4413 Cimmaron Trail Granbury, TX 76049

Estimated Value: $312,469 - $342,000

3

Beds

2

Baths

1,695

Sq Ft

$196/Sq Ft

Est. Value

About This Home

This home is located at 4413 Cimmaron Trail, Granbury, TX 76049 and is currently estimated at $332,117, approximately $195 per square foot. 4413 Cimmaron Trail is a home located in Hood County with nearby schools including Acton Elementary School, Acton Middle School, and Granbury High School.

Ownership History

Date

Name

Owned For

Owner Type

Purchase Details

Closed on

May 9, 2016

Sold by

Wilborn John P

Bought by

Wilborn John P and Wilborn Patricia E

Current Estimated Value

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$136,803

Outstanding Balance

$108,789

Interest Rate

3.71%

Mortgage Type

VA

Estimated Equity

$223,328

Purchase Details

Closed on

Jul 29, 2014

Sold by

Williams William Lewis

Bought by

Wilborn Johnp

Home Financials for this Owner

Home Financials are based on the most recent Mortgage that was taken out on this home.

Original Mortgage

$133,463

Interest Rate

4.16%

Mortgage Type

VA

Purchase Details

Closed on

Feb 18, 2006

Sold by

Williams William R

Bought by

Williams William Robert Lee and The William Robert Lee Williams Revocabl

Purchase Details

Closed on

Nov 18, 1999

Sold by

Williams William R

Bought by

Wilborn John P Et Ux Patricia E

Purchase Details

Closed on

Sep 21, 1989

Bought by

Wilborn John P Et Ux Patricia E

Create a Home Valuation Report for This Property

The Home Valuation Report is an in-depth analysis detailing your home's value as well as a comparison with similar homes in the area

Home Values in the Area

Average Home Value in this Area

Purchase History

| Date | Buyer | Sale Price | Title Company |

|---|---|---|---|

| Wilborn John P | -- | None Available | |

| Wilborn Johnp | -- | Central Texas Title | |

| Williams William Robert Lee | -- | None Available | |

| Wilborn John P Et Ux Patricia E | -- | -- | |

| Wilborn John P Et Ux Patricia E | -- | -- |

Source: Public Records

Mortgage History

| Date | Status | Borrower | Loan Amount |

|---|---|---|---|

| Open | Wilborn John P | $136,803 | |

| Closed | Wilborn Johnp | $133,463 |

Source: Public Records

Tax History Compared to Growth

Tax History

| Year | Tax Paid | Tax Assessment Tax Assessment Total Assessment is a certain percentage of the fair market value that is determined by local assessors to be the total taxable value of land and additions on the property. | Land | Improvement |

|---|---|---|---|---|

| 2025 | $522 | $285,230 | $40,000 | $245,230 |

| 2024 | $522 | $266,882 | $40,000 | $251,770 |

| 2023 | $2,952 | $295,040 | $40,000 | $255,040 |

| 2022 | $1,784 | $249,840 | $40,000 | $209,840 |

| 2021 | $3,078 | $200,520 | $20,000 | $180,520 |

| 2020 | $2,874 | $185,040 | $20,000 | $165,040 |

| 2019 | $2,841 | $174,720 | $20,000 | $154,720 |

| 2018 | $2,694 | $165,680 | $20,000 | $145,680 |

| 2017 | $2,725 | $162,980 | $20,000 | $142,980 |

| 2016 | $2,414 | $144,330 | $20,000 | $124,330 |

| 2015 | $666 | $134,790 | $20,000 | $114,790 |

| 2014 | $666 | $140,830 | $20,000 | $120,830 |

Source: Public Records

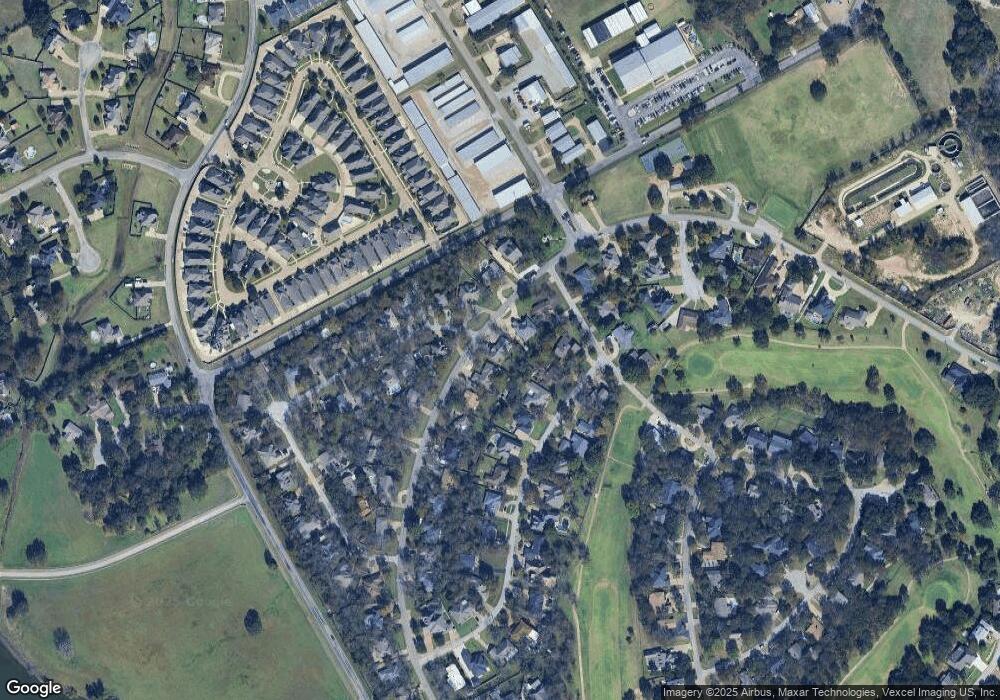

Map

Nearby Homes

- 5003 Bueno Dr

- 4512 Cimmaron Trail

- 3218 Fountain Way

- 4920 Centre Ct

- 5102 Largo Dr

- 3510 Fountain Way

- 4901 Fairway Ct

- 2918 James Rd

- 4904 Fairway Place Ct

- 2918 Willow Ridge Cir

- 4900 Del Rio Ct

- 2925 Willow Ridge Cir

- 4009 Scenic Way

- 5040 Santa Elena Ct

- 5041 Santa Elena Ct

- 4112 Cimmaron Trail

- 3207 Hummingbird Ct

- 2936 Willow Ridge Cir

- 5128 Country Club Dr

- 1141 Avery Rd

- 4411 Cimmaron Trail

- 4501 Cimmaron Trail

- 5002 Bueno Dr

- 5004 Bueno Dr

- 4503 Cimmaron Trail

- 3700 Nocona Dr

- 4110 Cimmaron Trail

- 4412 Cimmaron Trail

- 5000 Bueno Dr

- 5006 Bueno Dr

- 4505 Cimmaron Trail

- 4410 Cimmaron Trail

- 5002 Seminole Dr

- 5008 Bueno Dr

- 5005 Seminole Dr

- 4504 Cimmaron Trail

- 4408 Cimmaron Trail

- 5001 Bueno Dr

- 3701 Nocona Dr

- 5004 Seminole Dr