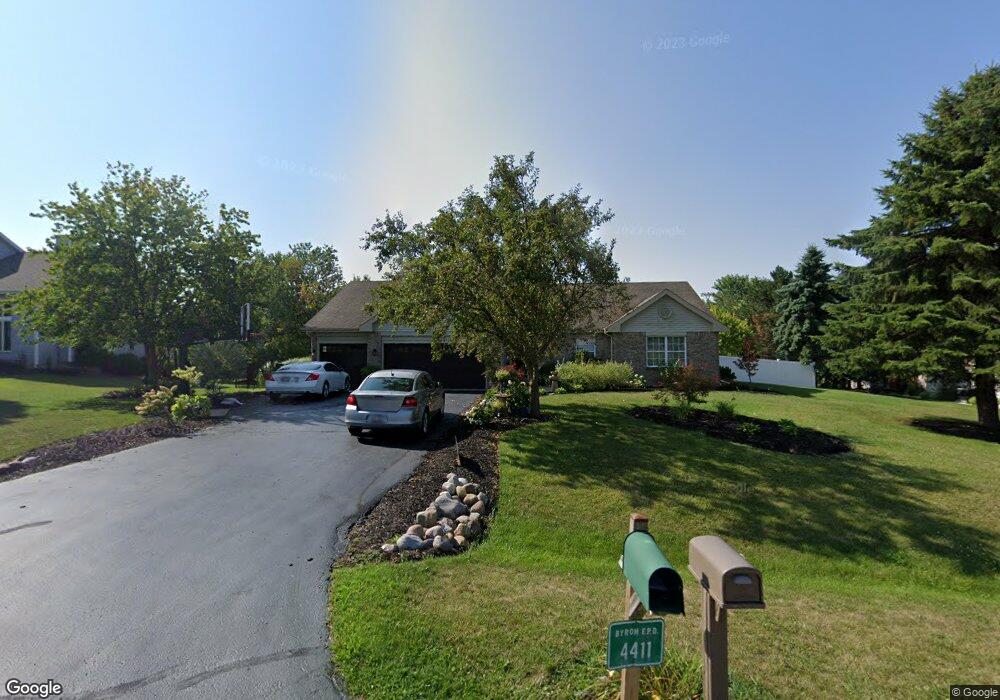

This home is located at 4411 E Cascio Dr, Byron, IL 61010 and is currently estimated at $377,357, approximately $180 per square foot. 4411 E Cascio Dr is a home located in Ogle County with nearby schools including Mary Morgan Elementary School, Byron Middle School, and Byron High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

Sep 24, 2014

Sold by

Bielskis Kristyn Marie

Bought by

Bielskis Raymond J

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$164,900

Outstanding Balance

$125,914

Interest Rate

4.07%

Mortgage Type

New Conventional

Estimated Equity

$251,443

Purchase Details

Closed on

Mar 26, 2010

Sold by

Bechtol Daniel J and Bechtol Olga A

Bought by

Bielskis Raymond J and Bielskis Kristyn Marie

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$193,200

Interest Rate

4.35%

Mortgage Type

New Conventional

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Bielskis Raymond J | -- | -- | |

| Bielskis Raymond J | $241,500 | None Available |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Bielskis Raymond J | $164,900 | |

| Closed | Bielskis Raymond J | $193,200 |

Source: Public Records

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2024 | $8,436 | $118,267 | $17,020 | $101,247 |

| 2023 | $7,881 | $112,432 | $16,180 | $96,252 |

| 2022 | $7,378 | $104,268 | $15,005 | $89,263 |

| 2021 | $5,926 | $82,711 | $14,364 | $68,347 |

| 2020 | $5,386 | $81,089 | $14,082 | $67,007 |

| 2019 | $5,410 | $78,537 | $13,639 | $64,898 |

| 2018 | $5,379 | $76,510 | $13,287 | $63,223 |

| 2017 | $5,271 | $76,510 | $13,287 | $63,223 |

| 2016 | $5,132 | $75,105 | $13,043 | $62,062 |

| 2015 | $4,873 | $72,705 | $12,626 | $60,079 |

| 2014 | $4,789 | $72,705 | $12,626 | $60,079 |

| 2013 | $4,907 | $73,640 | $12,788 | $60,852 |

Source: Public Records

Map

Nearby Homes

- 9345 N Oakleaf Ct

- 8894 Illinois 2

- 00 E Ashelford Dr Unit LOT 8

- 00 E Ashelford Dr

- 8628 Byron Hills Dr

- 8890 Hales Corner Rd Rd

- 617 E 3rd St

- 1368 Joanne Terrace

- 423 W 4th St

- 1269 E Kysor Rd

- 1257 Glacier Dr

- 1245 Glacier Dr

- 216 S Washington St

- 1903 Silverthorn Dr

- 309 Creekside Dr

- 265 Creekside Dr

- 00 White Tail Trail

- 000 Route 72

- 6700 N Alpine Dr

- Contact Agent

- 4408 E Cascio Dr

- 4441 E Cascio Dr

- 4393 E Cascio Dr

- 4448 E Cascio Dr

- 4475 E Cascio Dr

- 4382 E Cascio Dr

- 4371 E Cascio Dr

- 9114 N Raven Crest Ln

- 4343 E Cascio Dr

- 4284 E Cascio Dr

- 4415 E Falcon Dr

- 4339 E Falcon Dr

- 4447 E Falcon Dr

- 4363 E Falcon Dr

- 4321 E Cascio Dr

- 4535 E Cascio Dr

- 4481 E Falcon Dr

- 9005 N Raven Crest Ln

- 4299 E Cascio Dr

- 9151 N Raven Crest Ln